Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The 5 Most Important Metrics to Watch by @a16z

As we move past the first half of 2025, @DarenMatsuoka released a podcast breaking down the latest data across the crypto industry.

TLDR:

We’re seeing strong growth across users, volumes, ETF flows, and DeFi/on-chain trading - while infra is becoming increasingly commoditized, and value is expected to shift toward the application layer.

Fundamentals are stronger than ever and there are no signs of slowing down.

The apps are coming. The users are coming. And the value is shifting.

Let’s dive into it 🧵

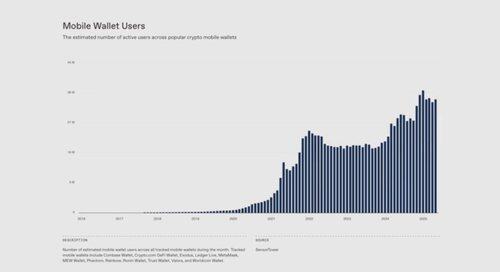

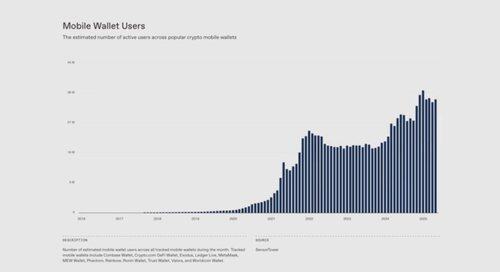

1. Monthly Mobile Wallet Users

With infrastructure and account abstraction improving massively over the last few years, it’s an ideal time to build next-gen mobile wallets.

2024 MAU: 27.9M

2025 MAU: 34.4M

Growth: +23% YoY

These figures come directly from the Apple App Store and Google Play, making them hard to manipulate - so this kind of sustained growth is especially encouraging.

Top contributors: @phantom & @worldcoin App

2. Adjusted Stablecoin Transaction Volume

This metric filters out inorganic behavior and bot activity to show real stablecoin usage on-chain.

2024 Avg Monthly Volume: $472B

2025 Avg Monthly Volume: $702B

Growth: +49% YoY

The recent hype around stablecoins is backed by real traction. Stablecoins are proving strong product-market fit, and growth is only accelerating.

9,64K

Johtavat

Rankkaus

Suosikit