Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

🧵: b2b moves $120T every year.

@zeebuofficial captures just 0.006% today.

how far can this expand?

crypto is full of "infra" that never made it past crypto itself.

thousands of projects solving problems that don’t really exist..

@zeebuofficial is a different story.

it launched when real businesses needed a way to stop waiting weeks for settlements.

telecom companies were burning hours, people, nerves just to close a single transaction. in 2023, a few lines of code replaced all of that.

since then, settlements happen daily, not a single day off.

each settlement = closing an invoice between companies.

real payments for real services: roaming + voice + data.

millions move through the chain every day. all via the protocol, all logged onchain = down to the last fee.

used to be all about SWIFT and banks.

manual ops + failed returns + timezone issues... normal stuff.

week just to close one deal...

so they built a new system - OCH.

what is OCH? type of architecture = onchain clearing house.

each move is atomic.

> protocol takes 2% fee

> splits stablecoins between validators, pool, and treasury

> $ZBU flows through system, part gets burned along the way (2.5b $ZBU already burned)

closed economy. check attached post to understand how it works.

15.7. klo 23.50

Clearing houses settle over $2 quadrillion annually.

They’re the core of institutional finance yet they’re centralized, slow, and designed around banks.

Zeebu is building the first Onchain Clearing House (OCH) for B2B payments.

Here’s how it works 🧵

now the whole system runs like a node:

invoice sent > signed onchain > final settlement.

companies sign off payments to each other onchain

just like they used to = but faster, and without room for error.

it’s no longer just telecom inside = logistics + SaaS + trade + fintech.

any B2B payment can move through the network with full onchain transparency.

some protocol achievements:

> $20m daily B2B settlements processed through protocol

> 126k total invoices fully cleared onchain

> 214 active enterprises using the system

> millions $ in stablecoins already paid out to stakers

without fake farming and no artificial boosts.

money moves because businesses need it to.

but now it's time to reveal the most interesting question...

what’s the upside of Zeebu?

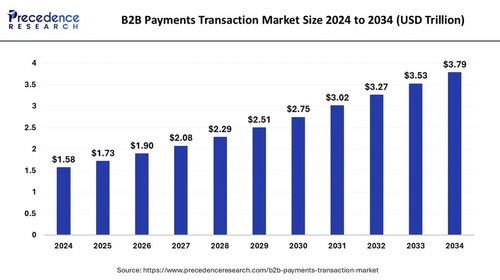

the global b2b payments market moves over $120 trillion every year. more than $40 trillion flows across borders between enterprises.

and infrastructure Zeebu builds into is expected to double in size by 2034.

currently Zeebu captures just 0.006% of the market.

even 0.1% would route $120 billion annually.

each step forward expands protocol revenue, real yield, and locked demand.

the upside grows with every new settlement...

so...

i think it’s truly important to filter through the noise and pick the one protocol that actually settles something.

and here, billions of $ move through it.

if your system becomes part of such payment flow = that’s mean huge trust, and in B2B, trust doesn’t come from tokenomics...

Zeebu potential is huge my frens?

@belizardd @0xDefiLeo @lenioneall @Haylesdefi @alphabatcher @Mars_DeFi @thelearningpill @0xAndrewMoh @kenodnb @DOLAK1NG @0xHvdes @DeRonin_ @cryppinfluence @eli5_defi @RubiksWeb3hub @the_smart_ape @AlphaFrog13 @0xJok9r @BringMeCoins @0x99Gohan @Hercules_Defi @0xSireal @YashasEdu @Defi_Warhol @CryptoShiro_

I hope you've found this thread helpful.

Follow me @splinter0n for more.

Like/Retweet the first tweet below if you can.

21 tuntia sitten

🧵: b2b moves $120T every year.

@zeebuofficial captures just 0.006% today.

how far can this expand?

8,88K

Johtavat

Rankkaus

Suosikit