Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Jesse Myers (Croesus 🔴)

Implementing Bitcoin treasury strategy for @UTXOmgmt portfolio companies @MoonIncHK and @smarterwebuk

past: Stanford MBA, Bain & Co

Jesse Myers (Croesus 🔴) kirjasi uudelleen

My Big 3 Treasuries

Right now, these are my highest conviction bets, with the best risk vs. reward.

I call them my Big 3:

🇺🇸 Strategy

🇯🇵 Metaplanet

🇬🇧 Smarter Web

These are the bets I am most comfortable in for the long term.

I also see them as „bear proof“.

All my other bets are more speculative, and currently have the goal to increase my Big 3.

Over time, the Big 3 will expand into the ₿7.

Enterprising investors will be able to outperform them by going further out the risk curve.

But 99% of people will be best served to just focus on the Big 3 or ultimately the ₿7.

That‘s how I see it.

32,63K

Jesse Myers (Croesus 🔴) kirjasi uudelleen

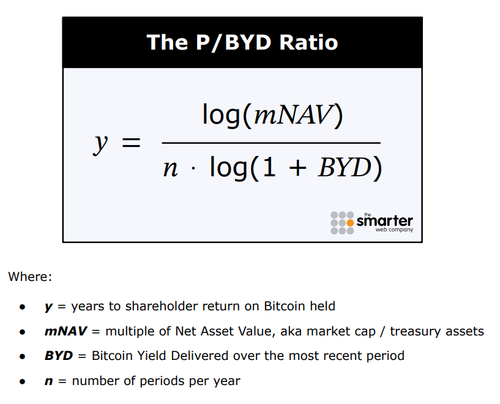

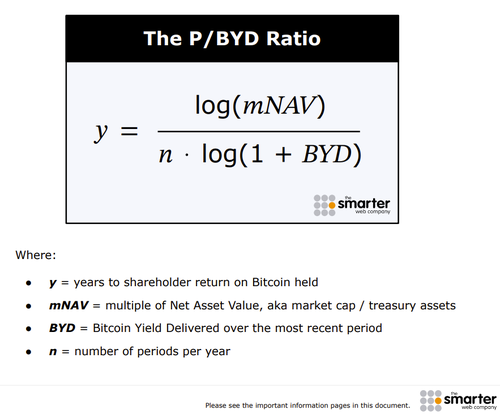

🔥THE ULTIMATE WAY TO VALUE BITCOIN TREASURY COMPANIES🔥

This is the P/BYD RATIO developed by Bitcoin Wizard Jesse Myers (@Croesus_BTC).

Goodbye P/E ratios and other archaic valuation methods!

If you've still value Bitcoin treasury companies by price-to-earnings, congratulations:

You've been timing the apocalypse with a sundial.

🧵Here's how to find the DEALS in the BTC treasury game👇

33,19K

SWC has increased its #Bitcoin holdings by +106% in the last 10 days

This has compressed mNAV down to 3.9x

P/BYD (analogous to P/E ratio) sits at an incredible 0.07 years 🤯

The Smarter Web Company16.7. klo 14.00

The Smarter Web Company (#SWC $TSWCF $3M8.F) RNS Announcement: Bitcoin Purchase and SWC Research Brief.

Purchase of additional Bitcoin as part of "The 10 Year Plan" which includes an ongoing treasury policy of acquiring Bitcoin.

The Smarter Web Company has also today published a Research Brief to introduce a new metric (P/BYD) for analysing the performance and valuation of Bitcoin Treasury Companies. The P/BYD ratio aims to enable investors and analysts to understand better why a public company would hold Bitcoin as a treasury asset, in a similar way to the P/E ratio commonly used when evaluating traditional equities.

Please read the RNS on our website:

27,13K

Jesse Myers (Croesus 🔴) kirjasi uudelleen

Just read the @Croesus_BTC document on their new metric P/BYD (pronounced p-bid)

Firstly, I am super happy that $SWC is putting this sort of stuff out there to move the whole industry forward - it really enhances the MSTR (US), MTPL (JP) and SWC (UK) as the top 3 narrative.

Secondly I really like the metric as an improved version of Days to Cover, focusing specifically on the BTC Yield over set time periods, the 'n' value.

Initially I was skeptical reading it (as I have been of the Days to Cover metric) as P/BYD assumes the same level of growth can be maintained.

But as Jesse points out, both SWC and MTPL have actually accelerated growth more recently on the P/BYD metric.

Tracking and looking at P/BYD over different time periods is how you can get a better read of it.

I.e. I imagine you will need to look at a 30 day P/BYD, QTD, YTD, H1, and 1Y P/BYD.

Very interested in others thoughts on this.

7,54K

Jesse Myers (Croesus 🔴) kirjasi uudelleen

LQWD has acquired ~57.5 BTC for ~$6.8 million at ~$118,162 per bitcoin and has achieved BTC Yield of 54.6% YTD 2025. As of 7/15/2025, we hodl ~238.5 $BTC acquired for ~$17.9 million at ~$75,331 per bitcoin. $LQWD $LQWDF @UTXOmgmt @DavidFBailey @saylor @shoneanstey @LQWDTech @CoynMateer @samcallah @Croesus_BTC @AshleyGarnot

28,51K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin