Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

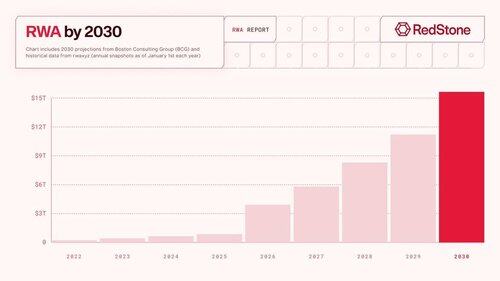

The next $30 trillion market is forming onchain.

BlackRock, JPMorgan, and others are already placing their bets. By 2030, up to 30% of global assets could be tokenized.

The real question: Who will benefit from this? 🧵

1/ In 2022, the tokenized RWA market size was just $5B.

TradFi finally sees what blockchain makes possible, and this time, it’s working.

2/ What is tokenization? 🪙

It turns real-world assets, like equities and credit, into digital forms that are verifiable, flexible, and liquid.

A token is merely a data wrapper; without real-world information, it can't accomplish much on-chain.

3/ You can tokenize a Treasury bond, a gold bar, or a private loan.

But unless their value is continuously updated on-chain, they’re just static placeholders. No utility, no composability.

Real DeFi utility needs live, accurate data 📊

4/ The infra behind that? Almost invisible, but absolutely vital 🫀

Oracles bridge the real world and blockchain by providing verified data on tokenized asset values.

But it’s not just about pulling an API. Most legacy oracles weren’t built for this new complexity.

5/ So, how is RedStone preparing for the $30T tokenization wave?

👉 We built a modular architecture designed to scale, ready to handle complex assets like bonds and private credit.

👉 And we’re already integrated across DeFi with the largest protocols in the space.

8,66K

Johtavat

Rankkaus

Suosikit