Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

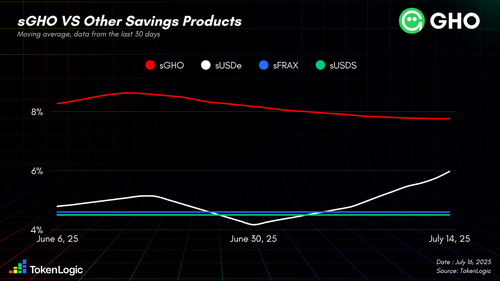

$sGHO has been dominating other risk-free savings products over the past 30 days.

► Since the start of Umbrella, $GHO has yielded an average of 8.16%, which is:

▪️ 81% higher than $sUSDS

▪️ 77% higher than $sFRAX

▪️ 67% higher than $sUSDe

And it’s all funded by Aave’s +$100M in annual protocol revenue.

Pretty incredible when you think that the Aave Savings Rate is truly risk-free:

✅ No protocol exposure

✅ No cooldown period

✅ No slashing

Just pure, sustainable yield, funded by real revenue.

278

Johtavat

Rankkaus

Suosikit