Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

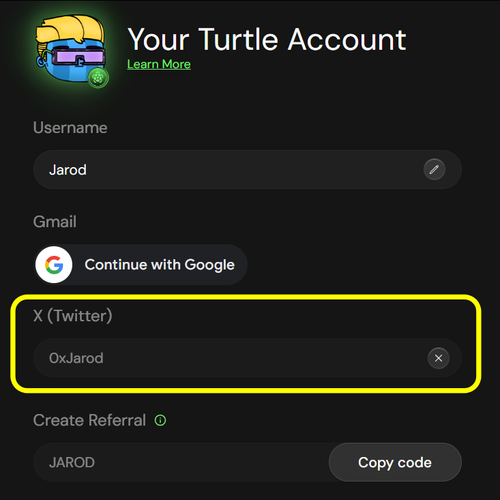

Jarod ⚔️🐢🟩

BTC ATH soon... Wen altszn?

| 🎙 #SpacesHost @eesee_io @LABtrade_

| 🚀 @0xPolygon 🐺 @wolfswapdotapp 🎮 @MedievalEmpires

The best SOL yield farms are on @katana ! 🌾

Get 316% APR for uSOL/ETH on @SushiSwap ! 🤯

(Fees 75% + SUSHI 52% + KAT 189%)

I'm bullish on SOL but very busy, so a low-risk set & forget strategy is best, which is why I went with stable pairs JitoSOL/uSOL for 24% APR (SUSHI 5% KAT 19%).

But that's not all, @steerprotocol boosts my yield by up to 20%! 👀

FYI: On Solana, the highest jitoSOL yield is just 9% APY with jitoSOL/SOL on Kamino.

✅ Farm 3x more yield on Katana!

💡 Move SOL to Katana SLIPPAGE-FREE:

- On @jito_sol, stake/swap to JitoSOL

- Use @StargateFinance to bridge of jitoSOL from Solana to Katana

🚀 Steer boosts the APR to 28%!

- Steer's Smart Pools actively rebalance liquidity

- Concentrated liquidity ensures more of the pool is used for swaps = more fees

- fees are automatically compounded into the position = boosting APR

🪂 SOON: Farm Steer points too!

- Steer does not have a token... yet

- Points accumulation available on Katana soon!

Nonetheless, Steer is far from perfect:

⚠️ You'll need to manually estimate the token ratio, as Steer's swap & single-side deposit features are unavailable on Katana. It takes a few tries & you'll have to live with dust in your wallet.

⚠️ Manually set token approve to a higher amount: The token ratio can shift in the seconds between approval & deposit causing deposits to fail.

Needless to say, I put my SOL into Steer for boosted yields & automatic management! 🧠

High yield for your favorite assets! Only on Katana! 🐈

13,57K

You're not bullish enough on BTC! 🔥

Tradfi bros are shilling our bags & sending us to unimaginable heights! 🚀

Bitcoin is living up to expectations of being the most important asset of our generation!

Yet, BTC is mostly idle 😅

This is what @Lombard_Finance is changing!

- We know them for LBTC which has become the market leader in DeFi for the Bitcoin economy

- Recently, they announced an ambitious vision to build Bitcoin Capital Markets onchain

If you're bullish on BTC, keep an eye on Lombard, the onchain Strategy! 🟩

Bitcoin Archive21.7. klo 20.18

BREAKING: Tom Lee predicts $250,000 Bitcoin by the end of the year

"Bitcoin should be worth over $1,00,000 in the next few years." 🔥

1,08K

Get USDC Yields On @hemi_xyz !

I was exploring Hemi when I discovered these amazing farms on @merkl_xyz !

EASY: Lending Loop

🚜 8.6% APR for USDC.e supplying on @zerolendxyz

- Supply USDC.e & get +1.7% Native APY = Total 10.3% APY

- Loop by borrowing USDC.e for 3.4% APY

- Since you're looping the same token, liquidation risk is very low! Max out your LTV at 80% (LLTV: 85%)

- Supply all your borrowed USDC.e for 10.3% APY

HARD: v3 LP Farms

🚜 81% APR for hemiBTC/satUSD on @SushiSwap

🚜 70% APR for hemiBTC/USDC.e on Sushi

🚜 30% APR for WETH/USDC.e on @izumi_Finance

⚠️ v3 liquidity provision is risky & requires active management

MEDIUM: LP Managers

The smart move is to use a manager that automates your LP management with an algorithm.

😭 However, none of those I checked supported these rewards, so only direct deposits into Sushi / Izumi gets tracked by Merkl

💡 Still, @steerprotocol has Merkl integrated, so check with them about creating a Smart Pool & tapping Merkl rewards

Enjoy the yield on the programmable Bitcoin chain! 🟠

528

NGL... Mobile @MedievalEmpires is looking really good! 🤩

TBH... I have a lot of meaningless meetings irl that would go by faster with its help 😜

Wen?

👀 Something must be brewing with MEE doing a 3x last week & holding up really well!

Medieval Empires20.7. klo 21.00

Sneak Peek from our upcoming Mobile version!🫣

$MEE

1,88K

The Best Low-Risk Yield For ETH On @katana 🌾

I'm a busy person, so I don't want to actively manage my farming positions. Set & forget is the goal + harvesting once a month. Thus, I'll be looking for low-risk farms for my ETH.

🍣 On @SushiSwap, weETH/vbETH LP gets 22% APR

🦋 Meanwhile, @MorphoLabs has 57% APY on ETH. This is how:

1️⃣ Bridge ETH to Katana with @JumperExchange

- E.g. $1000 in vbETH

2️⃣ Swap vbETH for weETH with @wolfswapdotapp

- weETH is EigenLayer restaked ETH from @ether_fi with 3.4% APR

- Yield: $34

3️⃣ Go to Morpho. Borrow from weETH/vbETH (LLTV: 91.5%) for 19% APY (KAT 14% + MORPHO 6% - Interest 1%)

- Since it's a stable pair, use a higher LTC of 81.5%

- With $1000 weETH, get a $815 vbETH loan

- Yield: $155 (KAT $114 + MORPHO $49 - Interest $8)

4️⃣ Borrow from vbETH/vbUSDT (LLTV: 86%) for 74% APY (KAT 58% + MORPHO 18% - Interest 2%)

- This is a volatile pair, be conservative with an LTC of 56%

- With $815 vbETH, get a $456 vbUSDT loan

- Yield: $337 (KAT $264 + MORPHO $82 - Interest $9)

5️⃣ Swap vbUSDT for AUSD with @wolfswapdotapp

6️⃣ Back on Morpho, Earn with AUSD for 10% APY (Native 1% KAT 9%)

- Yield: $46 (Native $5 + KAT $41)

TOTAL YIELD: $572 ($34 + $155 + $337 + $46) | APY: 57%

🧑🌾 My ETH is now working hard to make me rich! Only on Katana!

⚠️ The numbers above are rough estimates assuming APY & token prices remain stable + zero slippage/gas/protocol fees

5,4K

Want the next big 🪂 from @katana ? ⚔️

Added to my POL 🥩 today, because the @katana team has been dropping hints about POL staking & for good reason...

1.5B KAT will be dropped to only 3.5B POL staked!

They tend to reward those who are EARLY so act FAST! 💨

👀 Other projects incubated by @0xPolygon with confirmed 🪂 are Miden & Privado

Wanna 🥩 too? Step by step guide 👇

11,86K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin