Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Will Quist

Partner @slow

private company earnings calls are coming.

Boring_Business19.7. klo 00.15

Banks are starting to offer equity research on private companies such as OpenAI

At this rate, why do companies ever need to IPO anymore?

Continually capital raise from VC investors and payout employees with secondary fund raises

Private markets are the new public markets

2,19K

Ok. So this is leasing… and leasing only works with: 1. Captive financing arms 2. Securitization and 3. Secondary markets for the assets. Who wants to build those for ‘robots eat the world!’ With me?

Will Quist15.7. klo 02.26

Does the math of robot-as-a-service EVER work?!

2K

The opportunity cost of the team is the most valuable asset invested into any company. Use it wisely.

Semil15.7. klo 07.41

One reason raising too much $ too early is risky — it can subconsciously keep one anchored to an illusory outcome. It becomes too easy to stay on a suboptimal path out of duty or comfort, while invaluable time drifts by.

5,59K

If you want to work out the ripple effects from the obvious things that are going to happen, I'll be hosting 'so what' dinners in SF this fall and @yrechtman will be doing them in NYC... hit the link in the thread below to join

Slow Ventures14.7. klo 23.28

'So What' dinners have gotten 1K+ interests... incase you missed out see replies for context and link to sign up

918

Will Quist kirjasi uudelleen

Really excited about this. @kylascan is joining us in NY for a So What dinner and conversation on attention as a new economic substrate in August.

We'll pull the thread and extrapolate out the ripples of the attention economy across work, markets, life.

Read more and sign up below!

18,2K

And Warren Buffett should probably buy index funds… but here we are

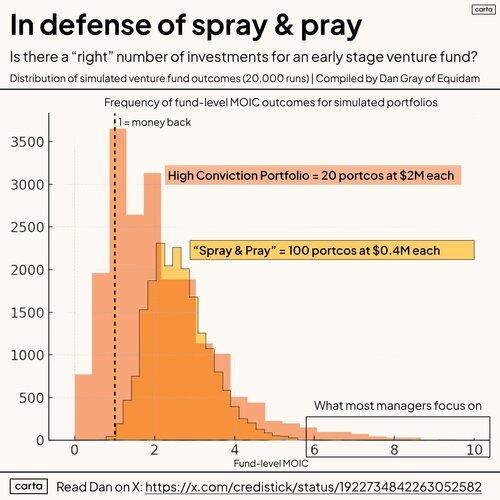

Peter Walker3.7. klo 00.54

Early stage VCs should (probably, on average) make more investments.

Lots of objections, some of them very valid. But the general disdain for "spray and pray" is pretty anti-math.

Link to the full argument as laid out by @credistick in following post

825

Will Quist kirjasi uudelleen

Almost everyone I know who did 5+ yrs at a great scale up ($1-$20B) has become successful

- Better education than grad school

- An embedded network

- Strong market signal, especially if promoted multiple times

Putting yourself on the right playing field is underrated

100,45K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin