Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

DOLAK1NG

Defi Research Educator | Enhancing your success in Decentralized Finance.

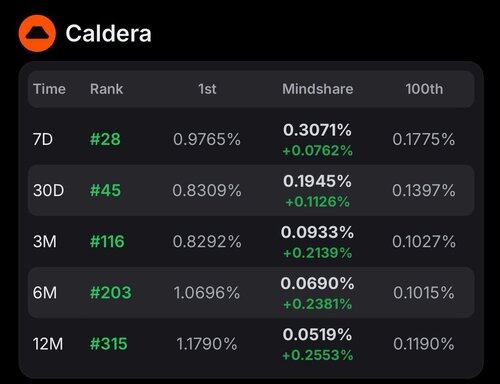

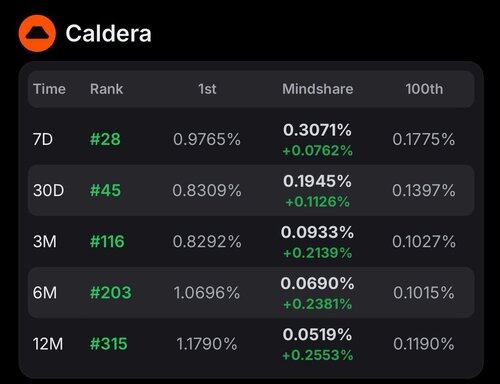

Thank you so much Caldera, even when I started late I was able to make over $4k caldera tokens

Believe in something, Believe in Caldera

Besides I went up alot in the leaderboard

Can't stop, wont stop haha:)

gMera

DOLAK1NG12.7. klo 19.29

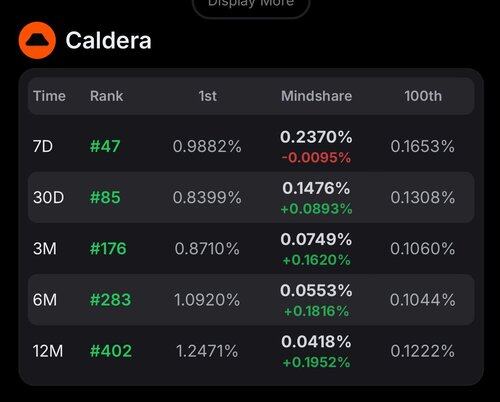

Seems they took the snapshot earlier than I thought.

Welps, congratulations to everyone eligible for the airdrop.

Didn’t get as much reward as others probably because I came late to the party!

But definitely a win is a win, climbed up the leaderboard like a whole lot. And I’m still keen on getting into top 100 for 3 month and 6 month leaderboard….

For those of you that haven’t checked if you’re eligible for the drop, here’s the link:

Recent @Calderaxyz stats:

- 100+ chains launched

- 100+ integrations

- 850M+ transactions across chains

- $400M+ TVL across chains

- The Metalayer connects it all

Caldera is really the future of rollup interoperability

gMera to those who gMera

4,8K

In 2020, the killer app was DeFi.

In 2021, it was NFTs.

In 2022, rollups.

Now? It’s infrastructure that makes all of them composable, provable, and creator-aligned.

This is the rise of the invisible infrastructure layer, the tooling beneath the surface powering ZK, AI, intents, appchains, and compute.

Here are 6 of the most important protocols building that foundation:

1. @SuccinctLabs

ZK as Easy as Code

Want to prove your code works without rewriting it into cryptographic circuits?

Succinct is building SP1, a zkVM that lets you write normal Rust or C++ and generate ZKPs from it.

Then comes the magic: proofs are executed by a decentralized Prover Network, where participants bid to generate proofs fast and cheap…. paid in $PROVE.

Succinct turns ZK into infrastructure you don’t even notice, proof without plumbing.

Perfect for:

- zkBridges

- Light clients

- AI verification

- Rollups

Anything that needs “provable compute”

ZK moves from the lab → to app-native scale.

2. @Mira_Network

Verifying AI Like It’s Math

ChatGPT can generate answers, but how do we know it’s right?

Mira makes AI provable and trust-minimized.

Each AI output is:

- Broken into atomic claims

- Verified independently by staked “fact checkers”

- Protected with privacy-preserving cryptography

- Certified on-chain

It’s zero-knowledge meets zero hallucination.

Imagine:

Verified agent responses in DeFi

Secure medical LLMs

Credible game-world NPCs

Auditable decision engines

Mira builds a trust layer for AI, so you don’t just use it, you can believe it.

3. @cysic_xyz

ZK Proofs as a Decentralized Commodity

Everyone wants ZKPs. No one wants to generate them.

Cysic fixes that with Proof-of-Compute.

A decentralized prover network of GPUs & ASICs

Tasks from any ZK project

Provers earn $CYS + computing governance tokens ($CGT)

Staking + slashing + finality ensures trust

Think: an open marketplace for zero-knowledge horsepower.

ZK now scales like cloud compute.

From light clients to rollups, Cysic makes provable logic cost-efficient, accessible, and credibly decentralized.

4. @Calderaxyz

Rollups as a Product, Not a Protocol

Launching a chain shouldn’t take 6 months.

Caldera is the AWS of rollups, spinning up high-performance appchains with a few clicks.

It stitches together:

Celestia (for Data Availability)

Espresso (for decentralized sequencing)

RISC Zero (for native proving)

EVM or custom VMs

So DAOs, dApps, and protocols can go from 0→1 with production-grade infra.

No custom infra.

No devops nightmares.

Just fast, modular rollups, deployed like Shopify stores.

5. @campnetworkxyz The Native IP Layer of Web3

AI needs data. Creators need provenance.

Camp is an L1 for programmable IP.

Think: every piece of content gets a cryptographic ID, legal metadata, and embedded rights logic.

Apps can:

Register IP

Let agents license/train on it

Pay creators based on usage

Prove origin and authorship

If Caldera is the AWS of rollups, Camp is the Ethereum of culture.

It makes IP programmable, and lets creators opt into revenue models instead of being extracted.

6. @anoma

Where Intents Replace Transactions

Blockchains don’t understand what users want. Anoma does.

Anoma doesn’t just process transactions. It interprets intents — what the user is trying to achieve.

Want to swap ETH → stETH → vote in a DAO? Just say it.

Want to mint an NFT only if your AI agent gets verified? Just declare it.

Need to interact across 4 rollups, but don’t know how to route it? Let Anoma figure it out.

Anoma turns UX from clickfest to constraint-resolved logic.

Intent-based execution is the future of smooth coordination.

This are my 6 top projects for now, would definitely drop another episode in the nearest future.

That’s a wrap!

11,1K

Rollups scaled Ethereum.

But rollups didn’t scale users.

Each L2 today is siloed, a self-contained execution island.

To move assets, logic, or liquidity between them, we still bridge.

We still wait.

We still risk.

Chain abstraction asks a different question:

What if users didn’t have to know what chain they’re on at all?

Let’s unpack why that shift changes everything.

Why Today’s UX Is Fundamentally Broken

Here’s how crypto works today:

1. A user lands on an app

2. App asks for wallet connection

3. Wallet asks for chain switch

4. User is now operating in one execution environment (e.g., Arbitrum)

5. Everything else is unreachable, unless bridged, swapped, or restaked

This model mirrors Web2 tightly coupled frontends and backends.

But crypto shouldn’t work like that.

Because blockchains aren’t apps.

They’re execution infrastructure.

And users should never have to reason about that layer to interact with value.

What Chain Abstraction Really Means

Forget “multi-chain” marketing.

- Chain abstraction means:

- One wallet

- One balance

- One interface

...but assets and logic distributed across many chains

It’s not about hiding the chains.

It’s about making composability ambient.

When a user wants to mint an NFT on Zora and stake on Lido, they shouldn’t have to switch chains, bridge ETH, or wait 12 minutes.

The app should route the intent, abstract the rails, and settle trustlessly.

Just like Stripe does for payments.

Or AWS for compute.

The Endgame: Execution-Agnostic Apps

Chain abstraction unlocks a new design paradigm:

Applications that span chains the same way websites span data centers.

Here’s what becomes possible:

= A game that stores items on Polygon, settles PvP on Arbitrum, and pays rewards via Base

= A DeFi aggregator that routes trades through whatever environment has the best liquidity, not where your wallet is connected

= A DAO with logic distributed across appchains, but governed from a single interface

No chain switching.

No manual bridging.

No scattered UIs or broken sessions.

One interface.

Multiple execution layers.

Zero friction.

How We Get There

To make this real, we need breakthroughs across three pillars:

1 Intents → Move from transactions to goal-based execution

2. Universal Accounts → Wallets that work across chains

3. Atomic Interop → Trust-minimized coordination across execution environments

Chain abstraction isn’t just a feature — it’s a full-stack redesign of how users interact with blockchains.

And the teams solving it today won’t just improve UX.

They’ll own the entire ZK + modular future — by owning the rails everyone will use to build.

11,65K

Every cycle in crypto has its moment of clarity.

In 2017, it was the limits of monolithic chains.

In 2021, it was the scaling ceiling for L1s.

And now in ZK, it's the proving bottleneck no one wants to admit.

ZK isn’t just anyhow innovation, It’s compute.

And while proving systems get shinier, the hard truth remains:

Generating a proof still takes minutes, costs real money, and demands industrial-grade hardware.

This is where most ZK infra dreams quietly die.

The problem isn’t the proof system.

It’s the lack of an execution layer for proofs themselves.

Projects spend months optimizing circuits, deploying zkVMs, or writing new proving systems, only to hit a wall when they need actual proofs generated at scale.

- Provers are centralized

- Compute is inaccessible

- Tooling is fragmented

- Latency is unbearable

The result? Promising zk protocols stall not because their ideas are bad, but because no one wants to run their proving stack.

ZK is ready. The ecosystem is not.

@cysic_xyz is flipping the proving stack inside out.

Instead of asking devs to run their own provers or rent cloud GPUs, Cysic turns proving into a decentralized commodity.

Anyone can contribute compute.

Anyone can post a proof job.

And the fastest nodes get paid in CYS.

It’s like mining - but instead of solving useless hashes, you're generating ZKPs that actually matter.

It’s like staking - but instead of idle delegation, you’re proving live ZK workloads.

It’s a Proof Layer - not built to replace Ethereum or scale transactions,

but to accelerate the entire ZK industry underneath.

This isn’t theoretical. It’s running and fast.

Cysic has already processed 7 million+ proofs.

They’re integrated with real zk ecosystems: Scroll, Risc0, Aleo.

They’ve shipped high-throughput GPU clusters and are testing SolarMSM on FPGAs.

Most ZK projects will eventually face the same question:

Who’s going to generate all your proofs when things get real?

The answer won’t be AWS.

It won’t be a handful of hand-run prover scripts.

It’ll be something like Cysic, a decentralized, performance-tuned, plug-and-play ZK compute network.

ZK is inevitable.

But it won’t scale through rollups alone.

It’ll scale through the invisible layers, the stuff no one brags about.

That’s what @cysic_xyz is building.

Not the next shiny zkVM.

Just the engine that powers them all.

Tagging Gigachads that might be intrested in this 👇

- @SamuelXeus

- @TheDeFISaint

- @hmalviya9

- @poopmandefi

- @ayyeandy

- @DigiTektrades

- @zerokn0wledge_

- @LadyofCrypto1

- @milesdeutscher

- @1CryptoMama

- @Deebs_DeFi

- @RubiksWeb3hub

- @stacy_muur

- @TheDeFinvestor

- @splinter0n

- @izu_crypt

- @belizardd

- @eli5_defi

- @the_smart_ape

- @ViktorDefi

- @cryppinfluence

- @CryptoGirlNova

- @Haylesdefi

- @DeRonin_

- @0xAndrewMoh

- @defiinfant

- @DeFiMinty

- @Louround_

- @0xSalazar

- @crypthoem

- @CryptoShiro_

7,15K

Seems they took the snapshot earlier than I thought.

Welps, congratulations to everyone eligible for the airdrop.

Didn’t get as much reward as others probably because I came late to the party!

But definitely a win is a win, climbed up the leaderboard like a whole lot. And I’m still keen on getting into top 100 for 3 month and 6 month leaderboard….

For those of you that haven’t checked if you’re eligible for the drop, here’s the link:

Recent @Calderaxyz stats:

- 100+ chains launched

- 100+ integrations

- 850M+ transactions across chains

- $400M+ TVL across chains

- The Metalayer connects it all

Caldera is really the future of rollup interoperability

gMera to those who gMera

DOLAK1NG8.7. klo 22.12

Up next! Get into top 100 of 3 month and 6 month leaderboard

CALDERA is really the future of rollup interoperability 🌋

Everyone will want their own chain.

And there’s nothing you can do about it.

gMera

2,21K

Infrastructure has held back creativity in crypto for too long.

@Calderaxyz is changing that.

Here’s how they’re shifting power back into the hands of founders:

Ride with me 👇

Traditionally, launching a chain meant raising capital just to build infrastructure.

You had to:

- Hire L2 engineers

- Choose a proving system

- Integrate DA

- Set up a sequencer

- Maintain devops

- Audit your stack

It was more protocol R&D than product building.

But most crypto teams aren’t trying to reinvent Layer 1s.

They’re trying to build new products.

That’s where @Calderaxyz modular stack comes in.

By abstracting DA (via Celestia), proving (via RISC Zero), and sequencing (via Espresso), Caldera lets founders deploy rollups without touching protocol complexity.

You don’t need a CTO with zero-knowledge experience anymore.

You just need a vision and a product to launch.

This dramatically lowers the barrier to entry, and most importantly, it shifts who gets to build in this space.

From protocol researchers → to indie developers

From venture-backed L2 labs → to DAOs and communities

From copycat forks → to novel design spaces

This is the kind of infra shift that supercharges the ecosystem.

Not because it’s technically impressive (which it is), but because it unlocks latent creativity that’s been waiting to build.

We’re entering a founder-first era.

Caldera is quietly enabling it.

Tagging Gigachads that might be intrested in this 👇

- @SamuelXeus

- @TheDeFISaint

- @hmalviya9

- @poopmandefi

- @ayyeandy

- @DigiTektrades

- @zerokn0wledge_

- @LadyofCrypto1

- @milesdeutscher

- @1CryptoMama

- @Deebs_DeFi

- @RubiksWeb3hub

- @stacy_muur

- @TheDeFinvestor

- @splinter0n

- @izu_crypt

- @belizardd

- @eli5_defi

- @the_smart_ape

- @ViktorDefi

- @cryppinfluence

- @CryptoGirlNova

- @Haylesdefi

- @DeRonin_

- @0xAndrewMoh

- @defiinfant

- @DeFiMinty

- @Louround_

- @0xSalazar

- @crypthoem

- @CryptoShiro_

DOLAK1NG9.7. klo 19.32

The first wave of rollups was all about architecture.

The next wave will be about distribution.

@Calderaxyz gets this. Most others don’t.

Let’s break it down 👇

In 2021–2023, we saw a surge in general-purpose rollups:

Arbitrum

Optimism

zkSync

Starknet

Base

Each tried to attract developers by offering “Ethereum, but scalable.”

But the UX still sucked:

Apps competed for blockspace

Gas costs spiked on demand

Devs were boxed into global constraints

Now, teams want more control. More flexibility. More ownership.

That’s why the appchain thesis emerged. And rollup frameworks like OP Stack, Arbitrum Orbit, and Polygon CDK began popping up.

But most of these are still highly fragmented and complex.

→ You need to integrate a DA layer

→ Plug in a prover

→ Build or manage your own sequencer

→ Monitor and upgrade the infra stack

→ Ship your own explorer + RPC infra

@Calderaxyz changes that.

They provide the full modular stack out of the box:

Celestia for DA

RISC Zero for proving

Espresso for sequencing

Dashboard deployment

Modular VM support (EVM today, others coming)

So instead of just competing on “decentralization” or “compression,” they’re competing on product velocity and builder UX.

That’s the actual unlock in this next phase of L2 wars.

Who wins?

→ Not who has the most novel cryptography

→ But who puts scalable infra in the hands of the most builders — fastest

Caldera’s lead isn’t architectural.

It’s operational.

And that’s exactly what wins distribution in the next rollup cycle.

Tagging Gigachads that might be intrested in this 👇

- @SamuelXeus

- @TheDeFISaint

- @hmalviya9

- @poopmandefi

- @ayyeandy

- @DigiTektrades

- @zerokn0wledge_

- @LadyofCrypto1

- @milesdeutscher

- @1CryptoMama

- @Deebs_DeFi

- @RubiksWeb3hub

- @stacy_muur

- @TheDeFinvestor

- @splinter0n

- @izu_crypt

- @belizardd

- @eli5_defi

- @the_smart_ape

- @ViktorDefi

- @cryppinfluence

- @CryptoGirlNova

- @Haylesdefi

- @DeRonin_

- @0xAndrewMoh

- @defiinfant

- @DeFiMinty

- @Louround_

- @0xSalazar

- @crypthoem

- @CryptoShiro_

8,97K

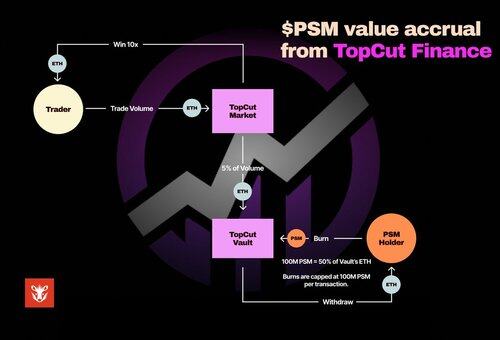

Been watching $PSM and wondering how it actually ties into @TopCutFinance?

Here’s the full picture…👇

TopCut is bringing a new kind of trading to DeFi - no liquidations, no complex fee structures.

Just price predictions, where the top 9% of calls win 10x.

Every trade sends 5% of volume into the TopCut Vault.

That Vault funds three things:

• Trader rewards

• Affiliate rewards

• $PSM redemptions

This is where it gets interesting for PSM holders…

…You can burn $PSM for ETH, straight from the Vault.

Burn 10M PSM → get 5% of the ETH in the Vault.

Burn 100M → up to 50%.

It’s capped and designed to scale with volume, without draining the system.

It’s clean, it’s balanced, and it finally gives real value back to long-term supporters.

Launch is July 16 on @arbitrum. This is worth keeping an eye on.

536EF92.7. klo 21.21

How $PSM accrues value from the @TopCutFinance protocol.

PSM holders were patiently waiting, so let's get straight to the point.

🧵👇

3,24K

The future of crypto isn't multichain—it's metalayered.

10,000 rollups. One seamless network.

@Calderaxyz just launched the most important infrastructure upgrade since L2s themselves.

Here's why the Metalayer could be the TCP/IP of blockchains 👇

@Calderaxyz powers 100+ rollups used by over 10 million users, but isolation is killing the UX. Developers are forced to integrate several patched-together bridges.

Users face wrapped assets, lag, and sticky UX.

Cost: months of dev time + integration fees + fragmented liquidity

So, what is the Metalayer?

It’s a composable, intent-based interoperability network comprised of:

= Execution Layer: Leverages Across, Eco & Relay to execute user intents (e.g., “move 100 USDC from Rollup A to B”) automatically finding the best route

= Settlement Layer: Powered by Hyperlane, delivers cross-chain messaging and state reads in seconds, not minutes.

= Developer Toolkit: Covered by API, SDK, UI widgets, developers just declare intents; the Metalayer handles the rest

Why it's a breakthrough

This means fewer integrations, lower costs, and faster innovation.

Every Caldera-powered rollup gets Metalayer integration day zero, testnet and mainnet.

No walled gardens, no chain-specific lock-in.

As new rollups come live,interop is automatic.

Intent = Your purpose, solved behind the scenes

- You declare: "Deposit X on Rollup B"

- Metalayer picks routes across Across/Eco/Relay

- Hyperlane messages pass securely and fast (<10 sec latency by default, optional finality layers if needed)

- Need stronger security (e.g., big transfers)? Just choose Finalized Mode and settle via the parent chain guarantees

The bigger Picture

Caldera isn’t stopping at 100 rollups, they’re planning a world of 10,000+ rollups. The Metalayer is the protocol layer that makes that dream realistic, enabling:

1. Cross-chain gaming economy (e.g., ApeChain + DeFi mints)

2. Unified DeFi liquidity (nobody builds isolated markets)

3. Cross-chain governance and data queries, for real-time, multi-rollup apps

@Calderaxyz Intent‑Based Metalayer is the modular OS for Ethereum rollups, and if you care about frictionless cross‑chain interactions, this is one to watch.

That's a wrap!

Tagging Gigachads that might be intrested in this 👇

- @SamuelXeus

- @TheDeFISaint

- @hmalviya9

- @poopmandefi

- @ayyeandy

- @DigiTektrades

- @zerokn0wledge_

- @LadyofCrypto1

- @milesdeutscher

- @1CryptoMama

- @Deebs_DeFi

- @RubiksWeb3hub

- @stacy_muur

- @TheDeFinvestor

- @splinter0n

- @izu_crypt

- @belizardd

- @eli5_defi

- @the_smart_ape

- @ViktorDefi

- @cryppinfluence

- @CryptoGirlNova

- @Haylesdefi

- @DeRonin_

- @0xAndrewMoh

- @defiinfant

- @DeFiMinty

- @Louround_

- @0xSalazar

- @crypthoem

- @CryptoShiro_

DOLAK1NG25.6.2025

25,000,000+ unique wallets have interacted with Caldera chains.

Caldera, takes modular scaling, seriously and lately, they’ve hit a different gear.

From wallet accessibility plays to usage milestones and ecosystem moves, the past week was a quiet flex, a reminder that @Calderaxyz is not just keeping pace in the rollup space.

Here’s the recent update and why caldera keeps hitting differently.

1. Wallets, Unlocked

Caldera teamed up with Dynamic so users can connect any wallet, no hacks, no hoops “Accept anything. Bring any wallet.”

That’s the kind of UX move that makes onboarding frictionless and adoption real.

2. 25 Million Wallets Hit

Yep, 25M unique wallets have already touched Caldera-powered chains.

That’s not hype, it’s proof. This is infrastructure that works under pressure, at scale.

3. The Thesis: More Rollups, Not Fewer

“There will never be enough rollups.”

That’s not just a line, it’s Caldera’s entire direction.

They’re betting big on a multi-rollup future, and giving builders the tools to launch fast, experiment freely, and scale without bottlenecks.

4. Builders First, Always

Every chain launched on @Calderaxyz gets the full support stack, infra, tooling, ecosystem push.

Because when chains win, @Calderaxyz wins. It’s not just infra, it’s alignment.

5. Community Input, Real Signals

They asked: What does your dream L2 look like?

Why? Because Caldera listens. And what they learn today becomes what they build tomorrow.

So What’s the Play.

If you’re a founder, dev, or just rollup-curious:

Explore what’s already running on Caldera (chances are, you’ve used a few)

Think about your use case; gaming, DeFi, social, whatever. Launch your own chain in hours, not weeks

Tap into their partner network for tools, liquidity, and users. Iterate, scale, repeat.

All of this without reinventing the wheel. Without battling base layer congestion. Without sacrificing UX.

And yes, community rewards, points systems, and airdrop meta are all part of the mix.

The infra is live. The wallets are here. The chains are growing.

Tagging Gigachads that might be intrested in this 👇

- @SamuelXeus

- @TheDeFISaint

- @hmalviya9

- @poopmandefi

- @ayyeandy

- @zerokn0wledge_

- @LadyofCrypto1

- @milesdeutscher

- @1CryptoMama

- @Deebs_DeFi

- @RubiksWeb3hub

- @stacy_muur

- @TheDeFinvestor

- @splinter0n

- @izu_crypt

- @belizardd

- @eli5_defi

- @the_smart_ape

- @ViktorDefi

- @cryppinfluence

- @CryptoGirlNova

- @Haylesdefi

- @DeRonin_

- @0xAndrewMoh

- @defiinfant

- @DeFiMinty

- @Louround_

- @0xSalazar

- @crypthoem

- @CryptoShiro_

5,62K

DOLAK1NG kirjasi uudelleen

Cryptocurrency is terrible at the moment.

"Shut up, boy."

I'm not talking about volatility, manipulation, cabals, or scams, but something beyond mere speculation.

"Hm, do you think something can give us hope? Hope for preventing prejudice, censorship, and the equitable distribution of intelligence?"

🧵

6,21K

Just thinking out loud, if Arbitrum can support @yapyo_arb which is currently the biggest L2 Atm

Then its not just a social experiment like @stayloudio

Here’s Why I think Yapyo might outshine Loudio 👇

- Smarter AI-Driven Rewards

Yapyo uses advanced analytics to score content based on depth, originality, and impact

moving beyond basic likes or retweets. This ensures creators are rewarded for quality, not just noise, based on what I've seen so far

- It’s built on Arbitrum’s Powerhouse

Arbitrum is currently the biggest L2 with its $1.5B+ market cap and low-cost, scalable Layer 2 chain, which offers @yapyo_arb a robust foundation for growth.

@stayloudio’s Solana-based model, while fast, doesn’t match Arbitrum’s ecosystem strength or developer support, limiting its long-term potential.

- Innovative Features for Creators & Users

Yapyo tokenized posts with 20% creator fees and exclusive, low-noise spaces with tradable Keys. Which create diverse ways to monetize attention.

Loudio token focuses on speculative trading without clear utility or unique features, making Yapyo’s model more engaging and sustainable.

This is just my thesis, lastly before the final snapshot, make sure you connect your wallet to your profile so you don't miss out on it

And if you end up missing out on the GTD sale make sure you follow this guide from my friend @0xFastLife

Arbitrum27.6.2025

yap it

yapyo it

arbitrum it

2,59K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin