Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The Smart Ape 🔥

Father | Building @BasePumpFUN and experimenting with ideas | I do technical stuff hard to explain | Love you Mom | Nothing is financial advice | DM open 📩 |

Many of you keep asking why we need @campnetworkxyz when IP licensing companies already exist.

Fair question, but the truth is traditional IP licensing is slow, centralized, and made for gatekeepers, not creators.

Camp changes everything by building an open infrastructure where anyone can register, remix, and monetize their content with full transparency.

It’s not just for big brands, even a tweet or a short video can become verifiable IP that’s tracked, licensed, and rewarded instantly.

We’re a generation that moves fast, and Camp is building an IP system that finally moves at the speed of the internet and creators.

1,68K

The stablecoin market is about to change forever. Yesterday, Trump signed the GENIUS Act, and this new law is going to reshape the landscape for stablecoins.

It allows banks and organizations to issue their own stablecoins. The main goal is to boost public trust and make crypto usage more accessible.

The act also introduces a more regulated framework, requiring transparency and reserve audits for stablecoins, meaning we’re less likely to see another UST-style collapse.

Many are pointing out a potential conflict of interest since Trump has ties to a stablecoin through World Liberty Financial (USD1). Not surprising coming from him, but regardless, it will likely drive adoption and trust.

So overall, it’s good news for us.

13,15K

The biggest thing coming in crypto is RWA.

We don’t need an alt season, RWA alone is enough.

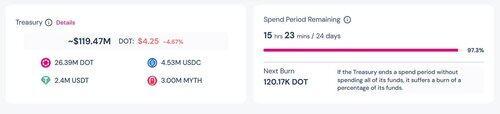

One of the sleeping giants infra in RWA is undoubtedly @Polkadot.

RWA demands infrastructure and flexibility, and Polkadot delivers both.

Just look at how it enabled @centrifuge to tokenize over $600M in real-world assets.

As a parachain, Centrifuge benefits from the shared security of Polkadot’s validator set, no need to maintain its own validator network.

Polkadot also provides a modular architecture, allowing Centrifuge to tokenize assets efficiently and at scale, without competing for resources with other chains.

Thanks to Polkadot’s interoperability, Centrifuge can also connect with other ecosystems like Ethereum, Arbitrum, and Avalanche, unlocking external DeFi liquidity with ease.

11,74K

WOW. @Coingaragesro has already raised over $1.35M in their presale.

The largest contribution so far is $40K, with 3,700+ holders, so a healthy distribution.

The $GARA token will offer a 25% trading fee discount, and 25% of the tokens used in fees will be burned, with a goal to reduce total supply from 900M to 200M. Check it out!

Coingarage18.7. klo 22.05

💸 $GARA Presale: Overview

We’ve officially crossed $1.35 MILLION raised in our $GARA presale! 🔥

A huge thank you to our incredible community — we wouldn’t be here without you ⚡️

With over 50% of our raise goal already reached, now is the perfect time to join before the 2x price increase at listing and upcoming CEX launches.

⏳ Time is running out…

👉 Join the $GARA Presale Now:

3,85K

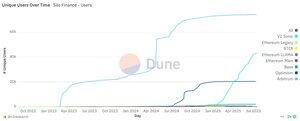

Is it just me, or $SILO is completely mispriced?

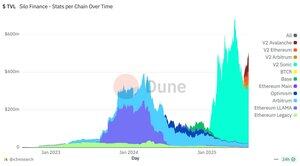

@SiloFinance surpassed $500M TVL, with $100M recently coming from @avax, thanks to the DeFi opportunities they’ve unlocked there.

During the hyper DeFi phase on Sonic, they delivered tons of yield opportunities, and now they’re doing the same on Avalanche.

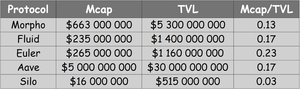

What really surprises me is the Mcap, just $16M, with a $38M FDV. That puts the Mcap/TVL ratio at 0.03, one of the lowest in the space right now.

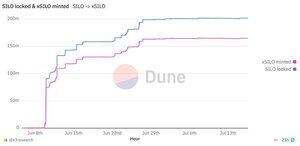

+ 20% of $SILO is locked in xSILO, which significantly reduces sell pressure.

If you compare the Mcap/TVL ratio with other protocols like @0xfluid, @MorphoLabs, @eulerfinance, or @aave, Silo’s valuation is way below.

All the metrics point toward healthy growth, both in TVL and unique users, which keep increasing steadily.

From what I see, real DeFi users are leveraging Silo heavily to boost their yields. And Silo keeps delivering, on Sonic, now on Avalanche, and for sure soon on another chain.

We can debate whether an alt season is coming or not, but if you believe, like I do, $SILO is definitely a strong contender given its core role in DeFi and how undervalued it currently is.

I don't like making that kind of prediction, but a 10x from here is more than possible.

6,13K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin