Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Kinji Steimetz

Enterprise Research Analyst @MessariCrypto | Former @MorganStanley

Never financial advice (DYOR)

Kinji Steimetz kirjasi uudelleen

HNT is up 64% since we called the bottom on June 23rd based on fundamentals growth and downstream effects of the August 1st Halving.

In that same period:

BTC: +13.4%

ETH: +53.5%

SOL: +20.7%

AAVE: +37.2%

To all the liquid funds - yes @MessariCrypto does have alpha.

24,09K

Fading Faith in the Monetary Premium

Key takeaways from my latest @MessariCrypto report

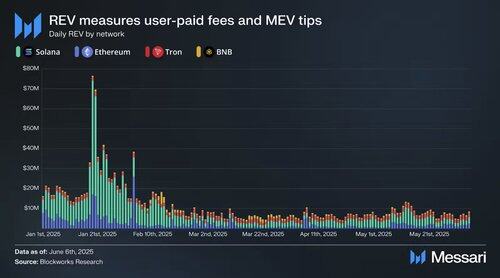

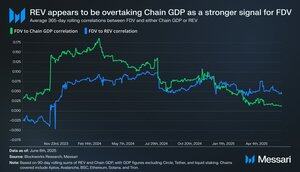

We believe the market is moving away from the idea that L1 tokens should be valued primarily on monetary premium. That framework, where token prices scale with chain-level economic activity, gained traction in early 2024, with FDV to Chain GDP correlations peaking just below 0.2. But those correlations have since collapsed to near zero, pointing to a broad market rejection of the monetary premium thesis.

In its place, REV has started to gain ground. While the absolute correlation between FDV and REV remains low at 0.07, it now exceeds that of GDP. We see this as an early signal that markets may be searching for a more durable valuation anchor that ties price to value capture rather than raw activity.

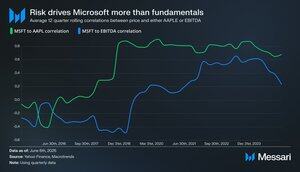

Bitcoin remains the dominant macro factor, with stronger correlations than either GDP or REV. Importantly, Bitcoin still dominates as the macro anchor. FDV correlations with BTC remain much stronger than with either GDP or REV. This mirrors patterns in traditional markets, where risk assets often trade more closely with peers than with their fundamentals. But beneath that macro layer, the message is clear: the market no longer seems to believe in the monetary premium narrative. If any valuation anchor is emerging, it’s REV.

In the full report, we evaluate growth expectations and REV multiples across major L1s, and provide our perspective on how various valuation models stack up in today’s market. Available for Messari Enterprise subs here :

2,09K

Fading Faith in the Monetary Premium

Key takeaways from my latest @MessariCrypto report

We believe the market is moving away from the idea that L1 tokens should be valued primarily on monetary premium. That framework, where token prices scale with chain-level economic activity, gained traction in early 2024, with FDV to Chain GDP correlations peaking just below 0.2. But those correlations have since collapsed to near zero, pointing to a broad market rejection of the monetary premium thesis.

In its place, REV has started to gain ground. While the absolute correlation between FDV and REV remains low at 0.07, it now exceeds that of GDP. We see this as an early signal that markets may be searching for a more durable valuation anchor that ties price to value capture rather than raw activity.

Bitcoin remains the dominant macro factor, with stronger correlations than either GDP or REV. Importantly, Bitcoin still dominates as the macro anchor. FDV correlations with BTC remain much stronger than with either GDP or REV. This mirrors patterns in traditional markets, where risk assets often trade more closely with peers than with their fundamentals. But beneath that macro layer, the message is clear: the market no longer seems to believe in the monetary premium narrative. If any valuation anchor is emerging, it’s REV.

In the full report, we evaluate growth expectations and REV multiples across major L1s, and provide our perspective on how various valuation models stack up in today’s market. Available for Messari Enterprise subs here :

763

Kinji Steimetz kirjasi uudelleen

1/ Crypto's Role in the Final Unbundling

Highlights from my recent Messari report.

A final unbundling is happening in software, and crypto will accelerate its financialization. We're in the early innings, and many people aren't paying attention yet. Here's the scoop 🧵👇:

19,21K

Kinji Steimetz kirjasi uudelleen

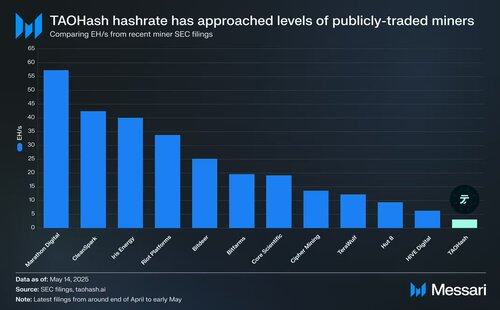

After a 6000%+ monthly return, @TAOHash (SN14) now sits at the #2 spot for Bittensor emissions. Its incentive feedback loop has garnered ~2.5 EH/s in hashrate (and 6+ at peak) in just a few weeks. This is approaching the levels of some of the biggest publicly traded miners.

25,38K

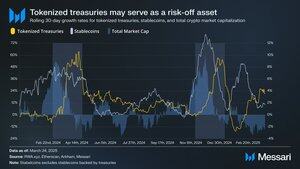

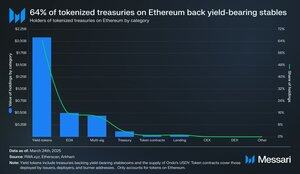

Who is driving tokenized treasury growth?

Key takeaways from my latest @MessariCrypto report

Tokenized treasuries have crossed $5B in market cap, fueling talk that TradFi is coming onchain. But wallet-level data points the other way. Around 64% of tokenized treasuries on Ethereum are held by yield-bearing stablecoin protocols. Over 90% of USCY backs Usual’s USD0++. About half of BUIDL is held by Ethena for USDtb. Across networks, nearly half of all tokenized treasuries are now being used as stablecoin collateral.

TradFi may be supplying the product, but the demand is coming from crypto-native users.

Tokenized treasuries also grow after market peaks, rising as broader crypto prices cool off. While they don’t trade inversely to the market, this pattern suggests they may be starting to act like a risk-off asset, with demand picking up once sentiment fades.

Future growth may stay cyclical if demand is from liquid and venture funds rotating during downtrends. That could change if new integrations take hold, exchanges using them as collateral, or protocols shifting idle assets into treasuries.

10,87K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin