Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

After watching this meeting, I felt like a dove and a dark eagle. The Fed continued to hold its ground, with the decision statement no longer saying that uncertainty about the economic outlook had increased further, changing to saying that it had weakened but remained high, removing the increased risk of rising unemployment and inflation, and reiterating that net export volatility affected the data but that the economy continued to expand steadily.

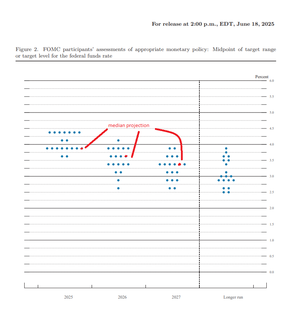

The important dot plot interest rate expectations are unchanged from the last time, and two 25 basis point rate cuts are still expected, but the interest rate dot plot shows that the number of people who expect no rate cut has increased by three to seven from the last time, and the number of people who predict two rate cuts is eight.

The Fed lowered its GDP growth forecast for this year and next, expecting GDP growth to slow to 1.4% this year, and raised its unemployment rate forecast and PCE inflation forecast for the next three years, raising its PCE forecast to 3.0% this year, significantly higher than the recent official level of 2.1%.

Powell's speech continued the tone of uncertainty and wait-and-see, but this time it was clear that the impact of tariffs on inflation is likely to be more stubborn, and a certain increase in inflationary pressures is expected in the coming months (more clearly than previous statements). But it also said it was very uncertain how big the overall impact of the tariffs would be, how long it would last, and when it would be fully felt. Satisfied with the state of the job market, he said that "the labor market is not calling for a rate cut." ”

19.6.2025

FOMC decision: No rate change

The median 2025 “dot” is unchanged at two cuts (by the barest possible margin)

There’s a bigger crew of policymakers (seven) who penciled in no cuts.

85,98K

Johtavat

Rankkaus

Suosikit