Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

How did Timeboost affect the market structure on Arbitrum? And how does it compare to Base?

Here are a few plots & data from the weth/usdc 5bps pairs.

Caveat emptor: I forgot to post this earlier and now the data are a bit stale, so use at your own risk!

1/

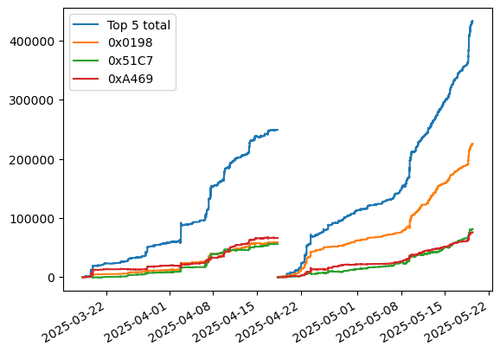

Here you see the markouts of the top 3 bots (and the total of top 5) before and after Timeboost on Arbitrum.

Arbitrage was very competitive before Tb, but since the change, 0x0198 has significantly pulled ahead.

Total top 5 profits increased by 74%, but hold your...

2/n

judgement on this until we compare this number to Base!

One concern about Tb is that it might make arbitrage slower and more extractive.

Do we see this in the data?

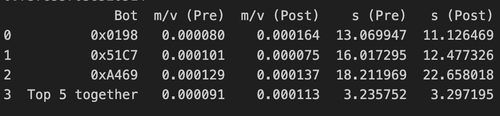

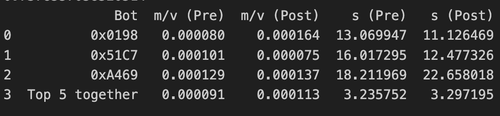

Let's look at two metrics: m/v—the mean markout per unit of volume, and...

3/n

s—the average time in seconds between swaps.

The line for Top 5 tells us that arbitrage has indeed become a bit slower (~3.3s vs 3.24s) and more extractive (1.1bps vs 0.9bps).

The profitability of 0x0198 has understandably gone up significantly as did its swap frequency...

4/n

Interestingly, 0x51C and 0xA469 appear to have adjusted differently:

The former now has more swaps of lower profitability, whereas the latter has fewer swaps of higher profitability.

And now let's compare all of this to the situation on Base over the same period...

5/n

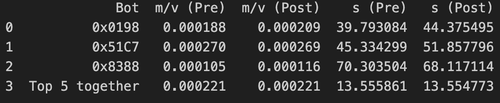

Base had a less competitive landscape both before and after the change, but dominated by 0x51C7.

As you can see, the total profits of the top 5 arbs also increased from the first period to the second but only by 47% (it was 74% for Arbitrum)...

6/n

The data on m/v and s tells us that (as expected) not much has changed on Base between the two periods.

Notably arbitrage on Base is both more extractive (2.2 vs 1.1bps) and slower than on Arbitrum. This is understandable since Arbitrum is still largely FCFS, while Base...

7/n

has 2s blocks. The pair on Base is also about half as liquid, and gas costs are different between the two L2s—these factors also contribute to arbitrage efficiency.

My takeaways are:

1. Timeboost has made arbitrage on Arbitrum more concentrated and (a bit) less efficient...

2. Either the current delay is too small or there hasn't yet been enough time for the arb teams to adjust, but the impact on efficiency doesn't appear to be huge (the impact on concentration is)

3. Priority chains urgently need something like priority taxes to compete with FCFS

23,99K

Johtavat

Rankkaus

Suosikit