Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

BidClub

🔈BidCast - New Interview with @ajwarner90 from @arbitrum on $ARB

📌 What the $HOOD deal means for $ARB, especially on institutional partner signal and impact

📌 How $ARB generates (volatile) $50 mm rev today

📌 What it is structurally well positioned to ramp this rev materially in coming years, and

📌 ...how this cashflow actually accrues only to $ARB token (vs. to equity like peers)

Timestamps 👇

00:00 Opening

00:45 Introduction to Arbitrum and AEP

08:22 Robinhood's Partnership with Arbitrum

16:20 The Importance of Custom Chains

23:38 Revenue Models and MEV Capture

29:45 Future Prospects and Industry Interest

37:34 Arbitrum's Financial Landscape

46:30 Understanding TimeBoost and Its Impact

50:15 Revenue Generation and DAO Governance

56:00 Operational Costs and Future Projections

01:02:07 Investor Concerns and Market Dynamics

9,45K

🔈BidCast - New Interview with @osf_rekt from @rektdrinks on $REKT

📌 How $REKT achieved 700k cans sold & 2 mm sales

📌 Mid-term plan towards 3.5-5 mm in revenue

📌 How convo w/ CPG & distributors changed w/ crypto-friendly regime, and

📌 What its longer-term growth plan is beyond DTC

Timestamps 👇

00:00 Opening

00:50 From TradFi to Sparkling Water: A Unique Journey

08:06 Building a Community: The Evolution of Rekt Brands

13:44 The Economics of Sparkling Water: Revenue and Costs

17:55 Navigating Two Worlds: CPG and Crypto

25:00 User Acquisition and Token Economics

25:55 Token Purchases and Business Growth

27:51 Equity vs. Token Holders

30:28 Exciting Future Directions

31:26 Crypto Regulation and Traditional Partnerships

33:20 The Concept of Brand Coin

35:27 Distribution Strategies and Revenue Growth

37:43 Customized Packaging and Token Incentives

39:47 DTC Revenue Targets and Future Plans

41:44 Expanding Product Lines

43:23 Balancing Token Incentives and Revenue

45:15 The Rekt Brand Identity

49:13 Scaling and Token Incentives

52:24 Future Goals and Case Studies

55:05 Investment Opportunities and Community Engagement

10,93K

🔈BidCast - New Interview with @jai_prasad17 from @DefinitiveFi on $EDGE

We discuss:

📌$10M run rate target by year-end, with current daily revenue already at $10K+ and growing.

📌Why its new Trench Mode could drive big volume.

📌How the Cross-chain TWAPs + DeFi API infra enable new flows from OTC desks, exchanges, and protocols.

Timestamps 👇

00:00 Opening

00:50 Introduction to Definitive and Its Founders

03:53 Understanding the Business Model and Revenue Generation

06:47 Targeting Advanced Traders in DeFi

10:02 Product Features and Upcoming Enhancements

12:52 Market Positioning and Competitive Landscape

15:59 User Experience and Education in DeFi Trading

18:49 Integration with Hyper-EVM and Future Plans

23:59 Future Vision and Goals

28:21 User Acquisition Strategies

32:38 Referral Programs and Marketing Efforts

34:31 Financial Health and Revenue Management

37:47 Token Strategy and Acquisition Considerations

41:44 Product Development and Partnerships

7,63K

🔈BidCast - New Interview with @cindy_leowtt from @DriftProtocol on $DRIFT

We discuss:

📌How $DRIFT is making $25–35M in annualized revenue, with 100% flowing to DAO-held treasury.

📌Why it targets $500M–$1B in daily volume by year-end, backed by upcoming Aug patch + SOL upgrades.

📌Token buybacks based on PE ratio w/ treasury.

📌Apollo private credit fund / RWA and more.

Timestamps 👇

00:00 Opening

00:50 Introduction to Drift Protocol and Trading Volume

03:57 Revenue Structure and Token Holder Dynamics

06:54 Future Opportunities and Business Growth

12:44 Performance Improvements and Competitive Landscape

18:46 Technological Innovations and User Experience

24:39 Market Strategy and Future Projections

27:56 Understanding Drift Volume and Market Dynamics

30:03 Challenges in Liquidity and User Retention

31:32 Innovations in Trading Instruments and Features

35:34 Institutional Products and Future Roadmap

40:15 Tokenization and Asset Management in DeFi

47:26 Token Incentives and Growth Strategies

32,31K

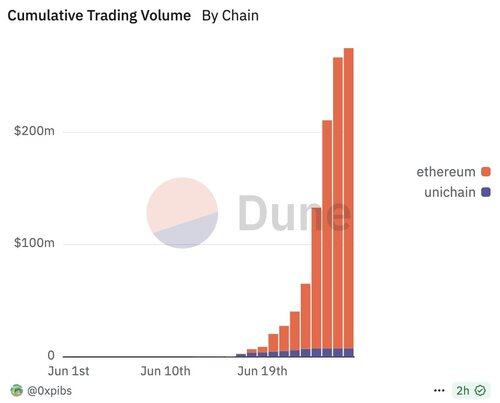

Mike's call re: EulerSwap's explosive growth was pretty spot on:

Michael Bentley27.6.2025

Euler is poised for explosive growth.

This EulerSwap volume was generated from a handful of closed beta testing positions.

What happens when EulerSwap is opened to the public and has hundreds or thousands of positions and a reward campaign behind it?

995

🔈BidCast - New Interview with @MikeSilagadze from @ether_fi on $ETHFI

We discuss:

📌 Why $ETHFI is a Neobank and not just (re)staking

📌 How big the new card business starting 1.5 months ago can get

📌 Why a 2025/26 3.7 Bn TVL and 100k+ cards can drive 100mm+ ARR and beyond

📌What a $1,000 ARPU and 1.5-month CAC payback means for EtherFi’s capital efficiency

Timestamps 👇

00:00 Opening

00:51 Introduction to EtherFi and Its Vision

03:42 Understanding EtherFi's Revenue Streams

06:42 The Importance of Vertical Integration in DeFi

09:51 Market Share and Growth Strategies

12:55 The Cash Product: A Game Changer

15:46 Customer Acquisition and User Engagement

18:47 Future Projections and Business Strategy

31:01 User Growth and Transaction Predictions

35:41 Revenue Models and Market Positioning

40:10 Cashback Strategies and Token Economics

46:35 Future Roadmap and Product Development

27,59K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin