Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

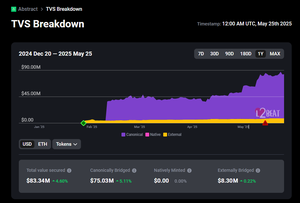

Abstract’s TVS Grew 158% in 2 Months. But That’s Not the Real Story

On May 25, Abstract reported a TVS of $83.34M.

Today, July 17, that number sits at $214.76M a jump of over 158% in less than 2 months.

But this isn’t just about “going up.”

The deeper signal lies in the TVS composition and it tells a very different story about Abstract's trajectory.

In May:

Total TVS: $83.34M

- Canonical bridged: $75.03M

- Externally bridged: $8.30M

- Native value: $0

This means nearly all the value on Abstract came from users bridging in from Ethereum.

In simple terms: Abstract was still in early inflow mode, with minimal ecosystem-level stickiness.

In July (today):

Total TVS: $214.76M

Value now spans:

- Canonical: Still growing

- External: Holding steady

- Native: Now showing up on the chart

This change is massive not just in size, but in type:

→ Native tokens are now being minted directly on Abstract

→ Value is entering from other chains

→ Ecosystem participants are launching, not just bridging

Why this matters:

- TVL growth is easy.

- Sustainable value growth isn’t.

Most L2s depend heavily on yield farming and mercenary liquidity to inflate their TVL.

But Abstract’s current numbers are:

- Not tied to emissions

- Not inflated by retroactive farming

- Not driven by DeFi whales

They’re the result of apps, games, creators, and users generating real activity.

The takeaway:

The number is impressive.

But the diversification of value sources is what really signals maturity.

Canonical = people bridging in

External = other chains recognizing Abstract

Native = real value being created on-chain

Together It’s becoming a place people build, not just visit.

And that’s the shift CT still hasn’t priced in.

5,9K

Johtavat

Rankkaus

Suosikit