Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Joe Burnett, MSBA

Bitcoin | $SMLR Director of Bitcoin Strategy | Not financial advice

Joe Burnett, MSBA kirjasi uudelleen

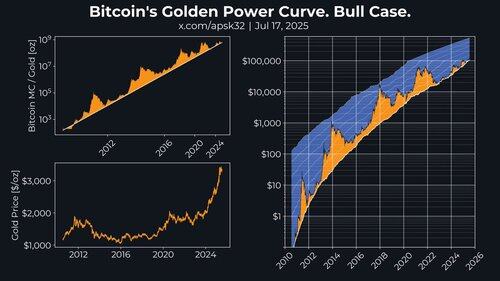

My bull case. Here I assume that the appropriate power curve is actually BTC/GOLD, not BTC/USD. Gold adds some noise to the signal because it has its own market dynamics. The benefit is that gold adjusts for the declining value of the dollar. If true, and if gold holds its value, Bitcoin has a lot of room to run.

78,16K

Over the past 50 years, investors in U.S. markets have moved further and further out on the risk curve.

They began by chasing future cash flows, then high-growth revenue, and even worthless hype-driven assets like meme stocks and NFTs.

Putting bitcoin, digital sound money, on the corporate balance sheet marks a return to balance sheet fundamentals.

It means valuing existing money today versus potential future money tomorrow.

The entire hyper-monetized financial system is about to bid bitcoin to millions.

6,99K

Notice how we bought 210 BTC.

21

Joe Burnett, MSBA17.7. klo 20.34

Semler Scientific has acquired 210 BTC for $25 million and has achieved BTC Yield of 30.3% YTD. Now holding 4,846 BTC. $SMLR

37,73K

Joe Burnett, MSBA kirjasi uudelleen

My Bitcoin Treasury discussion with @IIICapital.

0:00 – Intro

1:00 – First priority as Director of Bitcoin Strategy

3:11 – Should Bitcoin companies copy MSTR’s preferreds?

5:02 – Structuring credit: BTC Ratings from 2 to 10

6:25 – Long-term CAGR for Bitcoin vs. S&P 500

8:28 – Why Bitcoin has fewer risks than stocks

10:36 – The global index with no counterparty risk

15:14 – Is Bitcoin a global productivity index?

16:56 – Will MSTR join the S&P 500?

18:14 – Why Vanguard owns MSTR

19:23 – Unlocking passive capital for Bitcoin

21:14 – Why BTC companies magnetize capital

23:24 – Mag 7 adoption playbook: fast vs. slow

25:47 – Most CEOs don’t want the money

27:15 – Who should adopt Bitcoin—and who won’t

29:20 – Why MSTR is going all-in on preferreds

31:21 – Preferreds are better than convertibles

32:32 – Will BTC companies still trade above NAV in bear markets?

34:09 – Why 2022 was a crypto-catalyzed bear market

35:14 – The difference between 1.1x and 100x leverage

37:07 – How to defend BTC NAV with credit instruments

39:14 – How to create a Bitcoin short squeeze

41:20 – Why shorts don’t have the courage

43:20 – The future of BTC-backed credit and equity

45:04 – A new theory of Bitcoin corporate finance

49:30 – Copy MSTR: it’s good for everyone

50:26 – Harvard’s outdated Bitcoin case study

52:16 – Why the smartest firms are making bad moves

54:16 – Why academics ignore Strategy’s success

55:15 – How the world could look in four years

57:09 – Final thoughts and wrap-up

395,35K

Joe Burnett, MSBA kirjasi uudelleen

This was a great rip. A few highlights:

1. First question out the gate, Joe receives a masterclass in how to run Semler's bitcoin strategy.

2. @saylor speaking about the Harvard MBA program (and more generally about all business schools). Their curriculum is hopelessly out of date already and will have a hard time catching up.

3. Adopting bitcoin as a public corporation is not this cycle's ICO scam, for the fundamental reason that bitcoin is the best form of money and everyone needs good money. The first movers will have the most to gain, but all will gain.

8,19K

With this latest bitcoin acquisition, $SMLR now holds more bitcoin than $GME.

Catch us if you can, @ryancohen.

Joe Burnett, MSBA17.7. klo 20.34

Semler Scientific has acquired 210 BTC for $25 million and has achieved BTC Yield of 30.3% YTD. Now holding 4,846 BTC. $SMLR

50,27K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin