Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

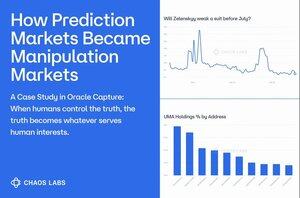

How Prediction Markets Became Manipulation Markets

When the cost of corruption is lower than the payoff, truth becomes a commodity auctioned to the highest bidder.

The controversy re: the Zelensky suit on Polymarket wasn't a glitch. It was a $200M demonstration of the fatal flaw in human-controlled oracles: when the cost of corruption is less than the reward, truth becomes a commodity sold to the highest bidder.

***

Zelensky’s $200 Million Fashion Show

Picture this: Zelensky walks into a NATO summit wearing what every major news outlet calls a suit. The market has $200M in volume. The outcome seems obvious.

Then UMA's oracle votes "No."

Not because Zelensky didn't wear a suit.

Not because the evidence was unclear.

But because the people controlling the oracle had tens of millions riding on "No" and only needed to use their voting power to rewrite reality without real risk.

***

Oracle Manipulation 101

The uncomfortable truth about human-controlled oracles is that humans are biased.

- Some of the biggest UMA holders were heavily positioned on “No.”

- When “Yes” looked like the correct outcome, they didn’t accept the loss; they flipped the vote.

- Over 23M UMA were cast, worth ~$25M, to dispute the result.

This wasn’t decentralization. It was whales protecting their bags.

With enough UMA and coordination, truth doesn’t matter. Outcome does.

***

The Broader Oracle Crisis

This problem extends far beyond Polymarket and UMA. Human controlled oracles are subject to various manipulation and incentive design pitfall vectors.

Although we’re using the Zelensky Suit Market as a case study, we’ll note that we’ve observed this problem before, in the case of the March 2025, Ukrainian Mineral Deal Market.

Every major prediction market faces the same fundamental challenge.

Where humans control truth, truth bends to human profit.

***

Graduating from Human-Controlled Oracles: Replacing Intent with Intelligence

The only real fix for human oracles is to remove the humans.

AI‑powered oracles change this:

- No Financial Incentives: The model doesn’t hold positions or care who wins.

- Bias‑Resistant Decision Rules: Same training weights, same prompt, same temperature = the model scores evidence with the same underlying criteria. AIs have no moods, no side bets, no back‑room coordination.

- Reasoning Pipelines: Every intermediate step can be logged, inspected, and replayed.

- Machine‑Scale Throughput: Thousands of sources ingested in parallel without burnout or side deals.

Residual error still exists, but it is random statistical noise. This is significantly harder for a trader to game. With clear resolution criteria and authenticated data feeds, state‑of‑the‑art models already deliver production‑grade accuracy, and the curve is steeply improving.

***

Residual Noise Beats Calculated Lies

The future of prediction markets requires removing humans entirely from truth determination.

What this architecture looks like:

- Predefined Source Hierarchies: Reuters > BBC > Local News > Blogs

- Cryptographic Proof of Data Origin: Verify information hasn't been tampered with

- Multi-Agent Consensus: Multiple AI systems reaching independent conclusions

- Transparent Reasoning: Full audit trails for every decision

- Immutable Evidence: Blockchain-stored proofs that can't be revised or deleted

***

Truth Discovery in a Post-Truth World

Prediction markets are a microcosm of a much larger challenge. When Wikipedia can be edited, news can be revised, and "facts" become negotiable, we need systems that can establish ground truth.

This extends across domains:

- Election integrity and verification

- Scientific consensus and research validation

- News authenticity in the age of deepfakes

- Historical record keeping and revision prevention

- Corporate transparency and accountability

***

Final Thoughts

The choice facing prediction markets is stark: continue pretending that incentive-driven humans can be neutral arbiters of truth, or build systems that remove human bias from truth determination entirely.

The question has already been answered by the markets themselves. When $200M flows through a market about an obvious outcome and the obvious answer loses, the system has revealed its true nature.

The technology to solve this exists.

Truth discovery is too important to auction to the highest bidder.

40,74K

Johtavat

Rankkaus

Suosikit