Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Want to earn some $KAT by LPing on @katana via Sushi? 🍣⚔️

We know LPing in v3 can feel tricky, so let’s break it down properly 🧵👇

Degens, this is not for you since you already know the drill.

Sushi v3 is a concentrated liquidity AMM.

Think of it like this:

In classic v2, your liquidity is spread evenly across the full price scale from 1 to 10, even if the price mostly trades between 4 and 6 in the timeframe you're watching.

So when the price is at 1,2,3 or 7,8,9,10, a big part of your capital isn’t earning fees. Most of it just sits idle.

Hence, in v3, you choose the range, so if you believe the price will trade between 4 and 6, you can concentrate your capital there for max efficiency.

✅ You choose a price range where your liquidity is active

✅ You earn fees only while the price stays in that range

✅ Narrower = more efficient use of capital

✅ Wider = safer but less efficient

Now that we have the basics covered, let's go through the tutorial👇

Step 1: Choose a rewards pool

You can start from two places:

🔗 : shows farmable pools with $KAT and/or $SUSHI rewards

🔗 : gives you full control to set range + fee tier

We’ll use the second one for this guide.

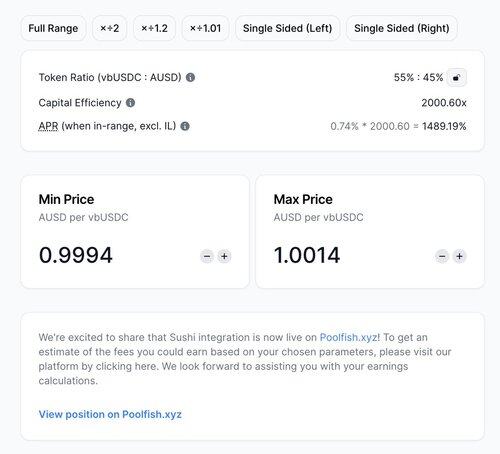

Step 5: Set your price range

This part might feel intimidating at first, but it’s simple:

Ask yourself, “What do I think this token will trade between?” That’s your min and max.

For stables, if AUSD = 1.00, a tight range like 0.995–1.005 gives max capital efficiency.

⚠️ If price goes out of range, you stop earning fees until it returns.

For volatile tokens, give more room based on recent price action.

Step 6: Use presets or drag manually

You can set your price range by:

🎛️ Dragging the sliders

⚙️ Or choosing a preset:

• Full Range – always in range, less efficient (like classic v2)

• ×÷2, ×÷1.2 – tighter, more efficient

• Single-sided – deposit only one token

Choose based on your view. Either way, you’re one click away from LPing.

Step 7: Add liquidity

After setting your range, Sushi shows you:

• Token Ratio – it won’t always be 50/50 (depends on the range)

• Capital Efficiency – how optimized your range is

• Estimated APR – based on recent fees (not IL-adjusted)

Enter how much to deposit → Approve both tokens → Preview → Confirm in wallet ✅

Step 8: Done ✅

You’ll get a confirmation + can view onchain.

55,23K

Johtavat

Rankkaus

Suosikit