Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

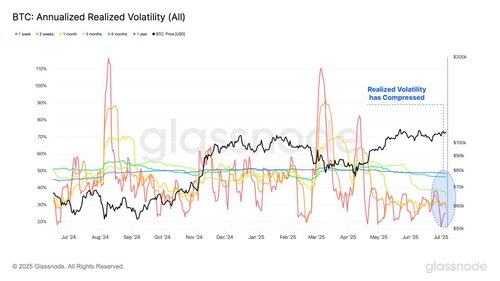

📊 According to the latest report from Glassnode, on-chain data shows that market supply continues to tighten, volatility is compressing, and accumulation pressure is building significantly. Long-term holder supply is on the rise, and small investors are net accumulating 19,300 BTC per month—well above the monthly issuance of 13,400 BTC📈. Around 19% of circulating supply is now concentrated within a ±10% range of the spot price, indicating heightened sensitivity to short-term price movements⚡.

Meanwhile, total assets under management (AUM) of U.S. spot Bitcoin ETFs have surpassed $137 billion, accounting for 6.4% of Bitcoin's total market cap. BlackRock’s IBIT leads the market with a dominant 55% share🔝. Although ETF inflows have slowed slightly, the long-term demand remains robust and may lead to significant price volatility.

OKX Ventures notes that tightening supply and increasing ETF market participation reflect strong institutional conviction in Bitcoin’s long-term value, which could become a key driver of future price movements.

2,73K

Johtavat

Rankkaus

Suosikit