Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Tanaka

gOcto,

I've been exploring AI x DeFi for a while, and one recurring concern keeps coming up: can we really trust AI agents in financial decisions?

Not just in theory, but provably?

That’s why the partnership between @OpenledgerHQ and @lagrangedev stands out to me.

▸ With DeepProve, every signal an AI makes in OpenLedger is cryptographically proven onchain in real time.

▸ You no longer need blind trust, proofs show the math, not the promise.

▸ Sensitive data like weights, inputs, models? Still private. But every decision? Verifiable.

▸ Even attribution is covered: you know which data influenced what, and who gets credit.

▸ Speed? #DeepProve is up to 1000x faster than older ZK systems, which means this actually works at DeFi speed.

We're entering a phase where verifiable AI isn’t a nice to have, it’s a requirement.

For trading bots, credit agents, protocol optimizers... trust must be baked into the chain.

This is how AI in crypto stops being a black box and starts being accountable infrastructure.

#OctoSnapboard #OPEN

LAGRANGE18.7. klo 21.09

Lagrange is partnering with @OpenLedgerHQ to make AI provable, auditable, and safe for DeFi.

With a DeepProve-powered agent on OpenLedger, trading predictions and smart contract optimizations can be verified onchain—in real time—without revealing sensitive data.

Learn more: 🧵

3,55K

CEX listings always feel like a trap to me. Too much control in too few hands.

So when I saw $TREN | @TrenFinance get wrecked post-MEXC launch, it wasn’t surprising, it was expected.

But here’s what wasn’t expected:

▸ They didn’t cope.

▸ They didn’t point fingers.

▸ They fought back.

The team axed the CEX path, cut ties with their market maker, and migrated the token — clean and fast.

Same token, new contract, 1:1 airdrop. No insider advantage. No MM games. Just a fresh shot at price discovery.

Why does this matter?

Because most projects still treat CEXs as a status symbol.

TREN saw through the illusion. They realized:

→ Liquidity without trust is just extraction.

→ DeFi without transparency is just TradFi in disguise.

I don’t know if $TREN will moon. But I do know this: they chose to fight the system, not exploit it.

And in this market, that choice is everything.

Tren Finance14.7. klo 13.08

On Friday July 11th, we launched $TREN on MEXC. What should have been a significant milestone and celebration became a nightmare. Our Market Maker failed us, so we're doing something unprecedented: 1:1 token relaunch to a new contract with DEX-only launch. We're fighting back.

7,19K

As someone tracking real-world adoption in AI x crypto, I think @Raiinmakerapp’s Pre-Launch deserves attention, not because of hype, but because of measurable traction.

The $RAIIN token will officially launches July 23 on @base and @SeiNetwork, bringing a native asset to a network that already operates at scale:

▸ 450K+ users across 190 countries

▸ 42M+ onchain transactions pre-token

▸ 153K+ validator nodes

▸ Revenue from API access and dataset licensing

▸ Google Veo as a live partner

The Pre-Launch phase is not just a teaser, it's a period where early participants can explore how $RAIIN connects to network roles: staking, validation, and reputation systems.

This looks less like a speculative listing, more like the tokenization of an existing AI data economy.

Raiinmaker18.7. klo 09.00

⚡️$RAIIN drops 07.23.25

8,85K

Stablecoins brought dollars onchain.

Now $USDY is bringing yield onchain and it’s landing on @SeiNetwork | $SEI.

Let me break down why this is a big deal for you all 👇

▫️ USDY = tokenized short-term US Treasuries + bank deposits

→ A yield-bearing stablecoin issued by @OndoFinance, now with $1.39B TVL and $56M+ in annualized revenue

▫️ Coming soon to @SeiNetwork, the fastest-growing modular L1

▫️ This is Sei’s first native tokenized treasury asset

▫️ Sets the stage for a fully composable RWA DeFi layer

I can see this is a stablecoin launch + an infra alignment.

You might already knoww $SEI brings:

– Sub-400ms finality

– Parallelized EVM execution

– Composability at scale

– 449k DAU, 30M+ wallets, growing TVL

USDY brings:

– Institutional-grade compliance

– Onchain yield baked into every dollar

– RWA-backed stability with passive income

– A new primitive for Sei-native #DeFi protocols to plug into

Now imagine what this unlocks

→ DAOs can park idle stablecoins into USDY for real yield

→ DEXs and money markets can build structured products backed by Treasuries

→ Developers can plug into a new yield layer without needing bridges or wrappers

→ Users get a yield-bearing stablecoin, usable like USDC, but better

Here’s why I care:

▫️ Few chains are actually integrating regulated, yield-generating dollars at the base layer and Sei just did but not everyone cares (yet).

▫️ If you believe the next wave of #DeFi needs speed, scalability, and yield to go mainstream, then I think $SEI just became the most serious RWA chain to watch.

11,26K

Let’s be real, most AI content on this platform feels like junk food.

Quick hits, no depth. Bots echoing bots.

But @NuanceSubnet?

It hits different. Subnet 23 on Bittensor isn’t chasing hype, it’s mining clarity.

I love the concept:

→ Reward truthful, nuanced takes with onchain value.

→ Let real humans (not bots) decide what matters.

This is what media could be, if we built it from scratch, with open protocols, not ad revenue.

Proof of Nuance isn’t just a feature, it’s a statement.

0x76605urf (🫡 •🫡)18.7. klo 16.56

Happy to present Bittensor’s Subnet 23 Nuance Network (@NuanceSubnet). It doesn’t just have the vibes, it carries a quiet depth. Feels like something intentional is forming with us, grounded in thoughtful dialogue.

8,41K

I’ve been tracking crypto regulation in the U.S. for years and this feels like a turning point.

With the GENIUS and CLARITY Acts now passed in the House, the U.S. finally has the legal backbone to approach crypto with logic, not fear. That alone is a massive win.

Let’s be clear: Fan Tokens™ aren’t directly regulated in these bills.

But here’s why it matters, we now have:

▸ Clearer rules around stablecoins (GENIUS Act)

▸ Clearer definitions of what’s a security vs commodity (CLARITY Act)

▸ Divided responsibility between SEC and CFTC

This means the U.S. can stop treating all tokens the same. It can start analyzing function, purpose, and design, exactly what Fan Tokens™ have needed.

For years, Fan Tokens have sat in a legal gray zone. Too #Web2 for the SEC to dismiss. Too #Web3 for legacy lawyers to understand. Now, that fog is finally lifting.

I don’t expect a fan-token explosion overnight. But I do think we’ll see real experiments from U.S. sports orgs who were just waiting for legal clarity to take the first step.

If you're curious about how Fan Tokens are evolving in real-time from charts, trading volume to news and utilities, check out the All-In-One Fan Token Hub:

👉

#Fantoken @FanTokens

Fan Tokens™18.7. klo 14.55

With the GENIUS and CLARITY Acts now passed in the House, the U.S. just took its biggest step yet toward regulating crypto.

Let’s break down what this means for the future of Fan Tokens™ in the U.S. 🇺🇸

— Thread —

10,78K

Most bots just wrap the DEX, @OceanBotsAI wraps your entire trading experience.

▫️10-step sell strategies

▫️Fast swaps from inside Telegram

▫️Positions, limits, copy-trade in one tap

▫️Wallet lives in bot, follows you anywhere

▫️Cashback + 30% lifetime referral rewards

It feels like chatting with your PNL.

They didn’t just build a Telegram bot.

They built a full trading terminal inside your messages and added real automation:

→ Sell if price +20%

→ Or if mcap hits 11M

→ Or dev stops pushing

Up to 10 conditions per order. That’s what I call custom exit IQ.

Try the bot + browser extension combo and tell me this isn't the easiest trade flow you’ve used:

OCEAN🌊🤖13.7. klo 19.25

🔧 Installing the Ocean extension takes less than a minute and unlocks powerful trading tools instantly.

🖱️ One-click buy & sell

🌐 Works on 15+ platforms

👛 One wallet, everywhere you go

📊 PNL tracking

Your edge starts here. 🚀

7,99K

Tanaka kirjasi uudelleen

OpenLedger isn't just another AI chain – it's the infrastructure for a sovereign AI economy?

▸ At first, I thought @OpenledgerHQ was just another AI-focused chain...

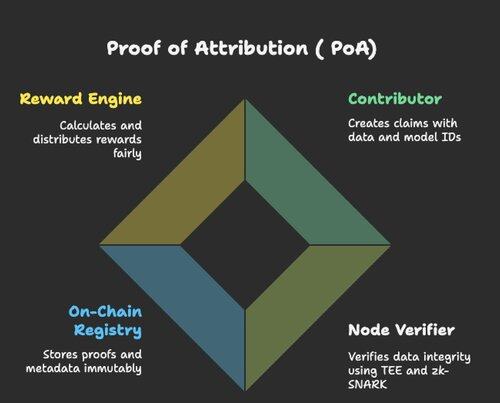

But once I understood PoA (Proof of Attribution), I realized it's the missing DePIN layer for data and AI models.

▸ AI is advancing fast ,but the data economy behind it remains unfair and invisible.

=> The core problems with today's AI:

→ AI data is opaque:

- No one knows what data trained which model.

- Contributors aren’t recognized or rewarded.

→ AI models are black boxes.

- Outputs are generated, but no one knows who or what contributed.

- There’s no way to trace value attribution.

→ Users are treated as “free raw materials.”

=> In fact, @OpenledgerHQ has deployed PoA (Proof of Attribution) to ensure that every data contribution and AI model is verified on-chain and rewarded fairly-something the AI market still lacks.

→ Attribution starts from Day 1

- Every dataset, model, and inference is linked to its contributor - on-chain.

→ Transparent usage trail

- You can trace how data is used, in which model, to generate what outcome.

→ Fair reward distribution

- Every contribution earns proportional rewards - automatically.

→ An actual data economy for AI

- No more “free data extraction” , but a reward-driven ecosystem where contributions have value.

=> To me, PoA isn’t just a mechanism .It’s the key to building a transparent, fair AI economy.

And #OpenLedger is pioneering it, even if most haven’t noticed yet.

5,47K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin