Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

🧵

1/

On DAT* and BTC/ETH Treasuries

*post has consent from @saylor

CASE STUDY: $MSTR created the template for crypto treasury.

- since 2020 start of $BTC strategy, @MicroStrategy

- stock gain from $13 to $455

QUESTION?

How much is due to BTC rise vs treasury strategy

$BMNR @BitMNR

2/

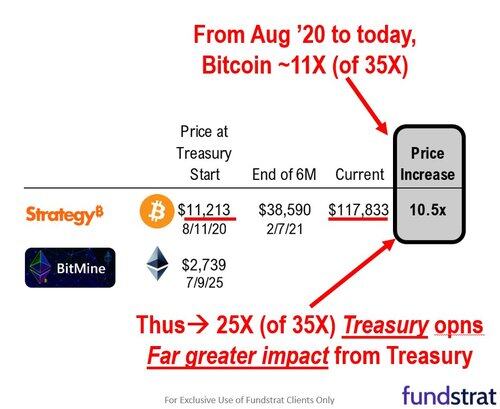

Of the 35X rise in $MSTR price:

- 11X due to $BTC Bitcoin rising from $11k to $118k

- 25X due to Treasury strategy

- aka increase in BTC per share

Treasury strategy far more significant than token price gain

@BitMNR $BMNR

3/

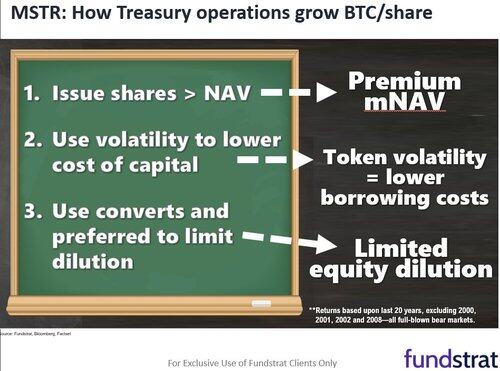

There are multiple ways $MSTR Treasury DAT strategies grow the token held per share:

- issue stock > P/NAV (mNAV) = rising token/share

- token volatility lowers cost of borrowing = better ROI

- use converts/preferred = limited equity dilution

By the way

- $ETH has higher volatilty than $BTC

- so this volatility reduces ETH DAT more than BTC DAT

@BitMNR $BMNR

5/

Bitmine announced its ETH treasury strategy on June 30, 2025 and closed this transaction on July 9th, 2025

@BitMNR $BMNR @CNBC

30.6.2025

Wall Street strategist Tom Lee is aiming to create the MicroStrategy of Ethereum

6/

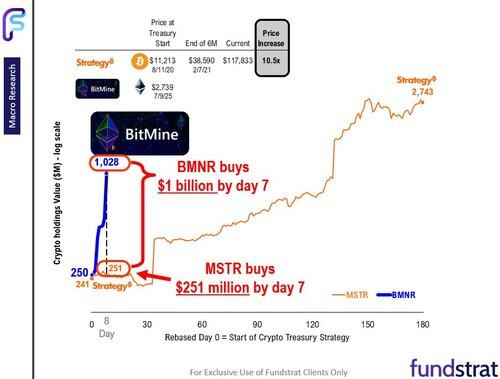

$MSTR has shown, buying tokens

- increased tokens/share

$BMNR by 7th day (post-initial closing)

- acquired $1 billion of ETH

- MSTR acquired $250 million in same timeframe

That is all!

@BitMNR @CNBC 6/ $MSTR has shown, buying tokens

- increased tokens/share $BMNR by 7th day (post-initial closing)

- acquired $1 billion of ETH

- MSTR acquired $250 million in same timeframe

That is all!

293,67K

Johtavat

Rankkaus

Suosikit