Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Jonaso

defi on-chain I prev @deloitte

with @puffer_finance and @lombard_finance

contributor at @ethena_labs I @build_on_bob

Over $6.5 million is silently extracted from DeFi users every single day.

Front-running. Sandwich attacks. MEV bots.

The system is broken and most users don’t even know it.

Let’s break down the damage ↓

• $2.3B lost to blockchain exploits in 2024

• $1.2M/month drained from sandwich attacks

• Over $674M extracted via MEV on Ethereum since 2020

• 2,700+ MEV bots active across 300+ chains

This is the extraction economy and it’s costing users billions.

HoudiniSwap V4 is the answer ↓

A new kind of DEX designed to protect users, not exploit them.

• No wallet connection required

• Supports 80+ chains

• Encrypted routing to prevent front-running and MEV

• Low fees and maximum privacy

• Built for user control and transparency

This isn’t just another DeFi product. This is infrastructure for the next chapter of permissionless finance.

@HoudiniSwap is live 🧙♂️

1,68K

Jonaso kirjasi uudelleen

Lombard’s $LBTC has proven it’s more than just a restaking derivative in the @babylonlabs_io BTC-Fi ecosystem with 40.6% dominance.

It’s setting the benchmark.

Despite launching just last year, $LBTC has captured significant market share with over +140 DeFi integrations across top-tier protocols & deep inflows from early adopters.

This traction isn’t accidental.

It’s the result of strong execution, institutional-grade security (via the Security Consortium) + a product vision that extends far beyond just being another BTC wrapper.

With $1.7B in collateral secured $LBTC has firmly established the 'Activation Stage', the first phase in a broader roadmap which extends:

Activation → Capital Markets (next stage) → Full-fledge Bitcoin Economy

The path is ambitious, but if any project is poised to claim that ground, it’s @Lombard_Finance.

For a deep retrospective on $LBTC's performance + trajectory, @Solofunk_ breaks it down with top insights.

Highly recommended read 👇

7,5K

Aave 2025: The Leading Bitcoin Use Case in DeFi

@Aave has long been recognized as the flagship DeFi protocol on Ethereum, consistently ranking top 1 lending about TVL, Active loan, Revenue and Fees.

→ But in 2025, Aave isn’t just Ethereum DeFi. It’s also Bitcoin DeFi.

Today, over 18% of Aave’s total supply, approximately $8B, comes from Bitcoin LSTs.

This makes Aave the most popular destination for Bitcoin in DeFi.

Top 5 Bitcoin Assets Supplied on Aave:

• WBTC @WrappedBTC | $5,6B

• cbBTC @coinbase | $2B

• BTC.b @BorderlessBTCb | $380M

• tBTC @tBTC_project | $213M

• LBTC @Lombard_Finance | $205M

Instead of selling your Bitcoin, use it as collateral on Aave to borrow stablecoins and earn more yield.

Aave is likely to become the central liquidity layer for this new wave of capital → first Ethereum, now Bitcoin.

What’s next? Tokenized stocks are coming.

→ Just use Aave

12,48K

$CATX is now live on @Catex_Fi DEX.

No centralized exchanges, no delays trading, staking, claiming, and governance are all available from day one.

If you joined the IDO or received an airdrop, your tokens are ready to claim now.

→ But this is just the start.

Governance begins July 17.

veCATX holders can vote from the first epoch, directing emissions and earning real protocol rewards.

• Dual incentives: CATX + UNI rewards

• High-APR pools for early LPs

• Protocol revenue flows directly to veCATX voters

I’ve already locked my governance position. Early alignment means influence, not just yield.

→ This is one of the rare launches where everything is active from day one.

If you’re waiting, you might already be late.

Catex15.7. klo 02.26

From TGE to Epoch 1, we’re laying out exactly how the next few days unfold.

veCATX voting, liquidity mining, airdrops — all kicking off in rapid sequence.

If you’re participating, this is your blueprint.

If you’re watching, this is your wake-up call.

📖

3,04K

Pareto is bringing real-world credit on-chain with USP

$USP is a synthetic dollar backed by institutional-grade private credit, offering consistent, real yield

→ Now ranked as a top 1 fixed-yield stablecoin on Pendle and Napier

How to Get USP ↓

• Mint via Pareto App: Verified users can mint USP by depositing stablecoins directly into the protocol.

• Buy on DEXs: USP is available on Balancer

_____________________________________________

Key Metrics

• $1,3M in TVL ~ USP market cap

• sUSP TVL: 800K

• 22% USP usage in Defi

• DEX integration : Balancer

• Yield Strategies : Pendle and Napier

_____________________________________________

How to Maximize Yield and Points with @paretocredit

➢ Start with USP on Pareto

Stake USP on Pareto to receive sUSP with a 10,5% base APR

• sUSP is a yield token from Pareto which generates yields from RWA institutional private credit.

• The yield sources currently are USDS, @FasanaraDigital

Credit Vault and @BastionTrading Credit Vault

It's not only reward, you can earn points with ↓

• Earn 20 EP/day for every $1 USP held

• Earn 10 EP/day for every $1 USP staked

• Earn 1 EP/day for every $1 deposited in any vault

→ But that’s not all, there’s even more to earn with sUSP

➢ Deploy sUSP on @NapierFinance

• Buy PT sUSP → Fixed yield: 31% (no.1 fixed APY on Napier)

• Buy YT sUSP → Napier Point 89X and Pareto efficiency points

400X

• LP sUSP → Retain most of your sUSP points while earning yields, swap fees, and points. → up to 17% APY

➢ Deploy sUSP on @Pendle_fi

• Buy PT sUSP → Fixed yield: 15% (no.1 fixed APY on Pendle)

• Buy YT sUSP → 1$ → 55 YT-sUSP → Pareto efficiency points 2565X

• LP sUSP up to 13% APY

➢ Provide liquidity in USP pools on @Balancer

• Earn trading fees

• Receives 3x Pareto Efficiency points

If you're exploring real yield and credit-backed stablecoins, Pareto is worth a look.

4,79K

Jonaso kirjasi uudelleen

Optimize stablecoin looping with PenSilit

PenSilit = @pendle_fi x @SiloFinance x @Infinit_Labs - a powerful strategy to supercharge your stablecoin loops while farming Silo points.

With PenSilit, I’ve simplified complex DeFi loops and maximized APY on stables, while also taking an indirect bet on @SonicLabs recovery.

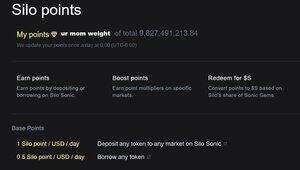

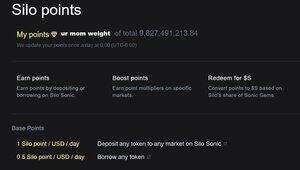

We know that Silo has a Point Program:

+ Earn points by depositing or borrowing on Silo Sonic.

+ Boost points with multipliers on select markets.

+ Redeem for $S based on Sonic Gems share.

📈 1 point/USD/day for deposits

📉 0.5 point/USD/day for borrows

With too many pairs offering 6x multiplier. I use Infinit to simulate and determine which asset optimizes both Point farming and APY for looping.

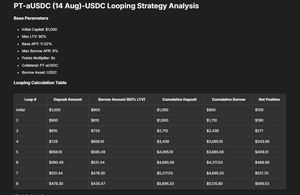

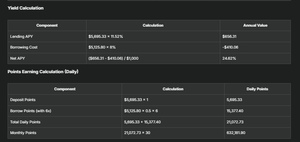

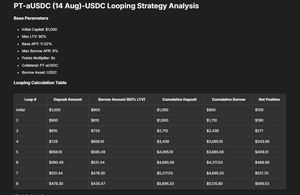

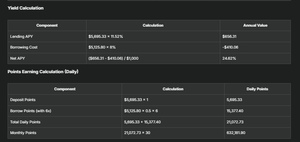

➡️Result: PT-aUSDC (14 Aug)-USDC offers ~11.52% Base APY with low risk, high yield growth.

Then, do the loop with PT-aUSDC (14 Aug) & USDC to grow stablecoin holdings while maximizing point multipliers.

🔗Market:

Infinit suggests 7x looping for optimal results:

🔹Total position: $5,695.33

🔹Net position: $569.53

🔹Net APY: 24.62%

🔹Daily points: 21,072.73

🔹Monthly points: 632,181.90

Not only does this grow my stablecoin stack, but it also farms a massive amount of Silo points, with upside exposure to $S via Sonic Gems.

PenSilit isn’t just a one-off strategy. It’s a blueprint for how Infinit can automate and scale point farming across the DeFi stack.

Whether you're hunting for thicc yields or point programs, Infinit is becoming an essential tool, cutting through complexity and letting you execute with precision.

P/S: You'd better look for a new job @SiloIntern kek

8,5K

Jonaso kirjasi uudelleen

Optimize stablecoin looping with PenSilit

PenSilit = @pendle_fi x @SiloFinance x @Infinit_Labs - a powerful strategy to supercharge your stablecoin loops while farming Silo points.

With PenSilit, I’ve simplified complex DeFi loops and maximized APY on stables, while also taking an indirect bet on @SonicLabs recovery.

We know that Silo has a Point Program:

+ Earn points by depositing or borrowing on Silo Sonic.

+ Boost points with multipliers on select markets.

+ Redeem for $S based on Sonic Gems share.

📈 1 point/USD/day for deposits

📉 0.5 point/USD/day for borrows

With too many pairs offering 6x multiplier. I use Infinit to simulate and determine which asset optimizes both Point farming and APY for looping.

➡️Result: PT-aUSDC (14 Aug)-USDC offers ~11.52% Base APY with low risk, high yield growth.

Then, do the loop with PT-aUSDC (14 Aug) & USDC to grow stablecoin holdings while maximizing point multipliers.

🔗Market:

Infinit suggests 7x looping for optimal results:

🔹Total position: $5,695.33

🔹Net position: $569.53

🔹Net APY: 24.62%

🔹Daily points: 21,072.73

🔹Monthly points: 632,181.90

Not only does this grow my stablecoin stack, but it also farms a massive amount of Silo points, with upside exposure to $S via Sonic Gems.

PenSilit isn’t just a one-off strategy. It’s a blueprint for how Infinit can automate and scale point farming across the DeFi stack.

Whether you're hunting for thicc yields or point programs, Infinit is becoming an essential tool, cutting through complexity and letting you execute with precision.

P/S: You'd better look for a new job @SiloIntern kek

8,5K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin