Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Holger Zschaepitz

Opendoor is the market’s latest Meme Stock w/insane trading volumes. Shares of the San Francisco-based tech group that focuses on the stagnant real estate sector have nearly tripled in value over the past week. The rally appears to have been sparked by a prominent investor discussing the stock on social media, which drew the attention of retail traders.

The company has struggled since peaking at a $20.6bn valuation in February 2021, shortly after merging with the SPAC (special purpose acquisition company) Social Capital Hedosophia Holdings Corp II, led by Chamath Palihapitiya.

That decline isn’t surprising: Opendoor’s core business is in the "instant buyer" market, where it aims to make home sales faster and bypass traditional realtor fees—an idea that has faced serious challenges in a cooling housing market.

3,63K

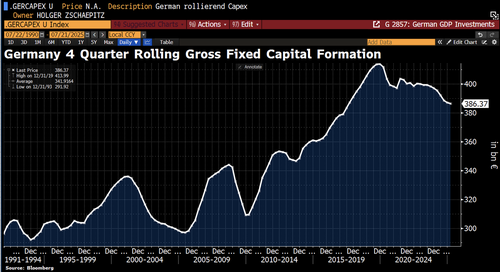

Good Morning from #Germany, where over 60 of the country’s top companies have kicked off a major new investment push worth at least €100bn. The goal: to help revive Europe’s largest economy, which has been stuck in a prolonged slump.

One of the biggest concerns is that business investment has been falling. Back in 2019, gross fixed capital formation – a key measure of investment in infrastructure, machinery, and equipment – made up 11.7% of GDP. Today, that share has dropped to below 9%, a clear sign of the country’s fading economic dynamism.

36,27K

Good Morning from Germany, where electricity prices on the energy exchanges have surged again – topping €100 per megawatt hour. So far this year, prices have crossed that level on 68 days. At these rates, building and operating large, energy-hungry data centers in Germany becomes increasingly difficult.

90,91K

Good Morning from #Germany, which has rejected the EU’s proposed €2tn budget. The objection isn’t just about the size – Germany would cover about a quarter of the total – but also about the plan to introduce a corporate substance tax, which Berlin argues would do little to boost competitiveness.

40,76K

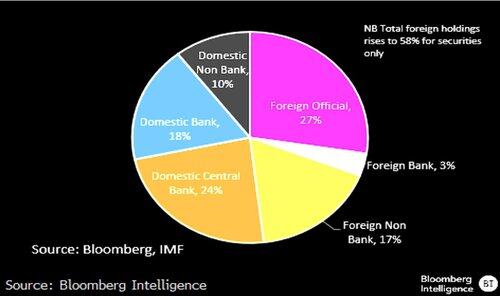

Good Morning from #Germany, where foreign investors now hold 48% of the country’s €2.69tn in govt debt, acc to Bloomberg Intelligence. That’s nearly double the share in Italy, but roughly in line with other major EU economies like France.

While this is a notable figure, it’s still well below the peak of around 76% seen before the European Central Bank launched its quantitative easing (QE) program in 2015. Back then, foreign investors were crowded out as the ECB bought up large volumes of sovereign debt.

Now, with the ECB in quantitative tightening (QT) mode and reducing its bond holdings, foreign ownership has risen again. Meanwhile, the Bundesbank’s share of German government debt has fallen to just 24%.

17,58K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin