Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

This is very misleading, the news outlets are fumbling as always. Unless the UAE gov confirms this, the actual tldr is:

- you stake ton hoping to get in

- the legal firm chosen by ton people receives their pretty big non-refundable $35k fee and then TRIES to submit your application to the Gov (perhaps nominates you, but what is their quota?)

- the Gov then decides to approve or not, while your staked ton (frozen for 3 years) balance serves as simply one of the requirements (💡 and it’s not even relevant anymore according to new rules; this seems to be legal firm marketing to compare with real estate). Great token utility sink though, no questions there :D

There has been no blanket approval for ton stakers? If the UAE gov confirms and supports this - then it’s awesome and gg. Will retract and be impressed. However, so far it looks like it’s just a legal firm partnership disguised as exclusive.

The answer is also not as clear because UAE as a very innovative jurisdiction often adjusts and improved rules - and chatgpt fails to pick up those changes. See chatgpt answers below. Perhaps ton will use their jurisdictional footing (verified incubator) in UAE and file some of the better applicants as good prospects? Sounds fine but then again, it’s not a blanket approval. It’s good token utility coupled with a legal firm. I’d be surprised if all random stakers get accepted.

PS: chatgpt misinterprets a lot, but this is also just common sense. Exclusive Gov programs do not get handed left & right, UAE is a pretty strict place but also very streamlined when it comes to processes!

Will attach the non-proven chatgpt output in the comment below for context.

Below is the chatgpt response. Idk how real or true it is, it’s just context. I don’t approve or disprove anything as I don’t know the intricacies to the core.

————

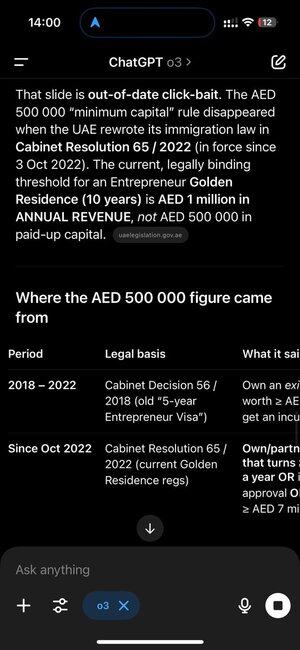

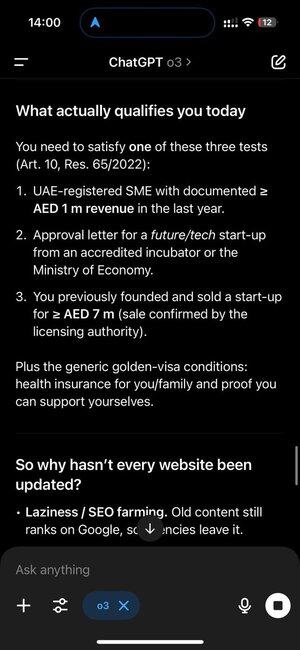

The hard facts behind TON’s “Stake $100 K → Get a 10-Year UAE Golden Visa” landing page

Claim on TON’s site What’s actually happening Legal basis

“Unlock a 10-year Golden Visa by staking $100 000 in TON for 3 years and paying a $35 000 processing fee.” The UAE has no visa category called “crypto-staking investor.” TON (or its unnamed local partner) will apply for you under an existing Golden Visa route that already allows case-by-case discretion — most likely:•

Entrepreneur path, option #2: an approval letter from an accredited business incubator; or• “Talented in Digital Technology” path: a recommendation from the Emirates Council for AI & Digital Transactions. Cabinet Resolution 65 / 2022, Art. 10-2 (entrepreneur incubator) & Art. 11-4 (digital-tech talent)

“Only $100 K required (80 % less than the ‘traditional’ routes).” The 100 K lock-up is TON’s own screening threshold, not a government rule. Official investor routes still start at AED 2 million (~US $545 K) in real estate or funds; the entrepreneur route needs AED 1 million annual revenue or an incubator letter. Art. 8 & 9 (investor) and Art. 10-1 (entrepreneur revenue ≥ AED 1 m)

“Approval in < 7 weeks.” Once a valid nomination letter reaches ICP/GDRFA, 2-6 weeks is normal. Your real bottleneck is whether TON’s partner can secure that letter — there’s no statutory SLA.

Processing practice (ICP Smart Services), not specified in law

“$35 K is a one-time fee.” That money goes to TON’s facilitator for the incubator/nomination paperwork. Government charges (≈ AED 2 790 ≈ US $760 per applicant) plus medical & Emirates ID (≈ AED 900) are extra. ICP fee schedule (unchanged)

“Funds ‘remain yours’ and earn 3-4 % APY.” True only in TON tokens. You bear full price-volatility risk for 36 months; the smart-contract merely stops you selling. If TON halves, your $100 K is now $50 K. TON T-&-C, footnote “Subject to change”

⸻

Is the offer “legit”? Technically yes — but it’s not a new visa category

• TON is exploiting the same discretionary channels every big accelerator or free-zone “sandbox” already uses: get an incubator or government tech body to nominate you as an entrepreneur or digital-tech talent.

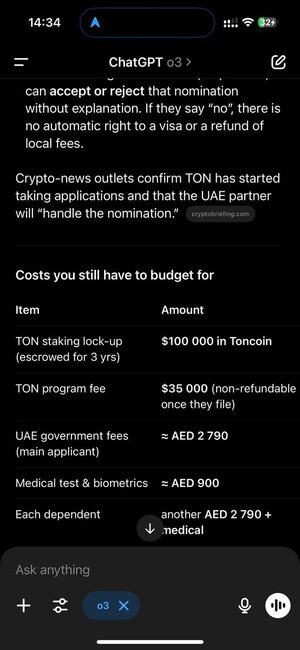

• The UAE immigration service (ICP/GDRFA) can accept or reject that nomination without explanation. If they say “no”, there is no automatic right to a visa or a refund of local fees.

Crypto-news outlets confirm TON has started taking applications and that the UAE partner will “handle the nomination.”

⸻

Costs you still have to budget for

Item Amount

TON staking lock-up (escrowed for 3 yrs) $100 000 in Toncoin

TON program fee $35 000 (non-refundable once they file)

UAE government fees (main applicant) ≈ AED 2 790

Medical test & biometrics ≈ AED 900

Each dependent another AED 2 790 + medical

⸻

Concrete risks (no sweet-talk)

1. Nomination fails → no visa, no refund of TON fee or ICP charges.

2. Token risk. After 3 years you get TON back, not dollars; market could be down 70 %.

3. Regulatory mood-swings. The UAE could tighten crypto due-diligence tomorrow, forcing the partner to reroute you via the expensive investor path.

4. Counter-party opacity. The site hides the name and licence number of the “visa-issuing partner.” Always ask for their MOHRE/ICP service-provider licence before paying anything.

⸻

Due-diligence checklist before you wire a cent

1. Demand these documents up-front:

• Trade Licence & immigration-service licence of the UAE partner.

• Sample incubator or tech-talent nomination letter they intend to use.

• Written refund policy covering visa rejection and token unlock.

Compare with orthodox routes. Buying an AED 2 m studio flat in Dubai Marina costs more, but you own a hard asset and pay zero facilitation premium.

14,83K

Johtavat

Rankkaus

Suosikit