Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Eugene Bulltime

Head of Analytics & Partner @ContributionCap | Blockchain and Crypto researcher | DeFi Advisor | Fulltime in crypto since 2017 | My Research Hub ↓

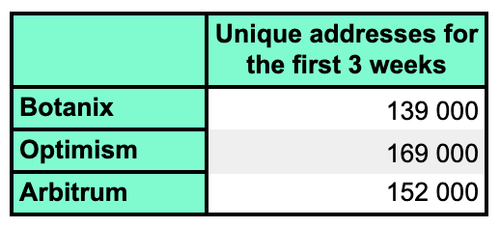

Only 1 project related to BTC - BitDeer - mining company

Why don't you invest in BTC related projects in BTCfi, BTC L2, BTC infra?

Here a lot of great companies:

@Lombard_Finance @BotanixLabs @build_on_bob @trustmachinesco @GOATRollup @babylonlabs_io @MezoNetwork @fiamma_labs

Paolo Ardoino 🤖4 tuntia sitten

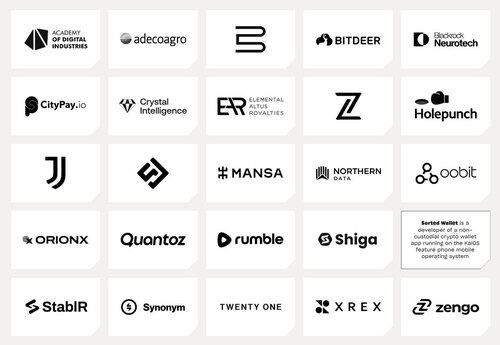

Today Tether publishes (a portion) of its investment/venture portfolio.

Overall Tether group invested in more than 120+ companies and this number is expected to grow significantly in the next months and years.

* these investments have been made with Tether's own profits (13.7B in 2024), outside of USDt (and other stables) reserves and are part of Tether Investments arm.

1,32K

Eugene Bulltime kirjasi uudelleen

➥ Which Next-Gen DeFi Lending Platform Is Right for Me?

DeFi lending protocols are among the leading products in the DeFi space, with a total combined TVL exceeding $64 billion and comprising 536 protocols across various networks.

As DeFi lending moves from one-size-fits-all models to innovative designs, there are three next-gen lending protocols I personally use.

While they may appear similar externally, they have distinct foundational differences:

➠ @SiloFinance

➠ @eulerfinance

➠ @MorphoLabs

Let's dive into our 30-second report (detailed comparisons can be found in the picture) 🧵

...

— Silo / $SILO

- Silo uses an isolated lending model that contains risk within each market, offering greater security than traditional aggregated models like Aave or Compound.

- Its V2 introduces modularity, allowing DeFi builders to deploy customizable markets with hook stacks for cross-market interactions and programmable elements.

- Customizable elements include fixed-term lending, interest rates, oracles, LTV/LT ratios, and others while maintaining core isolation.

- Silo is the first lending protocol to accept PT and LP as collateral, and this is possible because the risk-isolation allow for agile deployments of new market.

- Silo serves both DeFi users prioritizing security and builders aiming to develop products in a risk-isolated, secure environment.

- Supported chains: @ethereum, @SonicLabs, @avax, @arbitrum, @Optimism and @base

...

— Euler / $EULER

- Euler is focused on creating a lending superapp, featuring tools like the Euler Vault Kit (EVK), a modular framework for crafting custom vaults, and the Ethereum Vault Connector (EVC), which allows for the rehypothecation for clustered/chained collateral to enhance efficiency.

- Users get interest-earning eTokens for deposits and non-transferable dTokens for debts, enabling leverage by minting eTokens.

- EulerSwap launched May 2025 provides lending-boosted yields, just-in-time liquidity, and LP collateral.

- Euler appeals to builders and savvy DeFi users who want flexibility and leverage options, however there might possible of risks associated with the utilization of clustered collateral.

- Supported chains: Ethereum, Avalanche, @unichain, Sonic, @BNBCHAIN, Arbitrum, @swellnetworkio, Base, @berachain and @build_on_bob

...

— Morpho / $MORPHO

- Morpho is a hybrid aggregated lending protocol that operates as a peer-to-peer (P2P) layer on top of existing lending pools. It optimizes rates through direct matching and defaults to pool liquidity for unmatched positions.

- Morpho employs isolated markets with a single pool for each asset pair and minimal governance. It clusters liquidity through MetaMorpho vaults, allowing users or curators to manage these vaults.

- This method avoids shared-risk pools and tackles fragmentation, with curators managing risk through whitelists, LTVs, and oracles.

- Supported Chains: Ethereum, Base, @HyperliquidX, @katana, Unichain, @0xPolygon, @world_chain_, @plumenetwork, @use_corn, @LiskHQ, Optimism, @TacBuild.

14,07K

Aave has no competitors in the centralized world

Banks have too many obstacles, Aave does not.

Long term, I believe that people will leave their banks for decentralized lending, first of all in favor Aave.

So sooner or later Aave will become #1 on this list

Stani.eth20.7. klo 23.26

Aave climbing to the top.

2,61K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin