Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

CZA²

Policy Lead @SuperteamUK 🇬🇧 | Research @MCTDCambridge 🤓 | DePIN maxi @playonshaga 🎮 | 9/9 Bounty Winner + 2x Hackathon Winner 💻 | YHWH is king! 👑

Stablecoins in the US? ✅

Stablecoins in the UK?

- Rachel Reeves’ Mansion House speech signals the support for innovation in stablecoins and tokenised deposits

- FCA consultation paper deadline end of the month

CoinDesk18.7. klo 03.37

🚨 BREAKING: The GENIUS Act was just passed by the House of Representatives.

531

Always a good day to push forward the industry with @CapinUK 🫡

If you care about the future of technology in the UK, whether you’re a founder, dev, non-technical, just come through! 👇🏽

Superteam UK16.7. klo 21.58

Dive into all things future of tech next week and hear from brilliant speakers, including our very own @CapinUK and @czamaru at FrontiertechX

London

22.07.25

1,17K

There are NFTs worth $47,244.12 to $100k+ right now.

The average American doesn’t even have that in their bank accounts.

Kevín16.7. klo 21.33

I may not be right about everything. But I was right not to trust NFTs.

625

The US has @BoHines and @DavidSacks.

In the UK, we don't have an equivalent of such leaders in Parliament who can be champions for the digital assets industry.

We wait to be a "global leader" but we don't have an ambassador, even on a national level, to go to. 🙄

We need to appoint a digital asset special envoy ASAP. It's the only way we can progress faster in this country.

544

You know who's building the multi-trillion pound UK tech industry of tomorrow?

The founders, devs, and early-stage teams raising seed rounds and taking risks today.

But regulatory dialogue is currently only dominated by large incumbents with deep pockets, more focused on defending today’s position than building for tomorrow.

The result?

Regulation that makes the market inaccessible to early-stage startups. It’s no surprise then that many founders choose to launch elsewhere, in jurisdictions where compliance is clearer, cheaper, and more supportive and accessible.

That’s talent, capital and ambition we lose every day.

My solution?

Policy work at @SuperteamUK, where we stand ready to partner with government, regulators and the industry to ensure the next wave of digital asset breakthroughs is started, funded, and scaled on UK soil on a global stage.

Our 3 main mission?

> Education: Assist policymakers/regulators in understanding the impact of current frameworks and the unique challenges faced by smaller players.

> Talent retention: Foster an environment that retains, as well as attracts top tier tech talent (make the UK a destination of choice for domestic and global innovators).

> Engagement: Amplify early-stage voices, ensuring their experiences and needs directly influence digital asset policy development.

Maybe a 4th one is...dare I say...entertainment? 👀

387

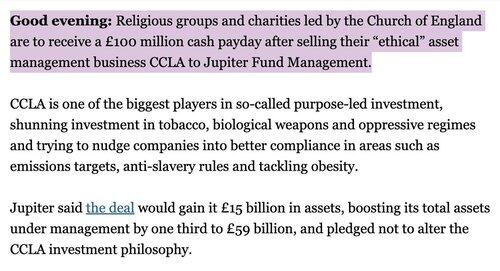

I been saying this for months:

Tokenise. The. Church. Of. England.

The Church Commissioners manages a £11.1bn investment fund.

They own RWAs––approx. 200,000 acres of land and a vast portfolio of other properties like rural estates, commercial properties, and land holdings across England and Wales.

There are probably ~1M church attendees p/m.

If the Church of England enjoys these kind of payouts, I think they're gonna enjoy the economic opportunities that tokenisation can provide.

581

Emerging markets, particularly Africa, are massively undervalued. In crypto, no one is even talking about it.

If you think stablecoins have found PMF in the West, imagine its value for the rest of the world?

Here's my hypothesis that no one asked for:

> VCs think the returns on emerging markets are too slow

> capital is circulating in the usual areas–– SF, NYC, Beijing, LDN. VCs don't want to miss out on these high-talent densities so they double down there instead of spreading their bets elsewhere

> there's definitely an assumption on emerging markets not being "high quality" enough as far as talent + product (huge oversight and bias-driven!)

> emerging markets are often associated with volatile currencies, so not enough scalability and liquidity

> founders who usually want to serve emerging markets are mostly black and brown founders...do I need to explain more?

2,93K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin