Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

.@aave has $750M of wstETH Earning 0.44% on the Prime instance

🤝 @LidoFinance. Builders need deep lasting liquidity with consistent predictable yield.

Our friends at @protocol_fx just deposited another 3,000 $wstETH into the Aave Prime Instance, pushing their total to over 15,500 wstETH (~$50M).

This capital is currently generating:

→ 2.7% from the embedded wstETH staking yield

→ 0.44% from the Aave supply APY

That additional 0.44% from Aave represents a +16% increase over the native wstETH yield alone.

💰 All in, that’s a blended yield of ~3.14%, earning them roughly ~$1.57M annually, or ~$4,300 every single day at the current price.

And all of that is possible on the most battle-tested protocol in DeFi.

If you’re curious why the Aave $wstETH supply rate sits around 0.44% on the Prime Instance, we broke it all down here:

3.7. klo 23.42

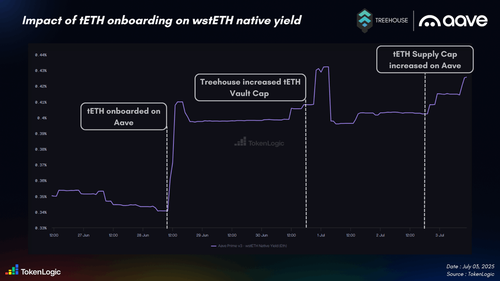

6 days ago, @TreehouseFi tETH was onboarded on the Aave Prime Instance.

Since then, users have been supplying $tETH (now 100% cap filled) and borrowing $wstETH to leverage up and earn native yield.

Right now, the embedded yield on $wstETH sits around 2.7%, while Treehouse offers ~3.26% on $tETH.

This difference comes from the MEY (Market Efficiency Yield), which captures the arbitrage between staking yields and borrowing costs.

With E-Mode, users can reach up to 92% LTV on tETH/wstETH, unlocking more borrowing power and capturing the ~0.5% yield gap between $wstETH and $tETH.

Days after onboarding, Treehouse raised the tETH vault cap, and Aave also increased the tETH supply cap.

This further amplified the effect, with wstETH native supply rate not only holding near 0.4% but even climbing higher, maintaining yields well above pre-onboarding levels.

1/

32,06K

Johtavat

Rankkaus

Suosikit