Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

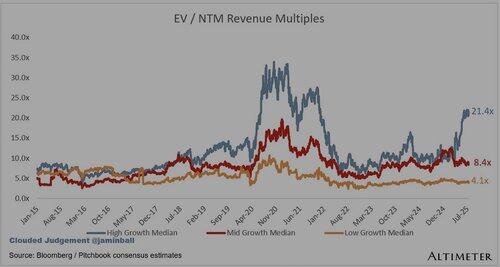

Growth multiples starting to blow out as the market goes full risk on. High growth bucket up 2x from 10.3x NTM Rev to 21.4x in a year. Not quite ‘21 levels but we’re 2/3s of the way there

1.7.2024

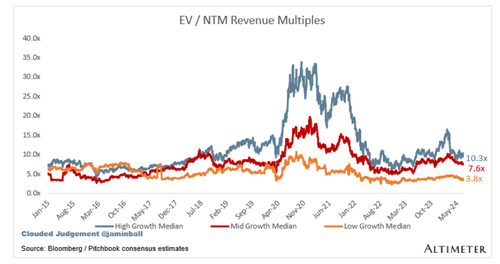

OO (#25): The primary reason traditional equity deals are struggling to get done in crypto is .... MULTIPLES.

A good way to get a baseline for pricing is by looking at median SAAS NTM revenue multiples in tradfi:

- High Growth (>27% y/y growth): 10.3x

- Medium Growth (15% - 27%): 7.6x

- Low Growth (0% - 15%): 3.8x

Example: if you have a business that is anticipated to grow 30% next year and generate $130m of revenue, it would be priced at an EV of ~$1.3b. That's it.

Despite having ~80% gross margins. That same business in '21, would have been priced at >$4.5b, and if growth was well north of 30%, it could have easily commanded >$6b.

Today, it is really hard to get your head around the math for these transactions when you incorporate what the public markets or a strategic will pay for the same business. Further, when you bake in the previous round valuation, cap-table, employee and founder equity, most founders don't want to deal with the restructuring of a down round. In turn they only raise when they're truly cash-strapped or if they can structure a piece of paper that allows them to maintain their valuation but still fund some type of strategic activity (i.e. M&A).

If you start adding market sizing, cost of growth, competition, and timeline for liquidity, most transactions just straight up don't make sense, which is why they aren't getting done.

That being said, starting to see some signs of life. Some of the best in-class businesses that are back to putting up good numbers have quietly started exploring potential raises across a range of structures.

Rates will certainly help this dynamic, but the public markets will serve as the primary indicator. When you see multiples accrete, probably a good sign that traditional equity deals will follow suit in the space.

H/t @jaminball for the graphic

48

Johtavat

Rankkaus

Suosikit