Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Thala 101

Thala is the most complete DeFi suite on Aptos. AMM, stablecoin, liquid staking — all composable across swaps, lending, and yield.

Full breakdown below 👇

AMM

The Thala AMM powers swaps across Aptos:

→ stable pools for parity assets

→ weighted pools for flexible ratios

→ metastable pools for assets with yield drift like sthAPT or sUSDe

It’s used across protocols as the default swap layer.

xLPTs

xLPT turns LP tokens into transferable, yield-bearing assets that keep farming on the move.

Built using Aptos' DFA standard - farming updates automatically on transfer.

Possible only on @Aptos.

10.6.2025

Disptachable Fungible Assets (DFA) = Programmable tokens on Aptos.

✅ Auto rewards

✅ Native fee routing

✅ Built-in compliance

@ThalaLabs' xLPT shows it in action: LP tokens that stake themselves and earn yield on every transfer.

Smarter tokens start with DFA. Learn how to start building on Aptos 👇

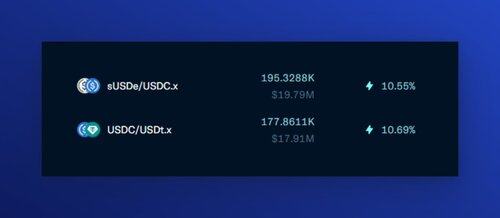

Over $38M in xLPTs are supplied to @EchelonMarket as collateral.

Key pairs:

→ sUSDe/USDC.x

→ USDC/USDT.x

Collateral that yields. Transferable. Boostable. Built for composability.

Metastable Pools

Assets like sUSDe or sthAPT don’t stay pegged - they accrue. Standard stable pools can’t handle that drift. Metastable pools do.

They price yield-bearing assets correctly and reduce IL without constant rebalancing.

More on metastable pools in thread below 👇

1.3.2025

New on Thala: Metastable Pools.

With sUSDe live on @Aptos via Thala and Echelon, Metastable Pools provide the best way to manage its price drift — ensuring efficient swaps and optimal liquidity for yield-bearing stablecoins.

Let’s break it down 🧵

1/

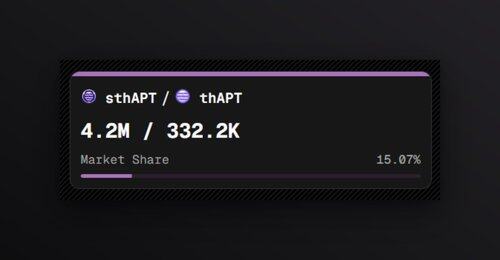

Thala LSTs hold over 4.5M APT — 15%+ of all staked APT.

Staked assets route into DeFi — not idle. All thAPT + sthAPT tokens are usable in lending protocols like @EchelonMarket.

MOD

MOD is an overcollateralized stablecoin native to Aptos. Backed by a mix of LP tokens, LSTs, and RWAs.

Borrowing always below collateral value. Peg held through liquidation logic, redemption paths, and asset filters.

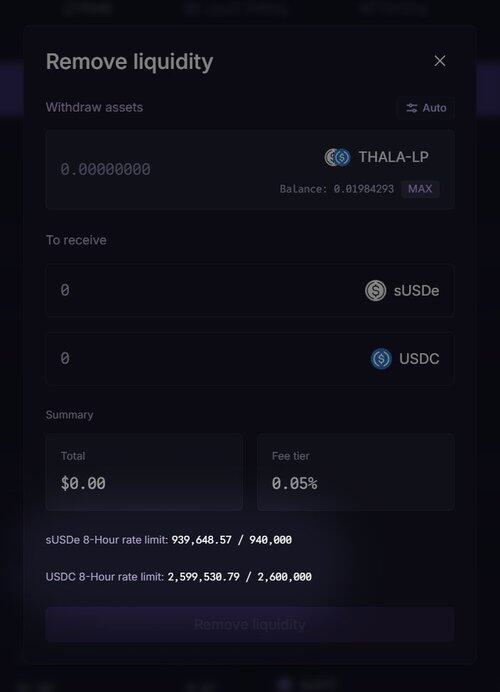

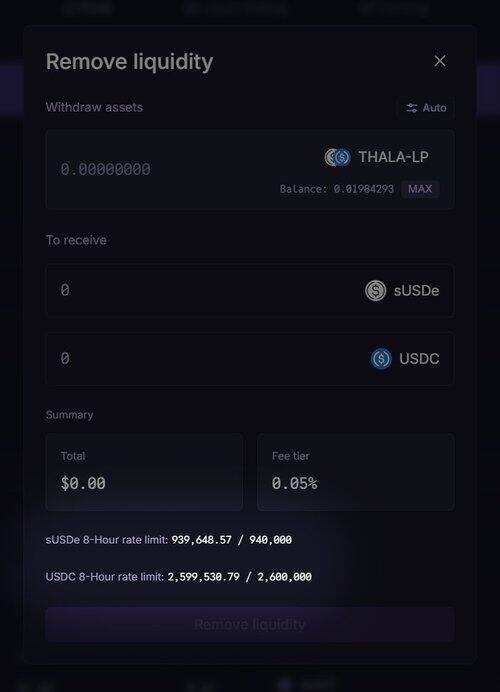

Rate Limits

Thala rate limits act as a security buffer.

When triggered, they slow down withdrawals - protecting the system during edge cases.

No sudden exits. Risk contained by enforced withdrawal windows.

veTHL

veTHL controls emissions and boosts yield:

→ lock THL or THL/MOD LP

→ earn veTHL based on size + duration

→ boost xLPT rewards

→ vote on distribution

LPTs get 2.5x THL weight inside the pool. Boosts are capped, fair, and adjustable.

Oracles

Thala uses @PythNetwork as primary price feed. Fallbacks include @chainlink and @switchboardxyz.

If data is stale, off-threshold, or invalid - system switches feeds automatically. If no valid price is available, operations halt until confirmed pricing resumes.

CLMM Coming

Concentrated Liquidity support is in progress and will be soon on Mainnet.

CLMM will enable deeper execution and higher efficiency — especially for stable pairs and high-volume trades. Designed to extend the AMM without fragmenting liquidity.

30,25K

Johtavat

Rankkaus

Suosikit