Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Latency and tx ordering on @HyperliquidX

Some alpha for MMs and researchers:

1) Hyperliquid L1 has a novel microstructure benefiting retail and makers over toxic takers

2) Volume would be multiples higher without this design

3) Hyperliquid is optimized for the end user, period. Not for VC metrics, fees, or HLP pnl

----

Background

A well-designed exchange matches trades when both sides want to transact. Maximizing volume is a secondary goal. First and foremost buyers and sellers should both be happy with the price. This guiding principle applies to all markets: centralized or decentralized, CLOB/AMM/RFQ etc.

For example, a user market buys on the UI and matches against the maker order with the lowest price. Both sides are happy.

The problem

An order book sometimes satisfies the "well-designed" principle above. If someone has a resting buy order, that means they think the fair price is higher than the limit price, and are happy with a fill.

The major exception is trades between HFT takers and HFT makers. The maker and taker have similar price preferences. Often the maker has sent the cancel request already, but the taker order is slightly faster and picks off the maker. It's no longer win-win. This is why this HFT taker volume is often called "toxic flow."

Toxic flow hurts retail end users the most. Makers will quote wider to minimize collisions with takers. Spreads and liquidity degrade so retail gets worse execution. Everyone is happy except the end user.

Hyperliquid's design

To address this flaw with the standard order book design, Hyperliquid makes a fundamental adjustment to the onchain order book: Cancels and post-only orders are prioritized above GTC and IOC orders.

This ordering is enforced onchain by the L1 itself. The only correct way for a node to execute a block on the Hyperliquid L1 is to sort cancels and post-only orders first.

Hyperliquid has the fastest L1 in production, so human users barely notice this ordering. Most users happily wait half a second to save hundreds of dollars on a trade.

The effects

On Hyperliquid, trades between HFT maker and HFT taker happen at a dramatically lower rate, at least 10x lower than other platforms as a fraction of total volume. Note that this flow is the majority of volume on most other venues.

Liquidity on Hyperliquid becomes deeper and more solid during times of volatility. Retail users get reduced slippage and lower spread on large orders.

Alpha for automated traders

When cancels go through with high success, makers can quote much more confidently.

Takers can still make money aggressing against retail limit orders, or limit orders that actually disagree with the taker's price model.

Hyperliquid's design empowers everyone except those trading against orders that didn't want to be filled to begin with.

Closing thoughts

If Hyperliquid's design is so great, why do no other DEXs or CEXs do it? Because most other venues are not optimized for the end user.

Most platforms instead optimize for some combination of fees and volume metrics. Investors often look at these aggregate stats instead of studying real user experiences.

Hyperliquid is solely focused on the end user. Fees and market maker pnl are all increasing exponentially, but this is a byproduct of the relentless focus on the end user.

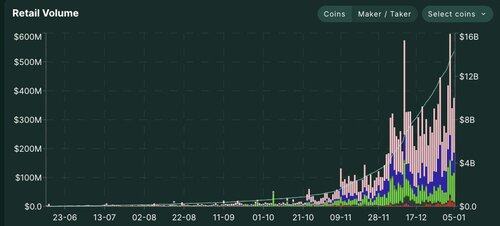

The stats speak for themselves: On a day where Hyperliquid does $1B in volume, more than $500M is retail.

89,06K

Johtavat

Rankkaus

Suosikit