Popularne tematy

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

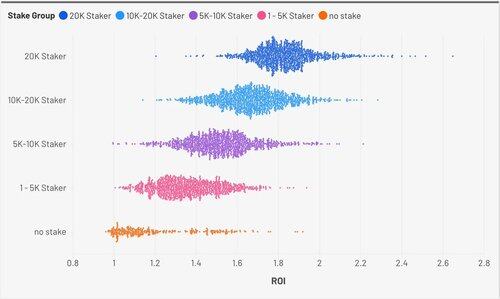

Wizualna ilustracja sezonowego ROI dla kwalifikujących się użytkowników, podzielona według kohorty stakowania.

27 maj 2025

Token design is iterative. The goal with L3 is to couple staking and usage in a way that supports long-term network growth.

Here’s how staking currently works on Layer3, starting with the consumer side of the marketplace:

– Passive APY: Stakers earn additional L3 (up to 37% APY), with approximately $1.3M distributed since TGE.

– Stake-gated activations: Active stakers (users on the platform) gain access to exclusive activations. Around $7M has been distributed to this cohort, with roughly 20% going to users staking 20K+ L3.

– Seasonal rewards: Users who stake and remain active also earn seasonal rewards. Approximately $15M has been distributed since TGE.

– Liquid rewards: Stakers also earn L3 in real time through liquid rewards. This feature is only about a month old, so earnings are still nominal but growing.

This “active plus staked” cohort has proven to be highly valuable, which is why many partners now require L3 staking as a prerequisite for token distributions. That demand is reflected in the $7M distributed through stake-gated activations.

On the B2B side of the marketplace:

– Projects must buy, stake, and lock L3 for one year to deploy activations using the Builder.

– Since the feature launched earlier this year, 6.7M L3 has been locked.

Looking ahead, governance will go live by the end of Q2, with staking required to participate.

The foundation has also been experimenting with buybacks using fees generated by the protocol. Since that feature launched in Q4, roughly 9.1M L3 has been bought back.

As mentioned, this process is iterative, particularly in consumer, where token utility and product experience are closely linked.

10,98K

Najlepsze

Ranking

Ulubione