Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

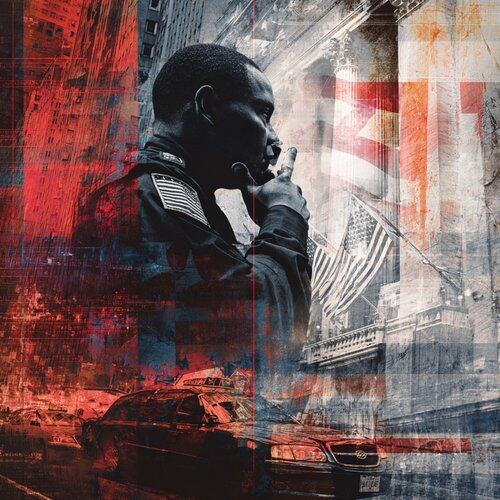

PCV CRIME CYCLE..

The whole PCV game is orchestrated by greedy venture investors, stock operators, and NASDAQ-listed low/mid-cap public companies.

Public companies are issuing more common shares through At-The-Market (ATM) offerings, and selling those shares at a discount via Private Investment in Public Equity (PIPE) deals to raise funds and build a reserve of coins like BTC, ETH, HYPE, SOL, BNB, TAO, DOGE, and LITE. We already have PCVs launched for more than 10 coins, including CYBER.

You can imagine the scale of crime happening here.

We could even see PCVs for more than 20 coins in the future, and some of these PCVs might also add multiple coins in reserve, like what is planned by Reserve One and Lion Group Holding.

Lion Group Holding has a market cap of around $2M, and they're talking about raising around $600M from a hedge fund called ATW Partners, which appears to be heavily involved in other PCVs like Sol Strategies.

Crypto VCs are very much involved in buying some of these PCV shares during PIPE rounds.

Galaxy, Parafi, Electric - they all participated in the SBET PIPE.

Delphi, GSR, Big Brain participated in the UPEXI PIPE.

Once the PIPE is executed, the next step is filing a resale registration with the SEC.

Sharplink has already done that, so technically, SBET PIPE investors can dump SBET anytime they want.

Also, Sharplink is going super hard on the PCV playbook - they’ve filed with the SEC to issue more common stock and raise $5B through more PIPE deals. If that goes through, ETH could get steady buying support. This would also create more dilution in SBET shares, eventually correcting the price.

But if their ETH treasury manages to yield more profits to the company, along with staking yield, it could actually support SBET’s price in the long term.

So maybe, some of the PCVs might survive in the long run - like how MSTR survived.

But that’s not the case with the hundreds of them floating around every day.

Most of these PCVs are being created to commit financial crime, where VCs and stock operators make gains by dumping on retail investors who enter at a later stage, buying into the common story of “institutional adoption on coin”, and viewing PCVs as a leveraged bet on altcoin price growth.

15,76K

Johtavat

Rankkaus

Suosikit