Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Optimize stablecoin looping with PenSilit

PenSilit = @pendle_fi x @SiloFinance x @Infinit_Labs - a powerful strategy to supercharge your stablecoin loops while farming Silo points.

With PenSilit, I’ve simplified complex DeFi loops and maximized APY on stables, while also taking an indirect bet on @SonicLabs recovery.

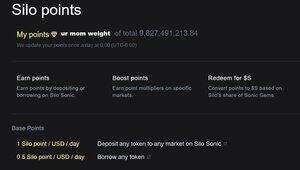

We know that Silo has a Point Program:

+ Earn points by depositing or borrowing on Silo Sonic.

+ Boost points with multipliers on select markets.

+ Redeem for $S based on Sonic Gems share.

📈 1 point/USD/day for deposits

📉 0.5 point/USD/day for borrows

With too many pairs offering 6x multiplier. I use Infinit to simulate and determine which asset optimizes both Point farming and APY for looping.

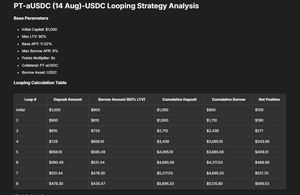

➡️Result: PT-aUSDC (14 Aug)-USDC offers ~11.52% Base APY with low risk, high yield growth.

Then, do the loop with PT-aUSDC (14 Aug) & USDC to grow stablecoin holdings while maximizing point multipliers.

🔗Market:

Infinit suggests 7x looping for optimal results:

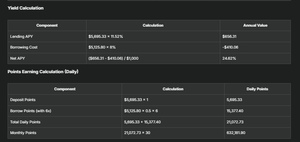

🔹Total position: $5,695.33

🔹Net position: $569.53

🔹Net APY: 24.62%

🔹Daily points: 21,072.73

🔹Monthly points: 632,181.90

Not only does this grow my stablecoin stack, but it also farms a massive amount of Silo points, with upside exposure to $S via Sonic Gems.

PenSilit isn’t just a one-off strategy. It’s a blueprint for how Infinit can automate and scale point farming across the DeFi stack.

Whether you're hunting for thicc yields or point programs, Infinit is becoming an essential tool, cutting through complexity and letting you execute with precision.

P/S: You'd better look for a new job @SiloIntern kek

8,52K

Johtavat

Rankkaus

Suosikit