Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

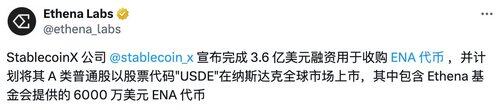

Is Ethena considered a reverse merger?

A Web2 company acquires a Web3 protocol, achieves a listing on the US stock market, successfully issues stocks, and then comes to Web3 through tokenization on the US stock market.

Having a protocol with both tokens and stocks might be what US stock market tokenization is all about?

21.7. klo 21.34

This wave is a self-help market for many VCs and market makers.

I invested too many junk projects and shitcoins, and it was difficult to save them no matter how much money I spended, but I just had a batch of ETH, SOL, or leftover US dollar funds in my hand.

Several companies invested together to collect a U.S. stock shell, I paid money, you paid money, issued a bunch of additional stocks to yourself, and the official announcement became a micro-strategy, selling it to those who were destined to follow the trend of U.S. stocks. Subsequent reprinting of shares can also distribute dividends to shareholders.

10,46K

Johtavat

Rankkaus

Suosikit