Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

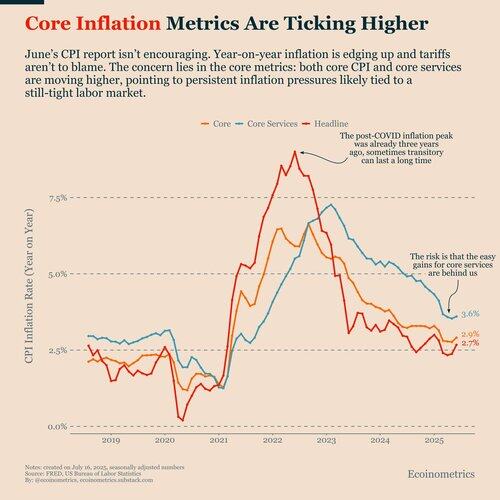

June’s CPI report isn’t encouraging but tariffs aren’t the problem.

The real issue is that core inflation, especially core services, ticked higher. That points to persistent structural pressure, likely tied to a still-tight labor market.

This kind of reading doesn’t support the case for the Fed to accelerate rate cuts.

The good news? These bumps don’t break the broader multi-year trend of disinflation. And so far, there’s no clear evidence that tariffs are causing a broad-based surge in prices.

So this isn’t a shock event. It is just a reminder that inflation’s most stubborn components aren’t fixed yet.

Follow @ecoinometrics fore more data-driven insights on Bitcoin and macro.

7,93K

Johtavat

Rankkaus

Suosikit