Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

CJ

Trader of Magic Internet Money. Not Financial Advice. No paid services.

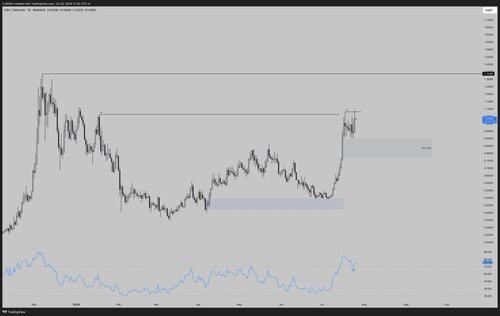

$ETH

Weekly -

After a strong move up, price has stalled and put in a consolidation week after tagging 3744 swing high. The prime opportunity for me after the weekly close is to tag the anticipated weekly imbalance, prior to continuation higher.

Daily -

I'd like to see us range a bit, perhaps take out both sides into said anticipated weekly imbalance, before higher. 3.5k on a shallow sweep, 3.2-3.3k on a deeper retracement. In either case, I'll be looking for longs targeting 4.1k+

As a side note, technically we could retrace to 2.5k demand and still hold bullish structure, because imo this is one giant range that was established from 2021-2022 and when price is range bound, we can expect many liquidity grabs and deep retracements. However, this is not my base case currently as I'd first look to the weekly imbalance for support to tee up longs. The good news about price being range bound for a number of years is the eventual breakout should be pretty explosive.

GL

8,57K

$BTC

More of a clarification post as some seem to think I'm "calling" for new lows based on a potential scenario I mapped out in a prior post.

- I'm swing long from 15.6k targeting new ATH.

- New lows within the Daily/Weekly imbalance I view as additional buying opportunities, would add to swing.

- Would also consider opening a separate long with a LTF trigger (tighter invalidation) if presented.

- If the low is in here, see the first point

- Soft invalidation would be daily candles closing below the midpoint of this imbalance ~ 13.7k. That to me is a warning sign. Hard invalidation would be a candle closing below the imbalance itself.

- Upside targets: 125.8k, 130-135k

Minor point: A rally to the upside that fails at 121560 just means we aren't ready to expand out of this range yet - where I would treat price as still "range bound" meaning range lows are still on the menu.

Hope that helps ...

14,42K

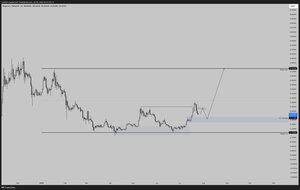

$CRV

Tough local consolidation here.

Price action is telling me there is a high likelihood of us tagging the daily imbalance before higher as we've put in a SFP into an old high from January, as well as the initial consolidation high itself.

However, we are bouncing off Daily RSI 70 as well as holding above H4 50 RSI - which is what you want to see for continuation.

As I am positioned from 0.49 in spot, I'm not too worried as I still believe below $1.3 is within a higher timeframe accumulation range.

If we do tag the daily imbalance, I would see it as an opportunity for:

- Adding to spot position

- Opening fresh long positions

🍿

17,53K

$BTC

Started building a swing long into 115k, however if we fail to invert this imbalance straight away, I'd be looking for another low into ~ 113k before higher (in which case I'd add to my position).

This type of move is where I'd also look to open a separate long based on a lower timeframe trigger.

Perhaps chop over the weekend, nuke early week creating a new low, then up. Let's see.

26,75K

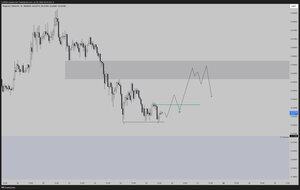

$DOGE

HTF plan (+ potential LTF long)

Still have spot from the 19c sweep.

The long I took and TP'd at 26c has offset some risk

Looking to add to spot and reload longs if we tag demand.

Think we might retrace up into the daily imbalance first before we see daily demand.

I will also be looking for a lower timeframe long up into said imbalance, if we create a 1hr csd.

The squiggly on the ltf chart is just an example - will post something a bit more actionable when price action prints.

27,83K

Btw this is where you get bullish on $BTC

Sweeping prior lows into a weekly imbalance that was created during a break of prior ATH.

I'd want to see wicks into 113k as max downside, otherwise it starts to get a bit iffy.

If we fail to hold this weekly imbalance, it's RIP and time to rethink the HTF context.

If we do hold this weekly imbalance, we should be expecting a leg up to around 130k next.

16,2K

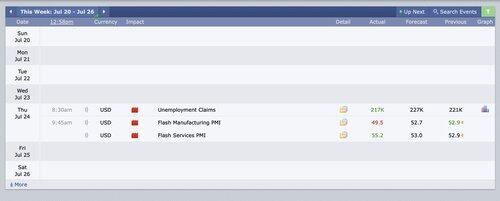

Expected today to produce a meaningful move given it was our main impactful news day.

Unless some out of band news drops, expecting the major move on $BTC to occur next week now.

I opened a long at the 17.3k level (which seems to be a bit of a gandalf level thus far) - but has not produced the reaction I was looking for yet. Will give it until this evening to play out perhaps.

However, with all of the above in mind, if we do get the larger flush lower into 113.6-115.7k that's a better opportunity to set up the swing imo so I'm all for it.

Plan this week was to attempt two longs:

- One at 117.3k

- The other on the larger sweep lower and reclaim if we get it.

Sometimes if the weekly profile is in large a consolidation - just need to have patience and wait for range extremes.

12,68K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin