Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Om Malviya | Superlend 🧡

Serial Bear Market Builder. Co-founder @SuperlendHQ, Contributor @dyorcryptoapp

did you know, majority of defi tvl is into loops?

prove we wrong if you can

Superlend22.7. klo 00.58

Something is coming to @etherlink.

Stay in the loop.

209

so you’re saying tezos l1 and etherlink l2 already satisfies this criteria?

nice

Wei Dai22.7. klo 14.20

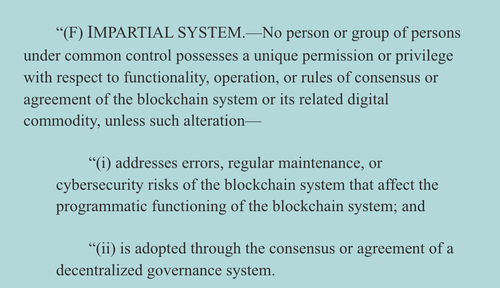

The CLARITY Act, if passed, is bullish for L1s (and decentralized L2s) because its "mature blockchain systems" definition of "impartial system" excludes centralized L2s (w/ single-entity sequencers).

(However, L2s can satisfy this criteria if its sequencer is elected by decentralized governance.)

Screenshot of Section 42(c)(2)(F) in CLARITY Act

* more precisely L1 tokens or tokens of decentralized chains

3,67K

what i wrote here is inevitable

Solid Intel 📡21.7. klo 18.20

INTEL: Pantera-backed Ether Machine has raised $1.5 billion for its Ethereum venture, with $800 million allocated to acquire $ETH

427

if nothing else, it deserves to have the same value as curve

for correlated assets it does do wonders

for uncorrelated we should wait until v2 arrives and they add some smart hedging mechanisms

don’t discount this team :)

sigma^221.7. klo 17.55

$FLUID might be one of the most overlooked ETH betas out there right now. Averaging $700M/day in volume.

Dex v2 is next — if it delivers and actually flips Uniswap on volatile pairs like they’re expecting, the market’s going to have to reprice that narrative fast.

It's already dominating stables and correlated tokens volumes.

Then there’s the Jupiter Lend partnership — Fluid gets 50% of the revenue. If that grows anything like Jupiter did, they’re going to be sitting on a serious revenue engine. Buybacks kick in at $10M annualized revenue — they’re already at $7M.

At some point, this should be priced as both a DEX and a lending market. Right now, it’s not.

Feels like one of those setups where the token is still priced like a forgotten protocol, while the infrastructure quietly eats market share from below.

The only thing they lack is marketing

12,26K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin