Atomic Swaps: Everything You Need to Know

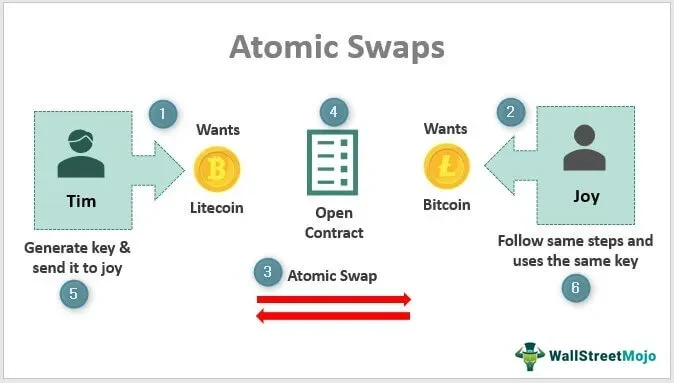

Atomic swaps, also known as cross-chain swaps or atomic cross-chain trading, refers to the process of exchanging of one cryptocurrency for another between two parties without the need for a centralized intermediary, such as a cryptocurrency exchange.

Through the use of cryptographic protocols and smart contracts, atomic swaps allow users to trade different cryptocurrencies securely and in a decentralized manner. These trustless transactions ensure that both parties fulfill the agreed terms simultaneously.

History of Atomic Swaps

The concept of atomic swaps dates back to 2013, when computer scientist Tier Nolan first proposed the idea. He introduced the basic principles of cross-chain trading in a Bitcointalk forum post, outlining the initial ideas of using cryptographic protocols to enable secure, trustless and decentralized cryptocurrency exchanges. Nolan's proposal was based on the premise that users should be able to trade cryptocurrencies directly with each other without relying on centralized third parties, which could be vulnerable to hacks, downtime, or other issues.

As cryptocurrencies and blockchain technology evolved, the idea of atomic swaps gained traction within the community, with developers and enthusiasts recognizing the potential benefits of enabling secure, decentralized, and direct trading between different cryptocurrencies. This led to further research and development to refine the concept and make atomic swaps a reality.

How Do Atomic Swaps Work?

Atomic utilizes a combination of cross-chain trading and cryptographic protocols, specifically Hash Time-Locked Contracts (HTLCs), to facilitate the secure and trustless exchange of cryptocurrencies between two parties. Here's a step-by-step breakdown of the process:

- Cross-chain trading: Atomic swaps enable the exchange of cryptocurrencies that operate on separate and distinct blockchains. The process is designed to be trustless, meaning that both parties can complete the transaction without needing to trust each other or a third party.

- Hash Time-Locked Contracts (HTLCs): HTLCs are a type of smart contract used in atomic swaps. They ensure that the swap either happens in its entirety or not at all, preventing partial or incomplete transactions.

- Concept and purpose: An HTLC is a time-bound smart contract that involves generating a cryptographic hash function. This hash function is used to lock the funds involved in the swap. The funds can only be unlocked by providing the correct secret key, known as a preimage, within a specified timeframe.

- HTLC process and mechanics: When two parties agree to an atomic swap, they create and sign an HTLC on each of their respective blockchains. Each party locks the agreed-upon amount of their cryptocurrency using the same hash function. The first party then shares the secret preimage with the second party, who must use it to unlock the funds on their blockchain within the specified timeframe.

Once the second party unlocks the funds, the first party can use the revealed preimage to unlock the funds on their own blockchain, completing the swap. If the preimage is not provided within the given timeframe, the HTLC expires, and the funds are returned to their original owners.

- On-chain and off-chain atomic swaps: Atomic swaps can be executed directly on the blockchains involved (on-chain) or through second-layer solutions, such as the Lightning Network (off-chain). On-chain atomic swaps require both blockchains to support the same scripting language and HTLCs, while off-chain atomic swaps leverage payment channels and networks like the Lightning Network to facilitate faster, more scalable transactions.

Is Atomic Swap Safe?

Atomic swaps are generally considered safe due to the use of cryptographic protocols and smart contracts, specifically Hash Time-Locked Contracts (HTLCs).

Additionally, atomic swaps allows users to maintain control over their private keys and funds throughout the transaction process. This provides enhanced security compared to centralized exchanges, which often act as custodians of users' funds and can be vulnerable to hacks or security breaches.

What Are the Different Types of Atomic Swaps?

There are two main types of atomic swaps: on-chain and off-chain atomic swaps. Both types aim to facilitate secure and trustless exchanges of cryptocurrencies between different blockchains, but they differ in terms of their execution and underlying technology.

- On-chain atomic swaps: These involve transactions that are directly executed and recorded on the respective blockchains of the cryptocurrencies involved. On-chain atomic swaps require both blockchains to support the same scripting language and be compatible with Hash Time-Locked Contracts (HTLCs).

- Off-chain atomic swaps: Off-chain atomic swaps utilize second-layer solutions, such as the Lightning Network, which enable transactions to occur off the main blockchain. This approach provides faster, more scalable and cheaper transactions compared to on-chain atomic swaps.

Both on-chain and off-chain atomic swaps contribute to the broader goal of enabling secure, decentralized, and trustless exchanges of digital assets, promoting greater interoperability between different blockchain networks and cryptocurrencies.

Advantages of Atomic Swaps

-

Decentralization and Trustless Exchange

Atomic swaps promote decentralization by eliminating the need for a centralized intermediary, such as a traditional cryptocurrency exchange. This allows users to maintain control of their assets throughout the transaction process. Trustless crypto exchange is made possible through the use of HTLCs, which ensure that both parties involved in the transaction can execute the swap without having to trust each other or a third party. HTLCs guarantee that the swap either takes place in its entirety or not at all, minimizing the risk of fraud and ensuring that no funds are lost in the process.

-

Enhanced Security

Atomic swaps offer enhanced security compared to centralized exchanges. Centralized exchanges act as custodians of users' funds and are often targeted by hackers due to the large amount of assets they hold. In contrast, atomic swaps allow users to retain control over their private keys and funds throughout the transaction process. Since the transactions are directly executed between the parties involved, the risk of losing funds due to exchange hacks or other security breaches is significantly reduced.

-

Reduced Transaction Fees

Atomic swaps can help users save on transaction fees compared to trading on centralized exchanges. Centralized exchanges typically charge fees for deposits, withdrawals, and trading, which can add up quickly for frequent traders. Atomic swaps, on the other hand, do not require an intermediary, so the fees associated with these exchanges are either non-existent or significantly lower.

-

Increased Privacy

Atomic swaps provide an additional layer of privacy compared to centralized exchanges. Centralized exchanges often require users to undergo identity verification processes, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which can compromise users' privacy. On the other hand, atomic swaps enable direct peer-to-peer exchanges, allowing users to maintain a higher degree of anonymity throughout the transaction process.

-

Faster Transaction Times

Atomic swaps have the potential to offer faster transaction times compared to traditional centralized exchanges. Centralized exchanges often suffer from delays due to issues such as system overload, server downtime, or manual processing of deposits and withdrawals. In contrast, atomic swaps leverage smart contracts and cryptographic protocols to execute transactions directly between the parties involved.

Additionally, off-chain atomic swaps that utilize second-layer solutions like the Lightning Network can further reduce transaction times, as they do not require the confirmation of each transaction on the main blockchain. This allows for near-instantaneous transactions, making atomic swaps an efficient and time-saving option for exchanging digital assets.

Disadvantages of Atomic Swaps

-

Compatibility Requirements

One of the primary limitations of atomic swaps is the compatibility requirements between the cryptocurrencies involved. For an atomic swap to occur, both cryptocurrencies must support the same scripting language and hash functions, as well as be compatible with HTLCs. This means that not all cryptocurrencies can be swapped using atomic swaps, potentially limiting the variety of trading pairs available to users.

-

Scalability Concerns

Scalability remains a challenge for atomic swaps, particularly for on-chain swaps. Since on-chain atomic swaps require transactions to be recorded and verified on the respective blockchains, they may face the same scalability issues that affect individual blockchains, such as network congestion or slow confirmation times. While off-chain atomic swaps using second-layer solutions like the Lightning Network can help mitigate these concerns, they still face limitations in terms of widespread adoption and ease of use.

-

Liquidity Issues

Liquidity can be a concern for atomic swaps, especially in the early stages of adoption. Centralized exchanges usually provide higher liquidity due to the large number of users and trading pairs they support. In contrast, atomic swaps rely on direct peer-to-peer exchanges, which may have lower liquidity if there are fewer participants or limited trading pairs available. Low liquidity can lead to price slippage and reduced trading efficiency, posing a challenge to the widespread adoption of atomic swaps.

A Real-World Example of Atomic Swaps

A notable real-world example of atomic swaps occurred on Sept. 20, 2017, when Litecoin creator Charlie Lee successfully executed an atomic swap between Litecoin (LTC) and Bitcoin (BTC). This marked the first-ever recorded on-chain atomic swap between two major cryptocurrencies, demonstrating the viability of the technology and its potential for facilitating decentralized, trustless exchanges.

In this historic event, Lee used a tool called "swapbill" to conduct the atomic swap. The process involved creating and signing HTLCs on both the Litecoin and Bitcoin blockchains. The transaction was completed once both parties revealed their respective preimages and unlocked the funds on their respective blockchains.

Since this initial atomic swap, numerous other projects and platforms have emerged that focus on enabling cross-chain transactions using atomic swap technology. Some examples include Komodo's decentralized exchange BarterDEX and the Lightning Network, which aims to facilitate off-chain atomic swaps for faster, more scalable transactions.

Future of Atomic Swaps

As the cryptocurrency ecosystem continues to evolve, the future of atomic swaps looks promising, with the potential to transform the way digital assets are traded and exchanged. Several factors are expected to influence the development and adoption of atomic swaps in the coming years:

- Increasing cross-chain interoperability: As the number of blockchain networks and cryptocurrencies grows, the demand for seamless, trustless cross-chain transactions is expected to rise. This growing demand will likely drive further research and development in atomic swap technology.

- Adoption of second-layer solutions: The increasing adoption of second-layer solutions, such as the Lightning Network, will help overcome scalability challenges associated with on-chain atomic swaps. These off-chain solutions can provide faster and cost-effective transactions, further encouraging the use of atomic swaps for cryptocurrency exchanges.

- Improved user experience: As atomic swap technology matures, an increasing amount of user-friendly interfaces and platforms will emerge. This will help drive adoption and make atomic swaps a more viable alternative to centralized exchanges for mainstream users.

- Regulatory developments: The regulatory landscape for cryptocurrencies and digital asset trading is continually evolving. As atomic swaps gain popularity, it is possible that regulators may introduce new rules and guidelines to govern their use. These regulations could influence the adoption and growth of atomic swaps, depending on their nature and scope.

- Integration with decentralized finance (DeFi): The growth of the decentralized finance (DeFi) sector presents opportunities for the integration of atomic swaps in various financial applications. By enabling trustless, decentralized exchanges, atomic swaps can potentially play a key role in the expansion of DeFi platforms and services.

Atomic Swaps Will Transform How We Trade Cryptocurrencies

Atomic swaps hold great potential to revolutionize the way cryptocurrencies are traded by enabling direct, decentralized, and trustless exchanges between different digital assets. This innovative technology offers numerous benefits, including enhanced security, reduced transaction fees, increased privacy, and faster transaction times, all while adhering to the core principles of blockchain technology.

However, atomic swaps also face limitations and challenges, such as compatibility requirements, scalability concerns, and liquidity issues. As the technology continues to evolve, these challenges are expected to be addressed, making atomic swaps more accessible and practical for mainstream users.

As more platforms and projects adopt atomic swap technology, it is essential for cryptocurrency enthusiasts and investors to keep an eye on this promising innovation. By understanding and embracing atomic swaps, the cryptocurrency community can move towards a more decentralized, secure, and efficient ecosystem, reducing reliance on centralized exchanges and promoting the true spirit of blockchain technology.

FAQs

What Is an Example of an Atomic Swap?

A notable example of an atomic swap occurred on September 20, 2017, when Litecoin creator Charlie Lee successfully executed an atomic swap between Litecoin (LTC) and Bitcoin (BTC). This marked the first-ever recorded on-chain atomic swap between two major cryptocurrencies, showcasing the potential of this technology for facilitating decentralized, trustless exchanges.

Is Atomic Swap Safe?

Atomic swaps are considered safe due to the use of cryptographic protocols and smart contracts, specifically Hash Time-Locked Contracts (HTLCs). HTLCs ensure that the swap either takes place in its entirety or not at all, minimizing the risk of fraud or incomplete transactions. Additionally, atomic swaps allow users to maintain control over their private keys and funds throughout the transaction process, providing enhanced security compared to centralized exchanges.

What Are the Different Types of Atomic Swaps?

There are two main types of atomic swaps: on-chain and off-chain atomic swaps. On-chain atomic swaps involve transactions that are directly executed and recorded on the respective blockchains of the cryptocurrencies involved. Off-chain atomic swaps utilize second-layer solutions, such as the Lightning Network, which enable transactions to occur off the main blockchain, providing faster and more scalable transactions.

What Is Atomic Swapping?

Atomic swapping, also known as atomic cross-chain trading or atomic swaps, refers to a technology that enables the direct, decentralized exchange of one cryptocurrency for another without the need for a centralized intermediary. Atomic swaps leverage cryptographic protocols and smart contracts, such as Hash Time-Locked Contracts (HTLCs), to facilitate secure and trustless exchanges between different digital assets. This technology offers numerous benefits, including enhanced security, reduced transaction fees, increased privacy, and faster transaction times.