Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

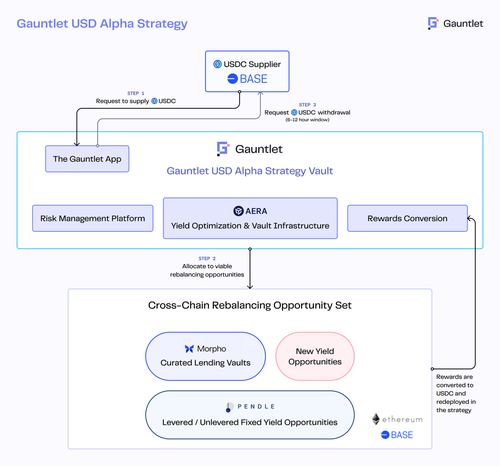

1/ Gauntlet USD Alpha is Live

The best risk-adjusted stablecoin yield in DeFi, powered by institutional-grade risk management from crypto's most vigilant, quantitative minds.

Learn more and supply the vault 👇

2/ Supplying the vault

Anyone can supply USDC to the vault, built on @base and accessible on the Gauntlet App.

To start, we will allocate to @MorphoLabs vaults on Mainnet and Base. Rewards are automatically swapped to USDC and compounded.

gtUSDa vault:

3/ Too many cowboys, not enough quants

$20B+ in USD stables deployed in 240+ yield opps. across EVM chains

$250B+ in outstanding stable supply. Gauntlet USD Alpha solves for:

Optimal rebalancing

Institutional-grade

Active and adaptive yield optimization strategy

4/ Gauntlet USD Alpha use cases span the crypto-native and TradFi divide. Built for:

Asset managers & financial institutions

L1 & L2 ecosystems

Wallet providers & exchanges

RWA Issuers & platforms

...and for retail, of course.

5/ Do you know how risk is managed on your yield sources?

Often, vault curators do not explain how they manage risk. Curators either have a risk framework they can clearly explain, or they don’t.

Explore our framework on the Gauntlet VaultBook:

6/ Backtest

Institutional allocators typically review a backtest: how a strategy would have performed in past market conditions. We’re making this information available for Gauntlet USD Alpha.

7/ Reintroducing the Gauntlet App

We designed the Gauntlet App to give everyone, from whales to first-time DeFi allocators, access to the metrics that matter most.

8/ Gauntlet Office Hours is now open

For news and other alpha on gtUSDa, join Office Hours, our update and support channel. Get updates from the quants, previews, and more.

10/

52,14K

Johtavat

Rankkaus

Suosikit