Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Today, we've released the State of Onchain Asset Management, co-published with @Sumcap.

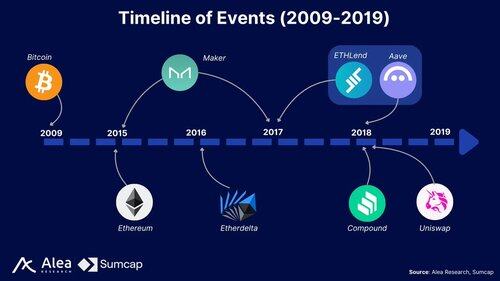

Yield farming has evolved into a $25B asset-management stack spanning $ETH L1s, rollups, & appchains.

In this report, we explore DeFi's evolution, the current yield landscape, & more 👇

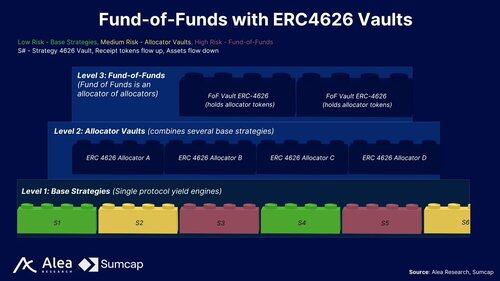

ERC4626 vaults enable programmable asset management.

Ethereum yield solutions have grown into a sector that now serves retail, institutions, DAO treasuries, asset issuers, fintech front-ends & more.

As the competition for yield capture increased, protocols started rushing to their go-to-market.

A series of unforced exploits showed the need for safer, more adaptive yield infrastructure.

By June 2022, the ERC4626 standard was officially merged into Ethereum’s standards set.

As protocols started implementing ERC4626, new opportunities were unlocked, such as the ability to build nested vaults that enabled “fund-of-funds” structures.

Today, there is over $25 billion in on-chain assets under management (AUM) managed by smart contract vaults, representing approximately 20% of the total decentralized finance (DeFi) total value locked (TVL).

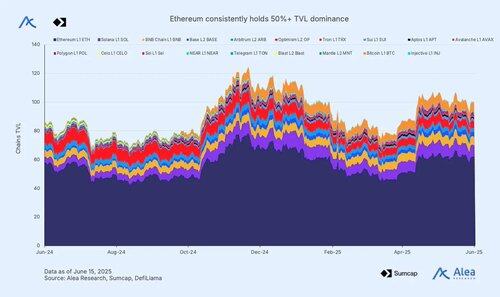

Ethereum remains the largest chain by TVL, consistently showing over 50% dominance.

Still, the $100B+ in DeFi TVL seems small compared to the trillions under TradFi managers' control.

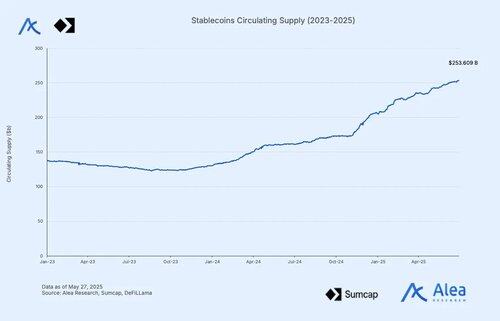

Most DAOs denominate their treasury in their native token & the stablecoin float itself ($255B+) remains largely undeployed.

This is an opportunity for DeFi's ceiling to grow.

2,56K

Johtavat

Rankkaus

Suosikit