Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

GammaSwap 👽

GammaSwap 👽 kirjasi uudelleen

My favorite team @GammaSwapLabs keeps shipping

+Aura vibes like this squad of rowers.

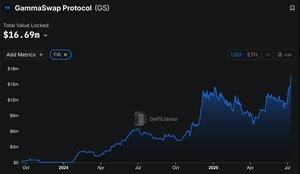

They’re offering juicy incentives — 46% APY on their LP pool.

I’ve been thinking hard about delta-neutral strategies, and @0xDeFiDevin himself shared a simple setup that delivers 37.98% APY with moderate risk.

Gud for this market

Let’s dive in 👇

🔹 We’ll use: $100,000 USDC

Platforms: @aave , Gammaswap

Network: Base

Breakdown:

Supply on Aave (Base): $60,000 USDC as collateral

Borrow on Aave (Base): $40,000 in ETH (15.85 ETH at $2,523)

GammaSwap LP (Base): $40,000 ETH + $40,000 USDC

🧩 GammaSwap automatically balances 50/50 in the LP.

Farm here →

Stake LP here →

💸 Yield Breakdown:

GammaSwap LP (Base): 46% APY on $80,000 = $36,800/year

Aave USDC Supply: 3.66% on $60,000 = $2,196/year

Aave ETH Borrowing: 2.53% on $40,000 = $1,012/year

🔹 Net yield:

Pool: $36,800 – $1,012 = $35,788

Aave: $2,196

Total: $37,984/year

Effective APY: 37.98% on $100,000

⚠️ Risks:

Rewards are in esGS, with a 30-day vesting to $GS. I'm personally bullish and willing to hold.

LTV: 66.67% ($40K borrow / $60K collateral) – close to the liquidation threshold (65%).

Watch your Health Factor.

Liquidation price: $3,729.54

Impermanent Loss (IL) is the main concern.

However, due to the Aave hedge, the loss is mitigated. Devi even shared a spreadsheet simulating IL impact.

Feels like old-school DeFi — wrapped yield, LP farming, and solid risk diversification.

Great for a low-volatility, low-liquidity market like now.

6,07K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin