Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

We’ve had an alarming number of projects building or integrating CLOBs in recent times.

I did a deep dive into the landscape a while ago, exploring about 30 of them. Couldn’t cover them all in one post, so if you’ve been waiting for part 2 of CLOB Wars, here you go🧵

ICYM the first part, check it out here

30.6.2025

First off, a Central Limit Order Book (CLOB) is a mechanism used by financial markets to facilitate trading between buyers and sellers.

It acts as a central hub where participants submit buy and sell orders. These orders are then matched and executed based on specific rules.

@Aster_DEX

Aster is a multi-chain perp DEX with high leverage and yield opportunities.

Features;

➸ Simple and pro trading modes to serve both newbies and advanced traders

➸ Users can place invisible orders that stay hidden from the public order book

➸ Multi-chain support.

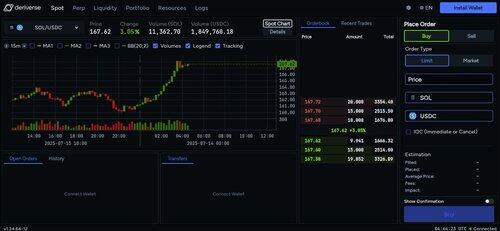

@deriverse_io

Deriverse is an all-in-one DEX for spot, derivatives, and options trading on @Solana.

Features;

➸ Low-cost, permissionless launchpad

➸ In-built and fully on-chain CLOB

➸ Comprehensive suite of trading instruments, eliminating the need for multiple platforms.

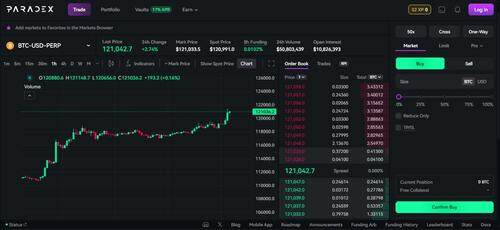

@tradeparadex

Paradex is a perpetual orderbook DEX with off-chain batching and on-chain verification.

Features;

➸ Custom L2

➸ Unified margin, multi-collateral, and automated vaults

➸ Perpetual options, offering leveraged exposure with no expiry and no liquidation risks for buyers.

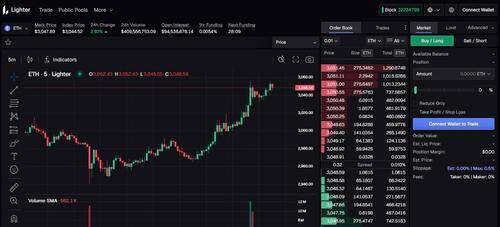

@lighter_xyz

Lighter is a perpetual order book DEX that supports full CLOB trading options.

Features;

➸ Custom zk-rollup (zkLighter) for better security and scalability

➸ Verifiable matching engine for auditable trade execution

➸ Transparent liquidations and anti-self trading, to ensure fairness and prevent wash trading.

➸ Use of order book tree instead of blobs

➸ Public pools for retail investors.

@bulletxyz_

Bullet is a Solana-based order book DEX for perps and spot trading.

Features;

➸ Specialized execution layer that uses ZKPs for verifiable on-chain settlements

➸ Low latency and multi-collateral functionality

➸ App-specific sequencing to minimize toxic MEV.

@edgeX_exchange

EdgeX is a high-performance, orderbook-based Perp Dex with native trading experience.

Features;

➸ Up to 100x leverage

➸ Features for hedging, splitting, reversing, or closing all postions

➸ Social login and multi-account functionality

➸ Self custody and ZKP verification

➸ Cross-chain deposits and withdrawals.

@MetalXApp

Metal X is an orderbook DEX on @XPRNetwork, with support for on-chain trading, farming, and lending.

Features;

➸ Fully on-chain orderbook

➸ Zero gas and trading fees

➸ TradingView chart integration for in-depth technical analysis.

@AftermathFi

Aftermath is a Sui-based order book DEX that offers low slippage and best price execution.

Features;

➸ Smart order routing for the best prices across liquidity sources

➸ Automated market-making vaults

➸ One-click hedging strategies

➸ Multi-asset liquidity pools.

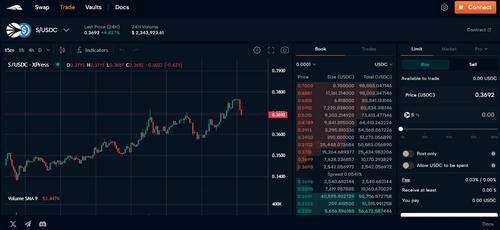

@XPRESSprotocol

XPress is a high efficiency DEX on @SonicLabs with low slippage and high composability.

Features;

➸ Fully on-chain CLOB

➸ One-click liquidity provisioning

➸ Sub-second finality and instant settlement.

@derivexyz

Derive is a CLOB DEX on Derive Chain, focused on perps and options trading.

Features;

➸ Centralized matching engine and on-chain settlement

➸ Low latency and multi-collateral support

➸ Subaccounting allows for portfolio management by isolating risk per strategy.

@etherealdex

Ethereal is Ethena’s order book DEX that supports perpetuals and spot trading.

Features;

➸ Powered by USDe and Ethena for deep liquidity

➸ USDe deposits use the Omnichain Fungible Token (OFT) standard via LayerZero, enabling one-click deposits from supported chains.

@hibachi_xyz

Hibachi is an anti-rug, hybrid perp DEX that executes orders off-chain and settles on Ethereum.

Features;

➸ Off-chain CLOB and on-chain settlement

➸ Verification using ZKPs

➸ Portfolio margin functionality, allowing the use of one pool of collateral across multiple positions.

There are definitely mour out there but i wanted to talk about all CLOBs that were initially highlighted so if you are following this series, watch out for the next part that will feature more.

15,32K

Johtavat

Rankkaus

Suosikit