Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

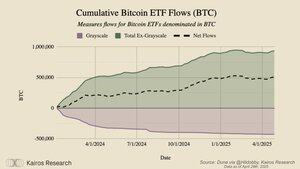

Over the last seven trading days Bitcoin ETFs have seen $3.76 billion in net inflows

When excluding Grayscale, the total ETF accumulation of Bitcoin is nearing the 1m BTC mark, with netflows now above 500k again.

While Blackrock and Fidelity dominate flows, it also gives proper perspective for how large the @babylonlabs_io ecosystem is growing in relative size.

Babylon itself is larger than 7 of the 11 Bitcoin ETFs currently on the American public markets, and @Lombard_Finance, a Bitcoin LST protocol, is larger than 5 of them.

With Phase 2 now underway for permissionless Bitcoin staking, and no deposit cap limits, these projects may potentially begin to aggregate enough BTC to truly rival some of the ETF issuer juggernauts.

It is also not-far-fetched to believe we will see structured institutional products around staked BTC, or staked BTC being used as collateral for prime-brokerages, and other trading venues.

Transparent, yield-bearing BTC is only just beginning its foray not only into the crypto economy, but the traditional financial world at large.

------------------------------------------------------------

Disclaimer:

The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.

3,12K

Johtavat

Rankkaus

Suosikit