Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Just in case you missed it, and because we love when the truth is this obvious:

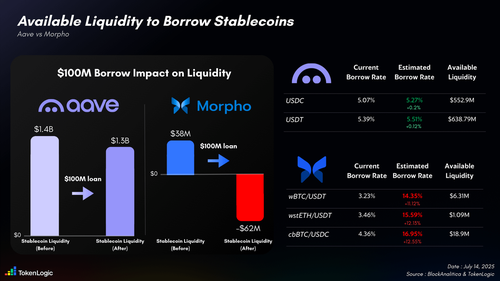

On Aave, there’s over $1.4B in stablecoin liquidity. Want to borrow $100M in USDC? It will cost you just 5.27%, barely a 0.2% increase from the current rate.

Meanwhile you simply can’t borrow more than $38M in stablecoins across all the vaults of a protocol that claims to be “ready for institutional onchain adoption".

Want to borrow that full $38M? Get ready to juggle between multiple vaults and pay around 15%. Thanks for the privilege, really.

And by the way, this isn’t our data. It’s straight from one of their own risk team dashboards:

On top of that, Aave Labs is building Horizon, a tokenization initiative that creates RWA products for institutions, where regulatory compliance still requires some level of centralization to integrate smoothly with permissionless DeFi.

That is what a protocol truly ready for institutional capital looks like: deep liquidity, robust security, and dedicated instances designed to onboard serious funds.

10.7. klo 02.00

$AAVE continues to outperform $MORPHO on all fronts.

Since last year:

▪️ $AAVE +267%

▪️ $MORPHO +8%

Aave’s FDV is 3.5x higher than Morpho’s, with 95% of its supply circulating versus 32% for Morpho, and 100% unlocked versus only 17%.

If you look at the FDV relative to active loans, Aave is nearly twice as capital efficient as Morpho.

Each $1 of Aave’s FDV supports ~$3.70 of active loans, while for Morpho it’s only ~$1.70.

Even more, Aave is buying back $AAVE with real revenue, while Morpho is buying users through MORPHO emissions — all supported by a low float and high FDV.

And the deeper you look, the more Bullish $AAVE you become 👻👇

1/

28,9K

Johtavat

Rankkaus

Suosikit