Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

False. This is the opposite of what’s likely to happen.

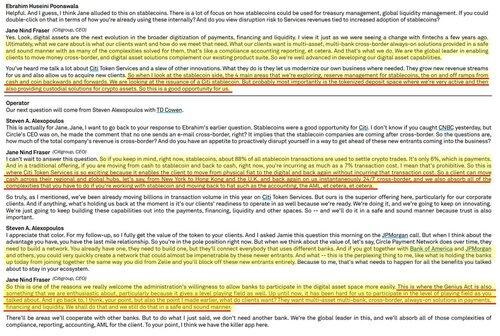

And I say this as someone who got in trouble at Citi talking about stablecoins as far back as 2018. (I was also on calls with Circle management where various bank MDs mocked the very idea of a tokenized dollar).

Fraser is correct that there are many profitable things banks could do to service stablecoin issuers, and crypto in general. They should do all of those things, in part to offset the coming competition for payments related services.

This was the overall pitch the few of us on the inside who understood crypto made post 2020: embrace bitcoin, custody, trading etc, to offset the inevitable losses from when the “sell side” no longer controls the rails.

The notion proposed by Citi, JPM etc that they’ll use tokenized deposits (that are restricted to their customers) to improve payments is nonsensical. Banks don’t need blockchains to do this, they could do it with an excel spreadsheet or Oracle db or whatever. Permissioned blockchains are just bad databases.

Bank-based payments across borders aren’t slow and expensive due to a lack of better tech. They are that way because there are too many intermediaries, and it’s profitable for each one to slow things down.

If a wire takes 3 days to settle, who gets the interest on it? And who decides the F/X rate? Etc etc

Part of this friction is regulatory (AML, etc) and part of it is due to liquidity constraints (banks have capital/reserve requirements in every country they operate, so they batch and net payments to save money).

But you know how you eliminate both? By getting rid of some of the intermediaries!

A stablecoin enables P2P payments on a decentralized rail. It also enables fierce competition likely to lead to the issuer paying out most of the float. Banks can’t compete with that. Deposits are meant to be a cheap source of funding.

If USDC pays 4% and can be sent to anyone, and a CitiUSD pays only 1% but can only be sent to Citi clients, which coin would you want?

Fraser is correct that for now, there’s lots to be done in terms of on and off ramps, servicing the reserve, and so on. But that’s like AT&T arguing in 1998 that their long distance phone franchise, one of the most profitable businesses in history, was safe because “if customers want VOIP, we will be the ones to give it to them”

LOL, sure. What they left out was how calls on the internet would be free, and that would blow up the business model.

Payments on the blockchain will also be effectively free. Banks make a killing charging for payments. For a bank like Citi, the payments franchise has been the crown jewel for a while. Their profit margins are stablecoins opportunity.

16.7. klo 15.41

🚨 BREAKING: Citi unveils it's stablecoin strategy.

And it's GENIUS (😁).

Circle spent years fighting for regulatory clarity.

Guess who benefits when the Genius Act passes?

The banks.

Here's what most people missed:

37,26K

Johtavat

Rankkaus

Suosikit