Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Otavio (Tavi) Costa

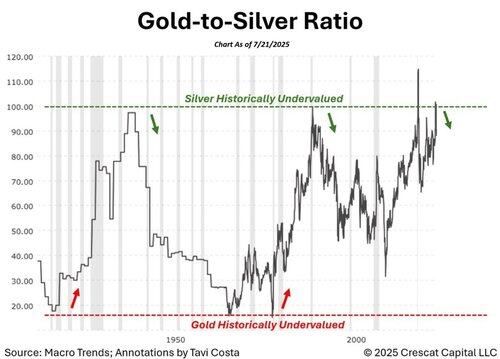

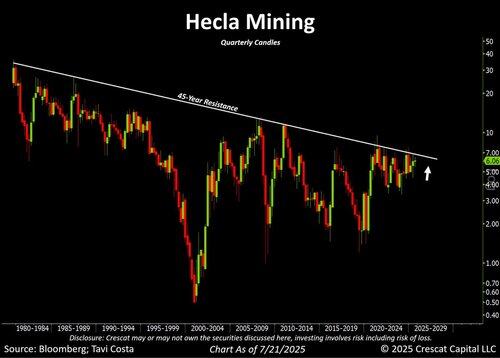

One of the longest-standing silver companies globally is, in my view, on the brink of breaking out from a 45-year resistance level.

A new silver bull market is likely unfolding, in my opinion.

Apologies for sounding repetitive, but I genuinely believe this is one of the most compelling macro opportunities I’ve seen in my career.

It’s no coincidence that we chose to acquire what is now the fourth-largest silver mine in the world a few years ago.

Game on.

67,03K

Otavio (Tavi) Costa kirjasi uudelleen

Oil, Copper, Zinc: Tavi’s Top 3 ‘No-Brainer’ Hard Asset Bets!

👉 Watch the Full Episode:

👉 Join Our Free Newsletter:

👉 Learn More:

Tavi Costa, partner at Crescat Capital, joins “In It To Win It” to deliver a sweeping macroeconomic outlook that spotlights the growing opportunities in commodities and emerging markets. Born and raised in Brazil, Tavi shares how his family’s business collapse and a scholarship tennis journey to the U.S. shaped his disciplined, contrarian investment philosophy—rooted in long-term macro trends and value.

Costa outlines his core thesis: the weakening U.S. dollar and suppressed interest rates are laying the foundation for a generational rotation into hard assets and non-U.S. equities. He identifies gold, silver, copper, and zinc as top beneficiaries of this shift, driven by global underinvestment in resource development and structural supply deficits. He highlights Brazil and Latin America as key destinations for capital, pointing to his own real estate investments as evidence of conviction.

Connect with Tavi Costa!

Website:

LinkedIn:

X:

🔥 Key Topics Discussed

✅ Major gold discovery in a historic Alaskan district

✅ Strong financial position: $13.5M CAD cash, zero debt

✅ Backed by Alaska’s largest native corporation (10% owner)

✅ Experienced team with $3B in deals and 30M oz discovered

✅ Alpha Bowl drill intercept: 27 g/t gold, open mineralization

✅ Near-term catalysts: August drill results, Q1 2026 resource estimate

✅ Tight share structure: 67M shares, 30% insider/institutional ownership

✅ Proximity to Donlin Gold’s 40M oz deposit (40km)

✅ Six high-impact targets across a 99,000-acre land package

✅ Over $2B raised by team in previous ventures

If you found value in today’s breakdown, please give this video a thumbs up, share it with friends, and don’t forget to subscribe for weekly market insights.

#TaviCosta #Gold #Silver #Copper #Uranium #Oil #NaturalGas #Coal #Nickel #IronOre #Platinum #Palladium #S&P500 #Brazil #China #InItToWinIt #SteveBarton

13,64K

Otavio (Tavi) Costa kirjasi uudelleen

What metal could become the backbone of tomorrow's electrified world?

Copper. With energy demands rising, infrastructure evolving, and materials pivotal to progress, copper's role is only expanding.

Watch copper’s surge—because the future is wired with it.

👉 Watch the Full Episode:

👉 Join Our Free Newsletter:

👉 Learn More:

#CopperBoom #ElectricFuture #InfrastructureGrowth #EnergyTransition #NaturalGas #UtilityInvestment #GreenEnergy #RawMaterials #CopperDemand #CleanPower

14,11K

An important reminder:

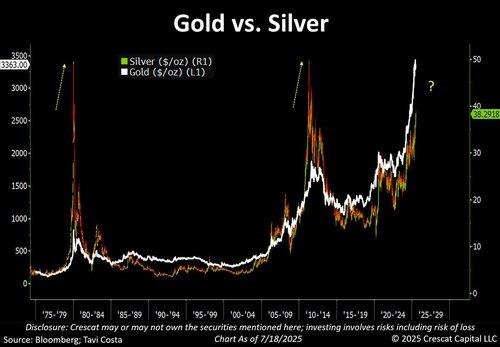

When gold goes, silver leads.

With gold now above $3,300, the silver side of the story is about to get a lot more interesting in my view.

Silver has formed one of the longest cup-and-handles on record.

From what I have seen historically, patterns like this often resolve with explosive upside.

48,15K

Inflation expectations are breaking out and approaching 3-year highs.

Markets aren’t stupid.

While the talking heads debate whether tariffs are inflationary or deflationary, here’s what’s really unfolding:

▪️Money supply is hitting new highs

▪️A shadow Fed Chair is in the mix

▪️Commodities are broadly moving higher

▪️The U.S. dollar is on track for its worst year since the 1970s

▪️And a “Big Beautiful Bill” is already in the works

In my view, a resurgence of inflation is already underway.

56,01K

The US dollar has strengthened over the past two weeks, largely as a result of positioning shifts from an extremely bearish stance.

This tactical move is likely closer to the end than the beginning, in my view.

I still believe we’re in the middle of a broader, structural downtrend in the dollar — one that’s far from over.

39,75K

A meaningful development, if true

Ryan Petersen15.7. klo 09.55

Two months after Trump declared a "ceasefire" with the Houthis, they sank another ship and released this image of the attack.

7,08K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin