Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

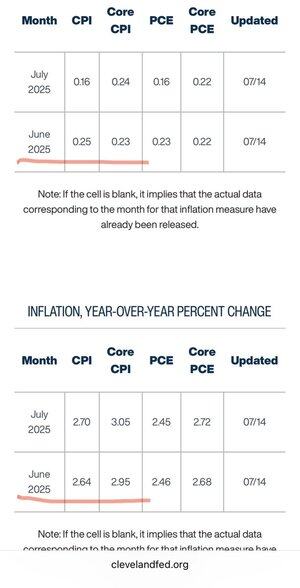

The recently released U.S. June CPI data shows that overall inflation is higher than the previous value but meets expectations, while the core CPI month-on-month is lower than expected. The Cleveland Fed's inflation forecast is very close to the actual published data. What do you think? The inflation data is higher than the previous value, but not higher than expected, which has an impact on the market but should not be too significant. It will slightly weaken momentum but has not reached the point of reversal. In the current market sentiment, it may be viewed as a one-time rebound. The slight drop in the ten-year U.S. Treasury yield after the data was released also indicates that the bond market sees the 0.2% month-on-month core CPI as favorable for interest rate cuts.

As mentioned last night, "Greed is always harder to reverse than fear."

15.7. klo 00.00

Regarding the U.S. June CPI to be announced tomorrow night: Currently, institutions have a consistent expectation of a year-on-year CPI and core CPI at 2.7% and 3% respectively, with a month-on-month increase of 0.3% for both. Looking back, the Cleveland Fed's inflation forecast, which has been highly accurate in the past, predicts the June CPI and core CPI to be 2.64% (the U.S. official usually rounds to 2.6%) and 2.95% (rounded to 3%), with month-on-month increases of 0.25% and 0.23% respectively.

If the Cleveland Fed's prediction accuracy remains intact this time, it would mean that June's U.S. inflation is higher than the previous value but slightly lower than expected (the core CPI year-on-year meets expectations). How will the market react?

There should be fluctuations in the main market, which will weaken the upward momentum but not reverse it completely; it is likely to be a consolidation phase because "greed is always harder to reverse than fear." Market sentiment may still consider this a one-time rebound, and then we will see what the final outcome of the tariffs will be.

Last weekend, Trump sent tariff letters to the EU, Mexico, and Canada. From the reactions of the parties involved (both the EU and Mexico have expressed their intention to reach an agreement before August), this has led the market to believe that the TACO trade will continue. The unexpected future lies in whether the conditions will ultimately not be met, and if Trump really enforces the tax rates mentioned in the tariff letters on August 1, the market will need to recalibrate.

84,52K

Johtavat

Rankkaus

Suosikit