Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Fading Faith in the Monetary Premium

Key takeaways from my latest @MessariCrypto report

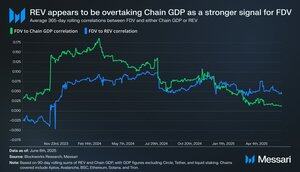

We believe the market is moving away from the idea that L1 tokens should be valued primarily on monetary premium. That framework, where token prices scale with chain-level economic activity, gained traction in early 2024, with FDV to Chain GDP correlations peaking just below 0.2. But those correlations have since collapsed to near zero, pointing to a broad market rejection of the monetary premium thesis.

In its place, REV has started to gain ground. While the absolute correlation between FDV and REV remains low at 0.07, it now exceeds that of GDP. We see this as an early signal that markets may be searching for a more durable valuation anchor that ties price to value capture rather than raw activity.

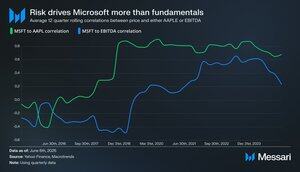

Bitcoin remains the dominant macro factor, with stronger correlations than either GDP or REV. Importantly, Bitcoin still dominates as the macro anchor. FDV correlations with BTC remain much stronger than with either GDP or REV. This mirrors patterns in traditional markets, where risk assets often trade more closely with peers than with their fundamentals. But beneath that macro layer, the message is clear: the market no longer seems to believe in the monetary premium narrative. If any valuation anchor is emerging, it’s REV.

In the full report, we evaluate growth expectations and REV multiples across major L1s, and provide our perspective on how various valuation models stack up in today’s market. Available for Messari Enterprise subs here :

2,09K

Johtavat

Rankkaus

Suosikit