Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The Sei Network Comeback

How did the Sei Network manage to achieve this in a few months:

- TVL is up 193% YTD

- >$280M increase of stablecoin supply

- DEX Volumes reached monthly ATH of $982M in June

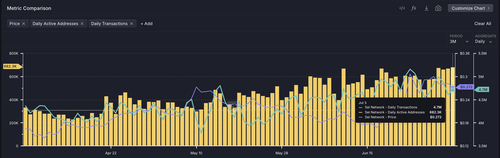

- >4.5M in total daily transactions by end of Q2

- Daily active users up 44% YTD

In this short, data-driven investigation, we aim to uncover the drivers behind Sei's accelerating growth, and put the numbers into context.

4 ) The Bottom Line

Sei's trajectory seems very promising with recent growth metrics outpacing many alt L1 competitors, and with the Giga upgrade likely acting as a crucial driver as people prepare for @SeiNetwork turning into a first-to-market EVM execution layer able to support high-performance DeFi use cases, real-time gaming and institutional-grade enterprise solutions.

The Giga architecture introduces intelligent transaction parallelization that predicts dependencies for optimal processing, making Sei the first EVM L1 to support multiple concurrent proposers, and allowing the chain to handle web2-scale applications that current blockchains cannot support.

With strong growth across gaming and DeFi ecosystems, the network has regained a healthy growth after suffering under Q1's market crash. Initial network effects from gaming adoption in Q4 seem to have increasingly spilled over into other sectors, contributing to the significant overall increase in TVL, daily active addresses and transaction volumes we see onchain.

The success demonstrates how L1 blockchains can find product-market fit in (potentially unexpected) verticals by leveraging their technical advantages for specific use cases rather than competing head-to-head directly with more established general-purpose chains.

Sei's community growth metrics similarly paint a picture of sustained traction, likely fueled by the "Sei More" campaign, which (alongside a series of major announcements) successfully drove content creation and social media engagement, contributing to Sei consistently ranking among the chains with highest mindshare on @KaitoAI in recent months.

While many of the above-cited metrics (incl. daily active wallets, tx or DEX volumes and social media mindshare) are prone to manipulation and hence have to be enjoyed with the corresponding caution, the congruence among all these metrics and the coinciding price recovery of $SEI in Q2 do indicate a sustained growth trajectory that is not solely driven by speculative interest, but rather fundamental improvements across the ecosystem.

13,99K

Johtavat

Rankkaus

Suosikit