Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Keeping other parameters unchanged, if ETH rises to $5000, the mNAV of SBET will only drop to around 1.8, maintaining a premium level similar to MSTR.

This means that with $ETH moving from 3100 to 5000, the momentum is strong, at least stronger than MSTR.

16.7. klo 14.16

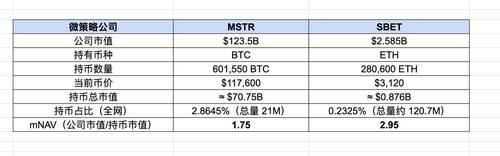

MSTR vs SBET Data Comparison (BTC MicroStrategy vs ETH MicroStrategy)

Currently, #MSTR's holding ratio is 2.8645%, while #SBET's holding ratio is only 0.2325%, a difference of 12 times, and the company's market capitalization differs by 47 times.

SBET's current mNAV is in the range of 2.5-3.5, higher than MSTR's 1.75, indicating that the market gives SBET a higher valuation premium. This premium also provides SBET with greater motivation to continue accumulating ETH, and the buying pressure for ETH will continue.

6,27K

Johtavat

Rankkaus

Suosikit