Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

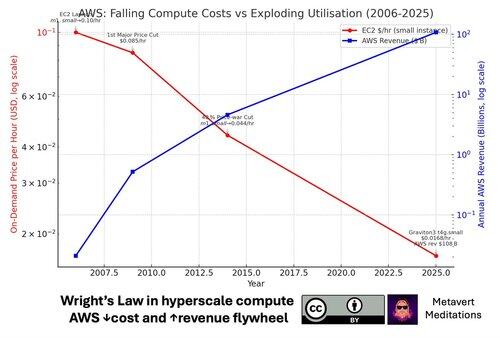

Wright’s Law = cost ⬇️ → usage ⬆️ → cost ⬇️⬇️.

It’s the growth engine behind every tech wave.

Next up? Cloud × blockchain × DePIN.

Let me show you the curve. 👇

Blockchains in one picture:

💸 Lower fees → 📈 More transactions → 💸 Even lower fees.

Solana lives in the upper-right “cheap & huge” quadrant; L2s are racing there fast.

Wright’s Law, meet on-chain economics.

Cloud did it first.

EC2 small instance: $0.10/hr → $0.017/hr

AWS revenue: $0.02 B → $108 B

Same downward slope, new altitude.

Why Solana wins big in DePIN:

* Avg fee ≈ $0.003

* Handles more daily tx than all other L1s combined

* Efficient fee market keeps tx fees low

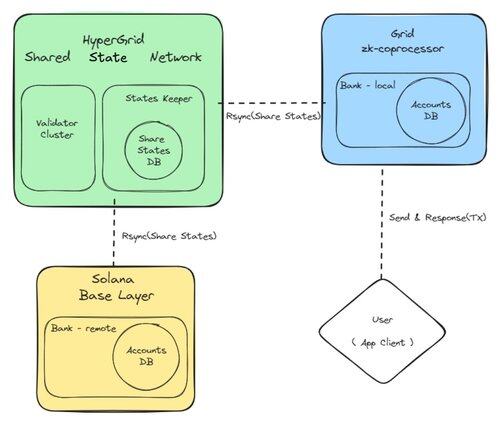

And the learning isn’t done: Sonic’s Hypergrid is Layer-2 for Solana. Think sub-fractional-penny fees for game loops, AI agents, micro-markets. Learning curve keeps bending down. @sonicsvm #hypergrid

Now combine cloud’s pay-as-you-go + blockchain’s fee flywheel → DePIN.

Idle GPUs, 5G hotspots, storage nodes: all liquid, all on-chain.

The result? A community-owned, serverless super-cloud priced at commodity cost. One example: the @BeamableNetwork for Gaming backends, built on the tech powering huge launches like @FIFARivals

If you're interested in the future of Cloud x Blockchain x Games --> follow me at @jradoff -- and give @BeamableNetwork a follow as well.

To read the full version of this article, click through here:

8,92K

Johtavat

Rankkaus

Suosikit